There is an ever increasing number of websites dedicated to aiding in analytics and investing in Lending Club and Prosper. In this comprehensive two-part series we will look at all of the popular tools that investors use today (there are ten in all) in order to backtest strategies, automate their investments and analyze data. Analytics and data has been a large part of p2p lending from the start and investors are always looking for an advantage to potentially maximize returns. Investment automation allows for a much better investment experience versus selecting notes on the platform by hand.

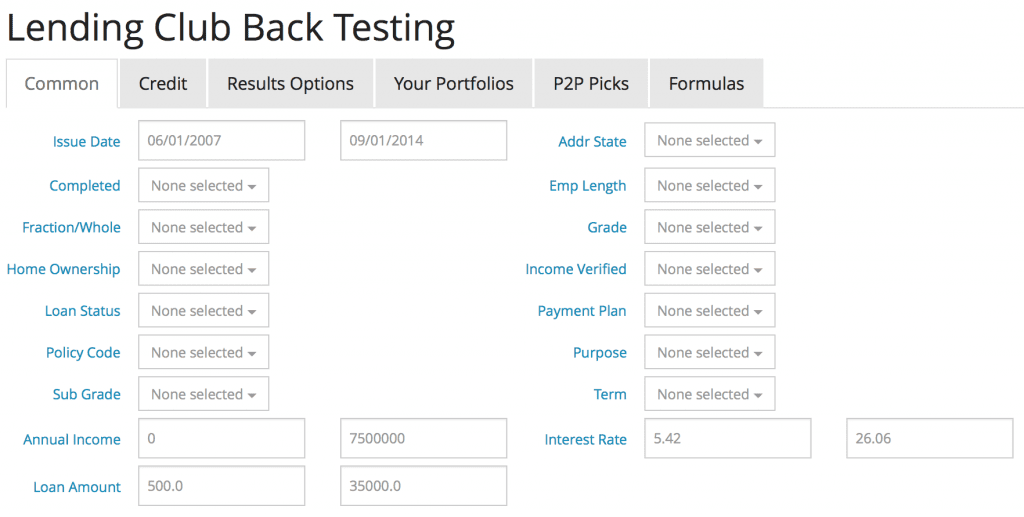

Nickel Steamroller has been around since mid 2011 and eventually merged with ProsperStats to bring Prosper and Lending Club data analytics into one single platform. With their site, you can back-test investment strategies and see how certain strategies would have fared over time. (Click of any of the images in this post to view them at full size.)

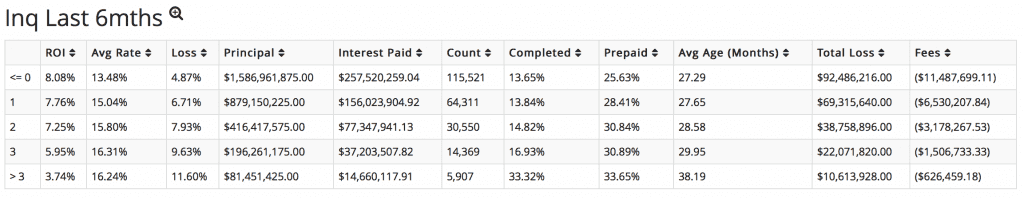

In the Results Options tab, you are able to further breakdown your strategy to look for other opportunities to increase ROI. For instance, a commonly used filter in the past has been to simply filter on inquiries. The below is the filtered breakout for loans that were issued before the end of 2013.

This is just one example of a filter you could use and the possibilities for creating strategies are endless. To get a better idea of returns, you can view loans that are aged like I did in the example above or modify the loss estimates to get a better idea of ROI. Once you determine a strategy, you can simply save the filter criteria and apply it to an auto-investment.

Nickel Steamroller also has higher level reporting with reports that allow users to see their allocation by loan grades as well as view volume analysis results. They also offer an immense amount of canned charts and graphs. These allow the user to see both Lending Club and Prosper data visualized in different ways. In addition, there is a portfolio analyzer for Lending Club and Prosper. This allows a user to easily see their portfolio composition and performance. Nickel Steamroller is currently free.

