[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. This post merely shares how Lending Club and Prosper are presenting their tax information this year. You should seek professional advice before taking action on any of the ideas presented here.]

Filing taxes with Lending Club and Prosper can be confusing since it is different than the tax treatment of most other investments. If you’ve had losses or recoveries in your account you’ll see several different forms provided by Lending Club and Prosper. It’s important to keep in mind that new investors may not have some of these tax forms since it can take several months for notes to chargeoff. This post will outline information regarding filing your taxes for 2015. We’ll also highlight any significant changes.

Lending Club Taxes

Probably the biggest and most welcome change for this year is Lending Club’s integration with TurboTax. For investors who use TurboTax, this will simplify the tax reporting process. Lending Club has a page dedicated to importing your Lending Club tax forms into TurboTax. If you don’t use TurboTax or want to fully understand the tax implications of your Lending Club account, Lending Club has provided an updated tax guide for retail investors.

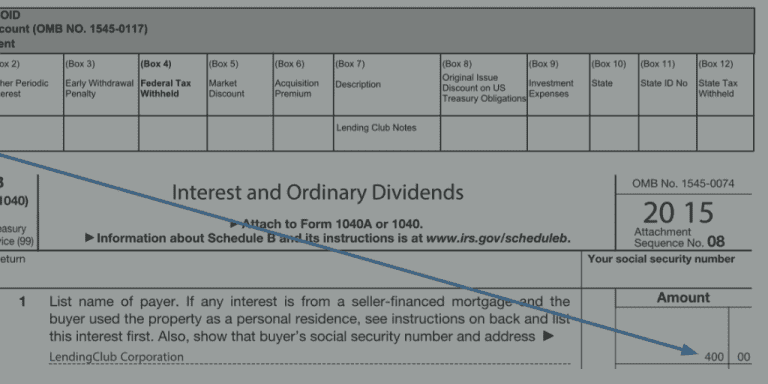

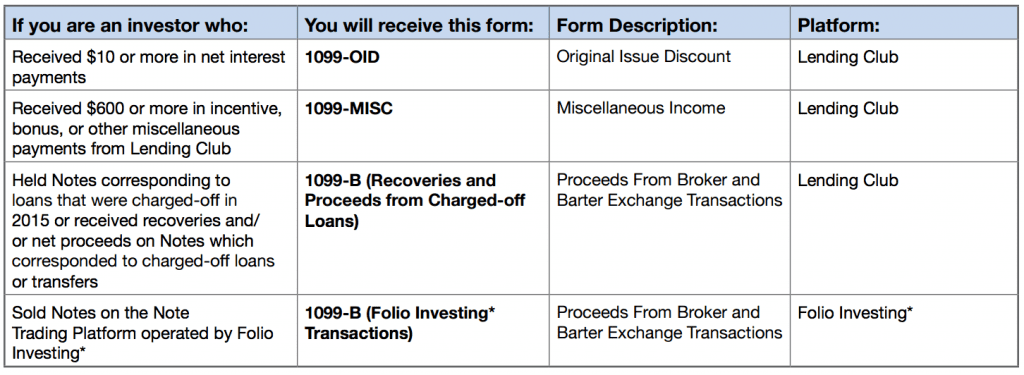

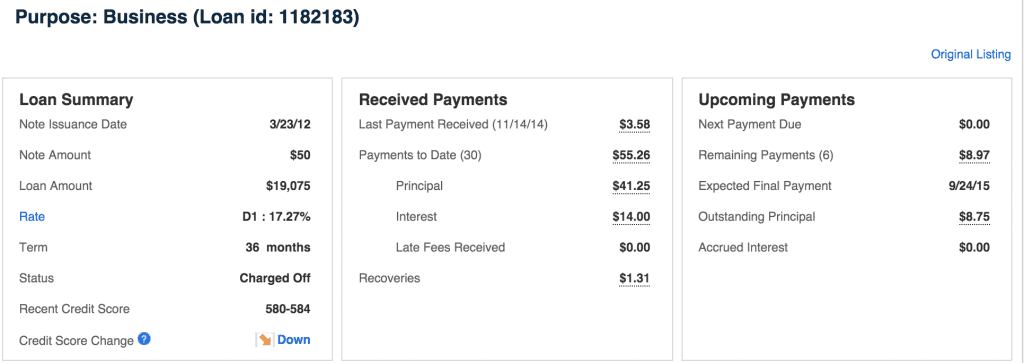

Your tax statement is available in the Statements section of Lending Club’s website. There you will find a Tax Statement section which will direct you to your 2015 tax forms which will be titled 2015 Consolidated 1099 Package. In the tax guide, you will see an outline of the forms that may be included in the 1099 package.

