[Editor’s note: This review contains several links to Lending Club that are affiliate links. If you open an account through one of these links the blog will receive a small commission from Lending Club. The owner of this blog been a Lending Club investor since 2009 and has over $300,000 invested across taxable and IRA accounts. You can view Peter’s p2p lending accounts and returns here. This review was last updated in June, 2015.]

Lending Club is the world leader in p2p lending having issued over $9 billion dollars in loans since they began in 2007. They are growing at a rate in excess of 150% a year. Why have they been so successful? They provide excellent returns for investors and they allow quick access to funds at competitive interest rates for borrowers.

Before You Begin Investing

Some investors read about Lending Club and dive right in. But the intelligent investor does some research. This article will provide all the information a new investor needs to get started.

To help you get familiar with the Lending Club platform I have recorded a short video. This video provides an introduction to the Lending Club interface and shows you how to invest in these p2p loans.

Before you begin, though, you need to consider if you are eligible to invest. To invest at Lending Club you need to meet a number of requirements:

- Must be at least 18 years of age and have a valid social security number.

- Have an annual gross income of at least $70,000 and a net worth (not including home, home furnishings and cars) of at least $70,000 or a net worth of at least $250,000 (with the same exclusions). Residents of California and Kentucky have slightly different net worth requirements.

- Reside in one of the approved states: California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kentucky, Louisiana, Minnesota, Missouri, Mississippi, Montana, New Hampshire, Nevada, New York, Rhode Island, South Dakota, Utah, Virginia, Washington, Wisconsin, West Virginia, and Wyoming. (there are options for people who live in several other states – you can invest via the Lending Club trading platform). With the recent Lending Club IPO, there is a possibility for these payment-dependent notes to become available to investors in all 50 states. You can read more about this topic here.

- You are only allowed to purchase notes up to 10% of your net worth.

The eligibility rules do change from time to time so you should check Lending Club’s website for the latest.

What are the Risks?

Every investor should consider the risks of an investment before committing their money. Investing with p2p lending has a number of risks:

- Borrower defaults – the loans are unsecured so an investor has little recourse if the borrower decides not to pay. The annual default rate across all grades at Lending Club is around 6 or 7% with higher risk borrowers having a higher default rate.

- Lending Club bankruptcy – This is a much smaller risk today than it was several years ago because Lending Club is making money and has had an influx of cash with the recent IPO. But the risk will always be there. In the unlikely event of a bankruptcy, there is a backup loan servicer who will take over servicing the loans but there would likely be some disruption and investors could lose some principal.

- Interest rate risk – the loan terms are three or five years so during this time interest rates could increase substantially. If an FDIC insured investment is paying 6% it makes investing in a Lending Club loan at 7% not the best investment.

- Poor loan diversification – many new investors get caught in this trap. They do not take advantage of the $25 minimum investment. If you invest in 20 loans at $250 you are running a much higher risk than if you invest in 200 loans at $25. If you only have 20 loans one default could wipe out most of your gains. You can learn more on basic portfolio diversification and then read a statistical analysis of p2p lending diversification.

- Liquidity risk – There is a secondary market on Lending Club where loans can be sold but if you need to liquidate your entire investment you will likely lose some principal in the process.

- Market-wide event or recession – While p2p lending has been around since the latest recession in 2008, the asset class still remains untested when platforms were originating significant volumes. In a recession, defaults will increase and thus will result in a decrease in investor returns.

How it Works

Peer to peer lending at Lending Club is a very simple process. It begins with the borrower. They apply for a loan and if they meet certain criteria (such as a minimum 660 FICO score) their loan is added to Lending Club’s online platform. Investors can browse the loans on the platform and build a portfolio of loans. The minimum investment an investor can make is just $25 per loan. Each portion of a loan is called a note and smart investors build a portfolio of notes to spread their risk among many borrowers.

Lending Club will perform some level of verification on every borrower. As this verification process is happening investors can be funding portions of the loans. If the borrower passes verification the loan is approved for investors and will be issued to the borrower if fully funded. If the borrower fails verification the loan will not be issued. It will be deleted from the platform and all money that had been invested will be returned to the respective investors.