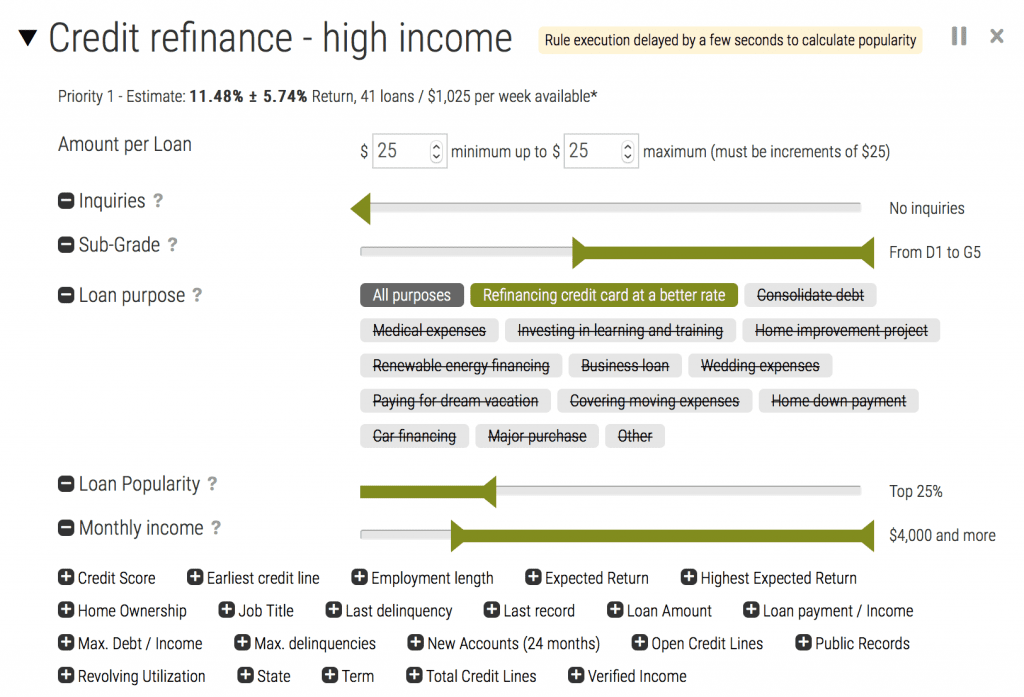

LendingRobot offers automated investing in both Lending Club and Prosper. LendingRobot offers investment rule suggestions which include: investing in popular loans, a more conservative strategy and a high risk/high return strategy. Once created these strategies can be modified to your liking. If you’re a more hands on investor, rules are simple to create from scratch and an estimated ROI is displayed with each filter change.

Note that one of these criteria is Loan Popularity. A few seconds after new loans are released, LendingRobot takes a snapshot of the loans and ranks them by popularity. Keep in mind that this calculation is the current allocated investment amount and doesn’t include committed cash since investors can remove notes from their shopping carts.