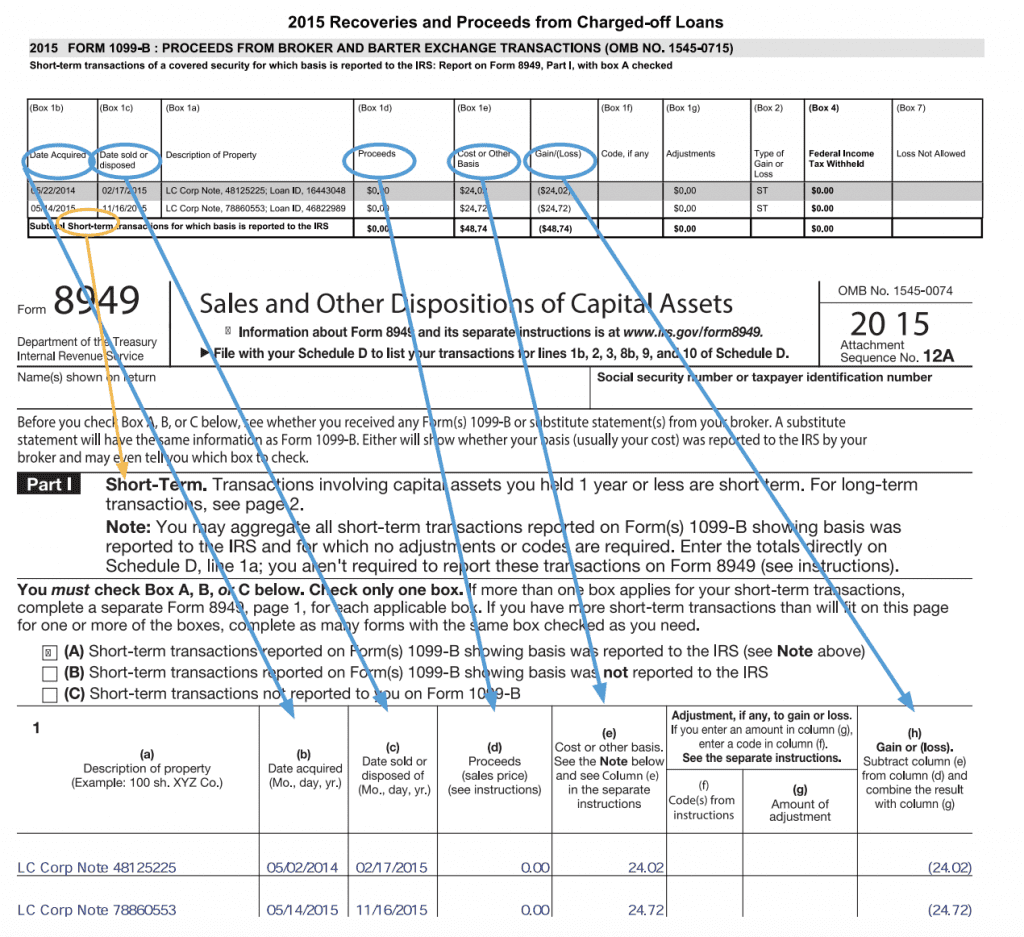

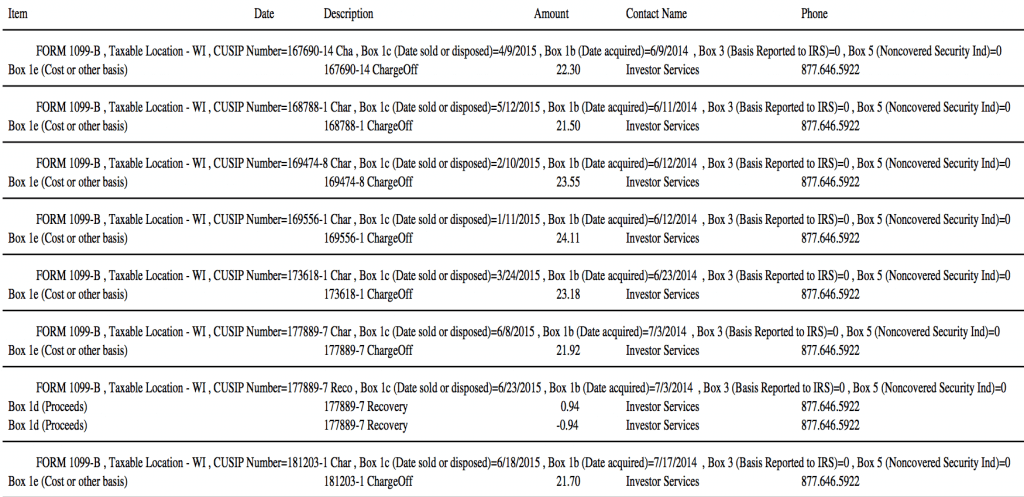

Lending Club has again shown an example of where income and short/long term losses may be reported when filing. The only difference from last year is that they show listing out each loan separately. Below is an example of how short term losses may be reported.

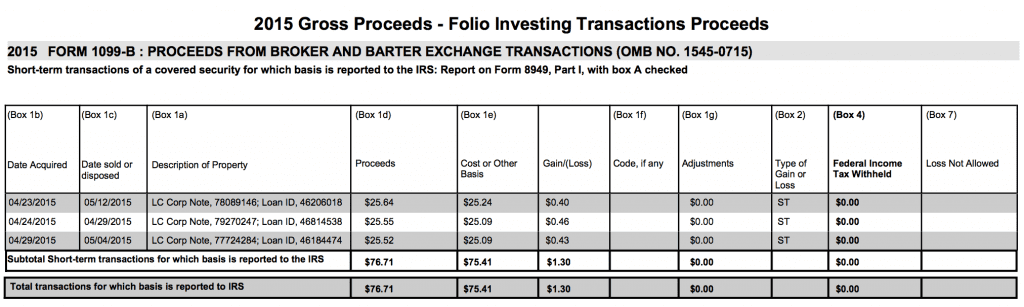

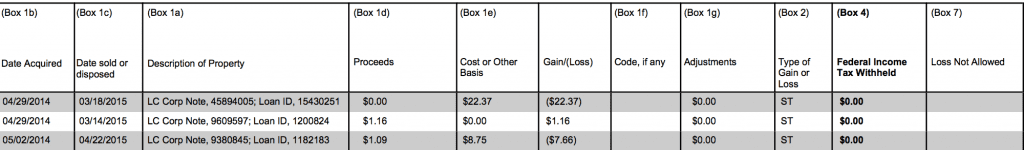

Perhaps the most complicated part of taxes with Lending Club is if you participated on the secondary market by purchasing notes. If you have not purchased or sold notes on the secondary market you can skip over this section. Note sales are accurately reported in a separate section and it is straight forward. Below is a screenshot of three notes I sold in 2015.