A loan can stay on the platform for up to 14 days. Most loans are funded much quicker than that and once funded the loan will be deleted from the platform. Approved borrowers will receive their money (less an origination fee) in just a couple of business days once funding is complete and then begin making payments within 30 days. These payments will be for principal plus interest on a standard amortization schedule.

Explanation of loan grades

Lending Club categorizes borrowers into seven different loan grades: A through G. Within each loan grade there are five sub-grades meaning there are 35 total loan grades for borrowers from A1 down to G5. Where a borrower is graded depends on many factors the most important of which is the data held in the borrower’s credit report. The better credit history a borrower has the better their loan grade with the very best borrowers receiving an A1 grade, which carries the lowest interest rate.

Lending Club will pull the latest credit report for every borrower and take the data held in that report and other factors such as loan amount and loan term to determine the interest rate. Lending Club provides more information on their Interest Rates and How We Set Them page on their site. Learn more about the Lending Club borrower experience in this video where I apply for a Lending Club loan.

Starting to Invest

Some investors like to consider every loan individually while others want to put their money to work quickly. Both are possible at Lending Club.

Automated Loan Picking

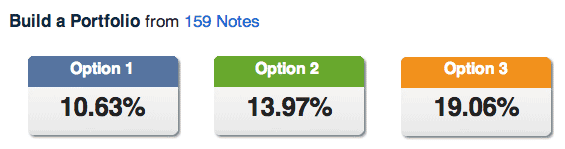

If the thought of choosing selection criteria or wading through hundreds of loans is overwhelming Lending Club makes it very easy to put your money to work quickly. When you click on Portfolio Builder on the main account page you are presented with three options.

Once you click on one of these options the tool will then build a portfolio based on your selections. Option 1, the low risk option will invest in mainly A and B grade loans. Option 2 will invest primarily in B and C grade loans with some A and some D grade loans as well. Option 3 invests in C, D, E and F grade loans.

If these three options are too restrictive there is a fourth option. The More Options button allows you to choose the exact target interest rate you would like and then it invests in the available loans that match your chosen rate.

Selecting Loans Manually

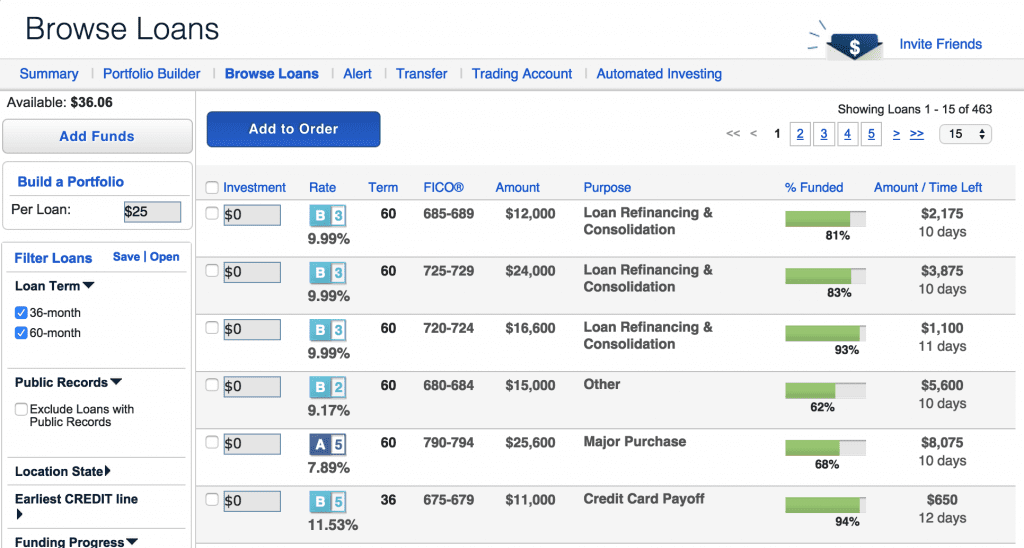

When you click the Browse Loans link from the Lending Club Accounts screen you are presented with all available loans as you can see in the screenshot above. There are typically somewhere between 300 and 500 loans available at any one time. When you click on a loan you are presented with the details for that borrower.