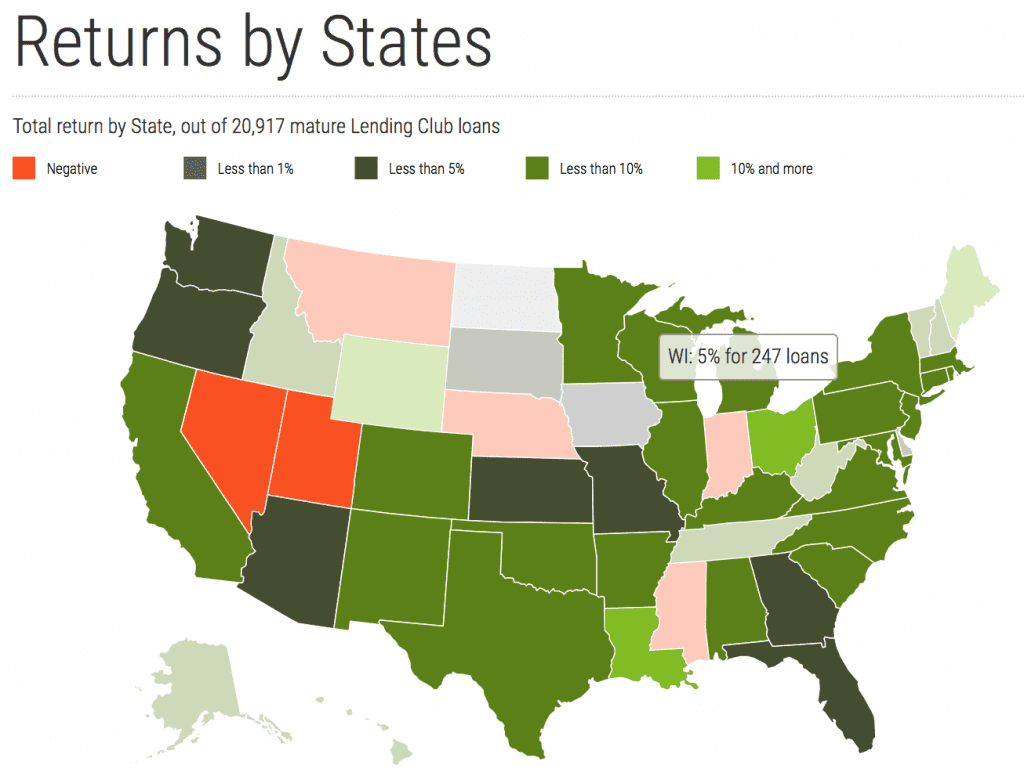

They also offer a high level dashboard of all of your p2p lending accounts. This includes Assets Under Management, Order History and a Cash-Flow Forecast. LendingRobot also provides several visualizations of LendingClub data. More of these can be found on the LendingRobot charts page.

The LendingRobot interface is simple to use and link to your Prosper or Lending Club accounts. In addition, LendingRobot is an SEC Registered Investment Advisor. There is no cost for managed accounts less than $10,000. For accounts above $10,000, the annual fee is equal to 0.45% of the amount above $10,000 and is based on the remaining principal of all the loans invested on your behalf by LendingRobot.

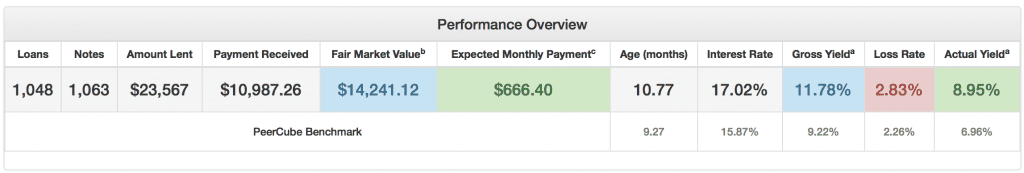

PeerCube focuses on analyzing p2p lending data and often does in-depth analysis in blog posts. Earlier this year, they introduced automated portfolio analysis as well as automated investing for Lending Club and Prosper. PeerCube allows realtime filtering and backtesting on both platforms. From there, you can view current notes meeting that criteria on the platform or assign it to an auto investment. PeerCube also offers a risk index for each loan which offers an independent perspective for the loan risk. The lower the index, the safer the loan and the less chance of it being charged off. One interesting feature is that you can view and load filter criteria of other users who have chosen to share them.

I connected my Lending Club account to PeerCube to run an analysis on my portfolio which offers many insights to your p2p lending portfolio.

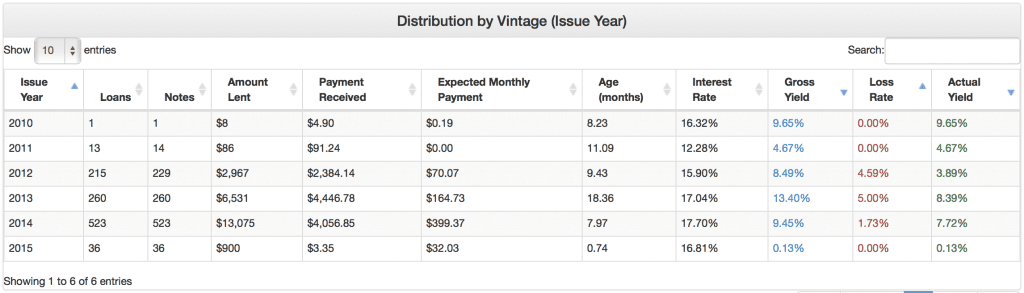

Users are also view the breakout of returns by vintage.

As someone who has tried several strategies over the years and has a separate portfolio for each, one feature I do really enjoy is the breakout of returns by portfolio. This and many additional insights are available with a free PeerCube account. PeerCube has dedicated a lot of time to aid in the secondary market with features like FOLIOfn pricing and seeing notes at risk. These features, along with automated investing are a part of the Pro Plan. The Pro Plan is $19.95 per month and more information can be found on the PeerCube subscription page.