[slb_exclude]

[/slb_exclude]

However, if you purchased notes on the secondary market, you may need to update your cost basis. A Lend Academy reader who only participates on the secondary market shared with us information on his account and I have verified this information on my account as well. For starters, Lending Club alludes to this in their tax guide:

Please keep in mind that Notes purchased on the Folio Investing* Note Trading Platform may have been purchased at a discount or premium relative to outstanding principal plus accrued interest at the time of purchase, and additional information is provided in order to help you determine the cost basis for transactions involving these Notes. However, investors are ultimately responsible for tracking their tax cost basis. The basis reported on Form 1099 may differ materially from an investor’s tax cost basis, depending on the investor’s personal tax situation. For more information, please consult your financial or tax advisor.

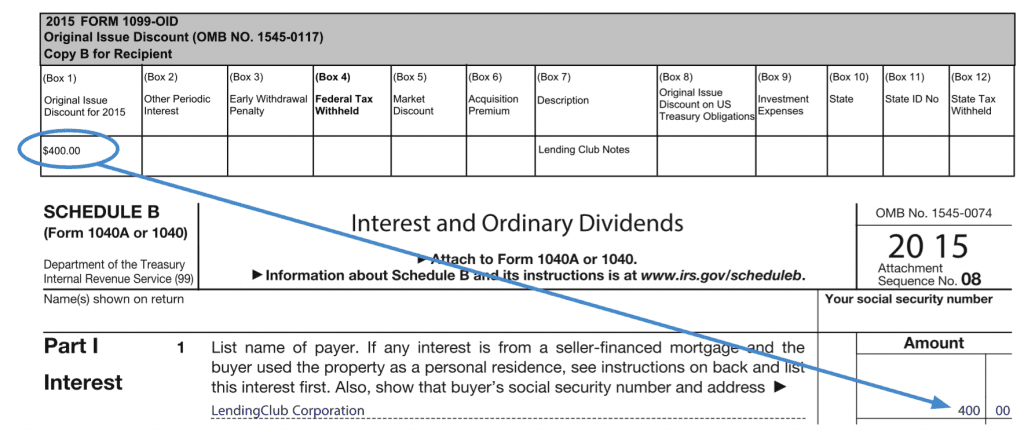

Below is a screenshot taken from my Lending Club tax statement which includes note 1182183 (third row) that was purchased on the secondary market. It was charged off in 2015 and reports a cost basis of $8.75.

[slb_exclude]

[/slb_exclude]

I looked at this note on Lending Club’s website and found that the $8.75 is the exact amount of the outstanding principal.

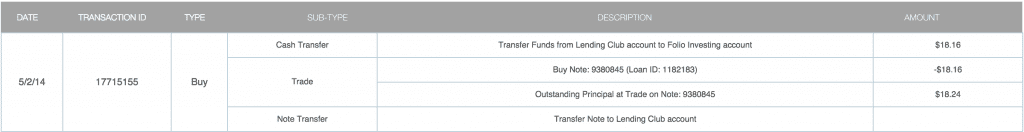

However, digging into my FOLIOfn statements I found that the amount I paid for this note, or the cost basis is a much higher amount of $18.16.

[slb_exclude]

[/slb_exclude]

Thus, it seems as though investors on FOLIOfn may have additional work to do by updating their cost basis which will in turn affect their losses for the year.

At the end of the tax guide Lending Club shares their guidance on reporting gains and losses as they have done in the past. This is an important piece of information for investors to understand which I discuss more in detail towards the end of this article.

Generally gains and losses from recoveries, sales or charge-offs related to Lending Club Notes are reported for tax purposes as capital gains or losses, rather than ordinary gains or losses. Generally, Lending Club Notes are considered capital assets because they are owned for the purposes of investment (similar to a stock or a bond). Generally, realized capital losses are first offset against realized capital gains. For individuals, any excess capital losses can be deducted against ordinary income up to $3,000 ($1,500 if married filing separately). Capital losses in excess of this limit may be carried forward to later years to reduce capital gains or ordinary income until the capital losses are fully utilized. For more information, you may want to refer to Chapter 2, Ordinary or Capital Gain or Loss of IRS Publication 544 – “Sales and Other Dispositions of Assets”.