A loan listing contains five different types of information to enable investors to make an informed decision whether to invest or not.

- The loan details – there is information about the loan itself such as the loan grade, loan purpose, interest rate, monthly payments, loan length and funding information.

- Borrower details – while personally identifying details such as name, address and social security number are withheld from investors, information such as job title, gross income and location (first 3 digits of zip code and state) are included.

- Credit information – Lending Club pulls a complete credit report during the application process and shares much of this information, such as credit score range, delinquencies and credit line details, with investors.

When investing manually investors can decide to lend any amount in multiples of $25. This can be done by just checking a box next to each loan and then clicking the Add to Order button. Then with just three more clicks the investor can complete the order.

Loan Filtering

Reading the details of hundreds of available loans could easily become a full-time job. So, Lending Club provides loan filters where investors can choose to look at only those loans that are of interest. There are over 30 different criteria to choose from – typical filters are interest rates (presented as loan grades), loan terms (36 or 60 month loans), loan purpose, length of employment, loan size and credit score. By utilizing these filters investors can create a more manageable list of loans to consider.

So how do you know where to start filtering loans? You can use one of the third party tools listed below to analyze the loan history or you can start with my simple p2p lending investing strategy.

You can filter the loans on Lending Club’s website and save the filters you create or you can download a CSV file from the Browse Notes screen. Some investors prefer this method so they can run their own loan filtering in Excel. Every loan contains a unique URL that allows for easy investing with just a copy and paste from Excel.

The Importance of Being Quick

In 2013 the environment changed for investors at Lending Club. It became a lot more competitive and loans became fully invested very quickly, sometimes in a matter of seconds. If you want the best selection of loans you should login right when new loans are being added to the platform.

Currently, new loans are added at 6am, 10am, 2pm, and 6pm Pacific Time seven days a week. By logging in within a couple of minutes of those appointed times you will get the best selection of loans. But be quick. Within minutes many of the loans have been fully invested and have therefore disappeared from the platform.

Third Party Tools

While Lending Club provides some analysis of investor portfolios they also provide their entire loan history for download. But you don’t have to do this analysis yourself. Luckily, an entire data analysis eco-system has been created around Lending Club that provides a great deal of information to investors. Since the entire loan history is available for public download some enterprising investors have created a way to query this data and back test various investment strategies.

- NSRPlatform (https://www.nsrplatform.com)

Has a complete suite of useful tools for Lending Club investors. There is a back testing and filter feature that provides a front end to the entire loan history of Lending Club broken down by loan grade. Investors can test various filtering strategies to determine the best historical returns. Investors can also upload their own Lending Club portfolio for analysis. NSR can also be used for order management and automation. - LendingRobot (https://www.lendingrobot.com/)

LendingRobot provides order execution for Lending Club and allows you to create filters to narrow your investment criteria. Besides filter based investing, they also offer a fully automated selection, which will invest in loans for you based on whether you seek a conservative or aggressive investment approach. They also provide data on order history, sell history and provide a cash-flow forecast. - PeerCube (https://www.peercube.com/lc/)

PeerCube has two main functions. It provides an alternative to the Browse Notes section of Lending Club allowing investors to run more sophisticated filters. Then in just one click investors are taken to the Lending Club site to complete an investment on the loan. There is also a Portfolio Upload section where PeerCube provides analysis of an investor’s portfolio. - BlueVestment (https://bluevestment.com/)

BlueVestment specializes in automation for LendingClub. Through BlueVestment, users can create their own filter criteria using 22 attributes and also create advanced filters using the node builder. From there, the strategy can be added to a Lending Club account for automation.

For a complete look at all of the p2p automation and analytics sites, view our comprehensive two part series on the topic.

Lending Club also offers its own Automated Investing service, available within LendingClub.com. This can be found in Automated Investing tab after you login to your account. The service is free to use, but does require an account minimum of $2,500. Users of this service can select investment criteria, which are then executed up to four times per day as loans are listed on the platform.

Conclusion

Lending Club is the largest and most successful p2p lender in the world. They have a long track record now of providing excellent returns to investors. This is why I have over $100,000 of my own money invested in Lending Club and continue to add to that amount. If you want to take the plunge and open an account then just click the link in the box below.