Orchard Platform is an investment and analytics platform for institutional investors. Orchard is about helping institutional investors and loan originators connect and transact. Orchard enables institutional investors to scale their investment in the space by providing investment strategy, real-time order execution and reporting, analytics, and access to supply. Another way to look at is that Orchard services as a back office solution for their clients.

As of December 2014, institutional investors were buying on five platforms through Orchard: Lending Club, Prosper, Funding Circle, OnDeck and Kabbage. Orchard also recently launched the Orchard Originator Database as a first-of-its-kind source for aggregated information on a large and growing number of leading loan originators across a wide range of global asset classes. The database gives investors an efficient way to discover and evaluate originators and provides emerging and established originators with a venue to share information about their loan inventory with qualified institutional investors. Orchard is also working on establishing a secondary market for institutional investors.

Orchard’s services are only available for registered clients, there are no tools available to the general public. Although they do have an excellent blog with interesting articles that is frequently included in our Saturday news roundups.

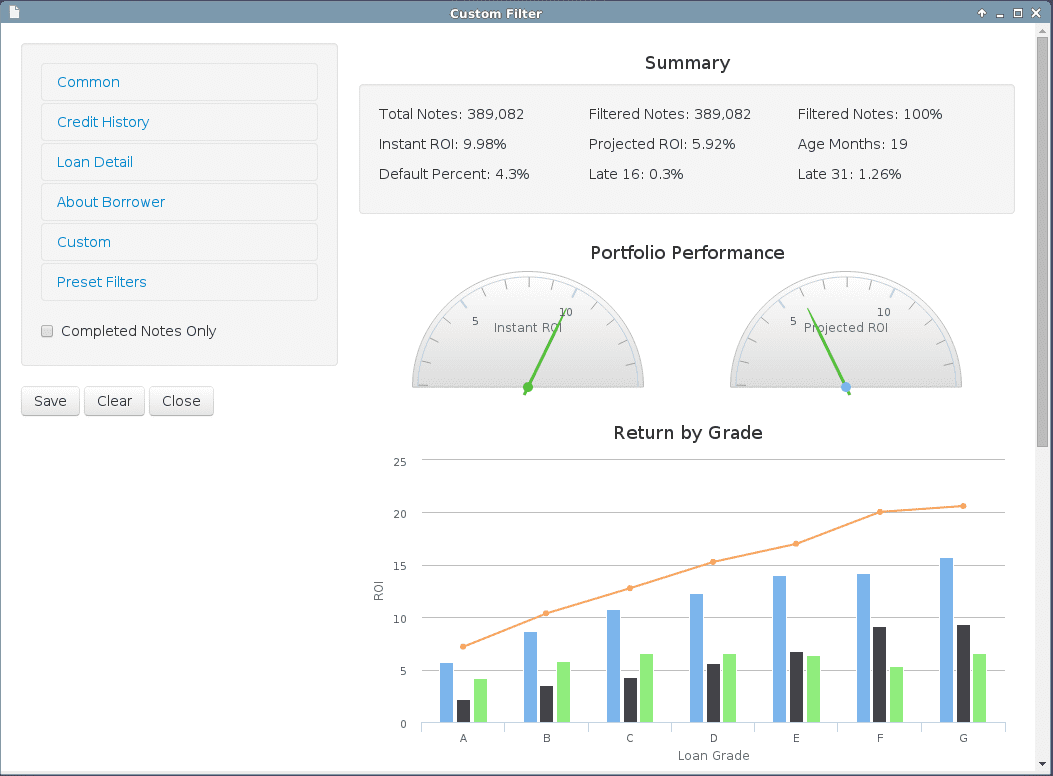

Peer Lending Server (“PLS”) automates the process of investing in Lending Club loans. It is a unique offering as it is the only publicly available, self-hosted platform. This is different compared to the many cloud solutions that host the hardware and software required for order management. The software application is installed on a virtual machine which resides on your Windows, Mac or Linux based computer. You can read more about this process on the PLS website. The benefit of this type of solution is that there are no shared resources with other users, potentially leading to faster processing times.

Like many of the other tools, PLS is focused on providing speed and decision making tools to its users, which includes a machine learning algorithm. In addition, PLS provides historical analysis with real-time charting, which provides an effective approach to create customized filters.

PLS users can browse current notes with many additional data points for those interested in manually underwriting and ordering notes. It also provides detailed logs including micro-second time stamps from detection to order to track every step of the process. Peer Lending Server is 100% free to use.

Look for part 2 in this series coming tomorrow featuring even more tools for investors.