Prosper Taxes

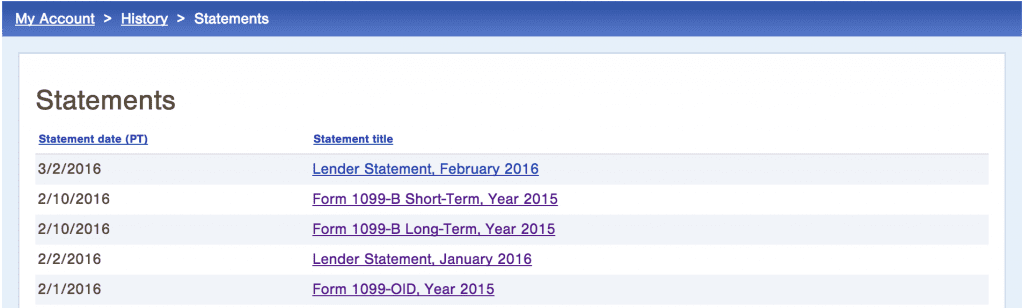

Prosper provides similar tax forms to that of Lending Club and the tax treatment is also similar. Although they do not have a tax guide, they do offer some frequently asked tax questions on their website. If you’re looking for your statements they can be found under History when hovering over your account name. From the History screen, select Statements. Instead of all of your tax documentation being consolidated in one report, you’ll find several different forms. I have shown the ones listed in my account below.

Below is the breakdown taken from Prosper’s FAQ that highlights the forms you may receive from Prosper (if applicable) for your account. Included below are screenshots from my Prosper account.

1099-INT

You will receive a form 1099-INT in each tax year that you earn $10 or more in interest on Notes purchased prior to 2009, unless you live in a state for which there is an applicable reporting exception.

1099-MISC

You will receive a form 1099-MISC in each tax year that you receive borrower late fees, referral awards, bonuses, incentives, and the like. Income shown on form 1099-MISC will be reported to the Internal Revenue Service and State tax authorities in the event applicable thresholds as established by them are met.

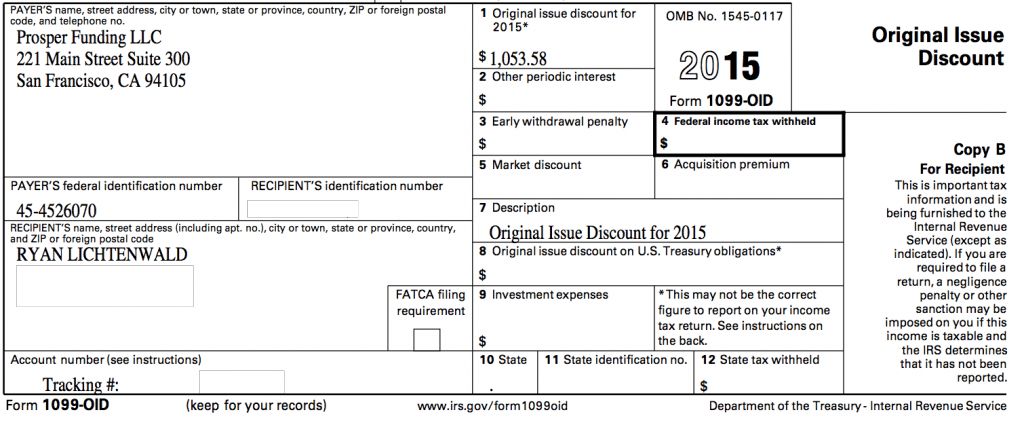

1099-OID

You will receive a form 1099-OID in each tax year that you have interest income on Notes originated in 2009 or later. Income shown on form 1099-OID will be reported to the Internal Revenue Service and State tax authorities in the event applicable thresholds established by them are met. This form details income reported on Notes that are subject to OID tax reporting.

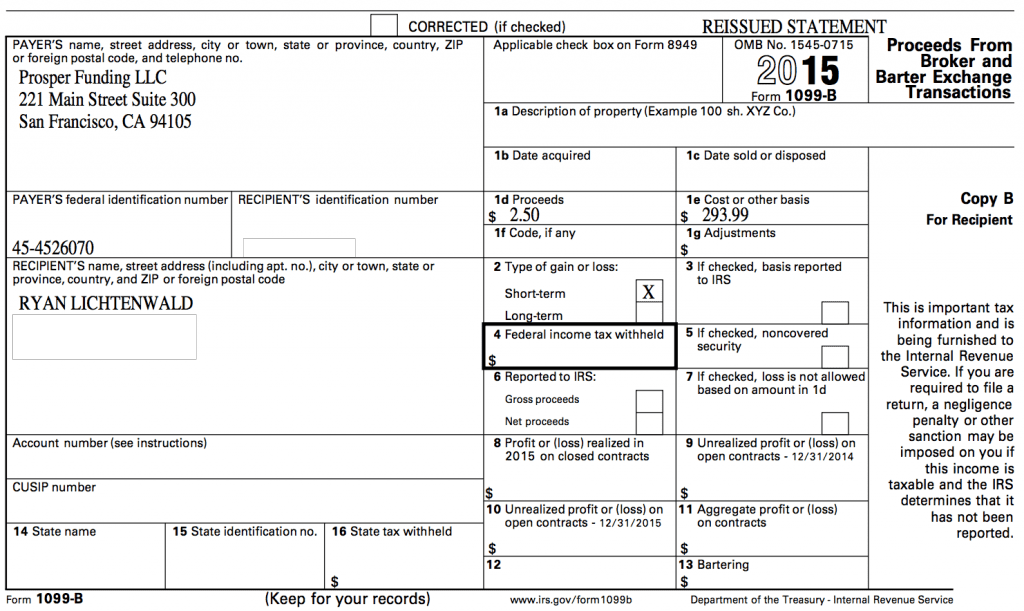

1099-B

If you sold Notes on the FOLIOfn trading platform during the tax year, you will receive a Form 1099-B from FOLIOfn that shows your sale date, proceeds, and cost basis, broken down into short and long term gains. You will receive a Form 1099-B from Prosper for any Notes that were charged off/ discharged during the tax year or recovery payments received during the tax year.

A Case For Investing In a Tax Deferred Account

Since we are talking about tax treatment of this asset class, it’s important to note that investing in Lending Club or Prosper has a more unfavorable tax treatment compared to other investments. Due to this, there is a strong case for investing in a tax deferred account like a traditional IRA or a Roth IRA. This is something that every p2p lending investor should at least be aware of, keeping in mind that this is also a personal investment decision.

Income through p2p lending is taxed as ordinary income, similar to that of a regular job. As covered above, losses fall into two categories: short and long term capital losses, which means that losses don’t necessarily offset the gains of your ordinary income as I’ll cover below. In a tax year, the maximum capital losses you can deduct is $3,000. The remainder is carried forward to future years. If you’re focused on investing in higher interest loans, this means that you’ll hit $3,000 of capital losses with around a $30,000 investment.

Additionally, capital losses first offset capital gains. If you have no capital gains, then you can deduct losses from your ordinary income. For most investors this is not the case. Depending on your ordinary income tax rate, this means that your capital losses may be offset first by long-term gains that have more favorable tax treatment, usually 15% (depending on your income), as opposed to your potentially higher ordinary income tax rate. Short-term gains on the other hand have a higher tax rate, similar to the ordinary income tax rates (see Capital gains tax in the U.S.). There is also the consideration that p2p lending is an income producing investment. To optimize taxes, fixed-income investments like p2p lending are better placed in tax deferred accounts.

Conclusion

For the 2015 tax year it was nice to see Lending Club fully integrate with TurboTax and hopefully Prosper will follow suit in the coming years. Taxes on investing in both Lending Club and Prosper are sometimes confusing for newcomers, but hopefully this guide helps you better understand how to file your taxes and the tax implications associated with investing in a taxable account.