[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. This post merely shares how Lending Club and Prosper are presenting their tax information this year. You should seek professional advice before taking action on any of the ideas presented here.]

[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. This post merely shares how Lending Club and Prosper are presenting their tax information this year. You should seek professional advice before taking action on any of the ideas presented here.]

When it comes to taxes and p2p lending, things can get quite complicated. This is especially true for new investors as it can be overwhelming to see many unfamiliar forms. The length and amount of forms you have available to download can vary depending on when you began investing and any losses you incurred. There can also be recoveries, which further complicates things. This post will help Lending Club and Prosper investors find the information they need to file taxes for 2014.

Lending Club Taxes

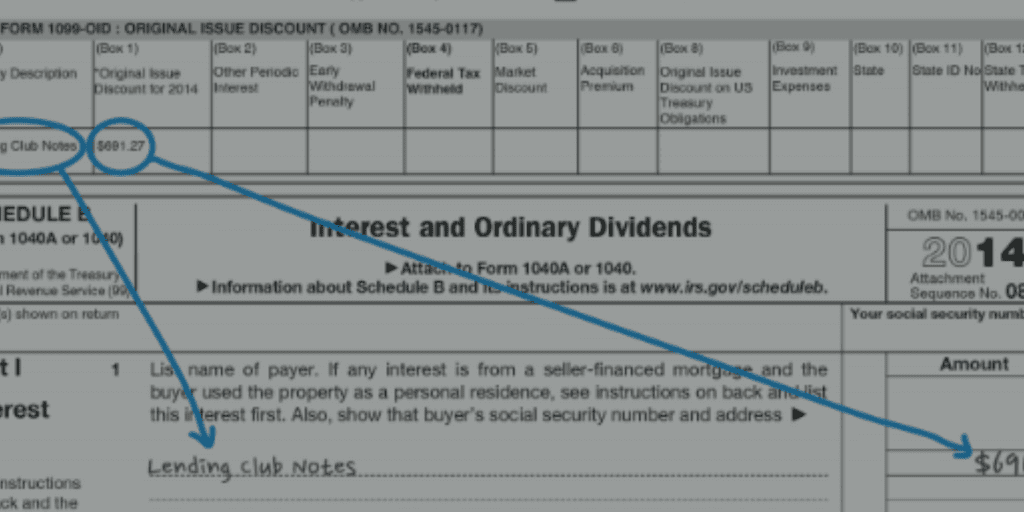

Lending Club has provided an eleven page tax guide, which is much more detailed than last years. I have to give Lending Club a lot of credit for providing a useful tax information guide. It can be found in the tax statements section of your Lending Club account. Otherwise, you can download it from this direct link. The guide explains which accounts will receive certain tax forms, which are outlined below. These statements should all be available in your account as of January 31, 2015.

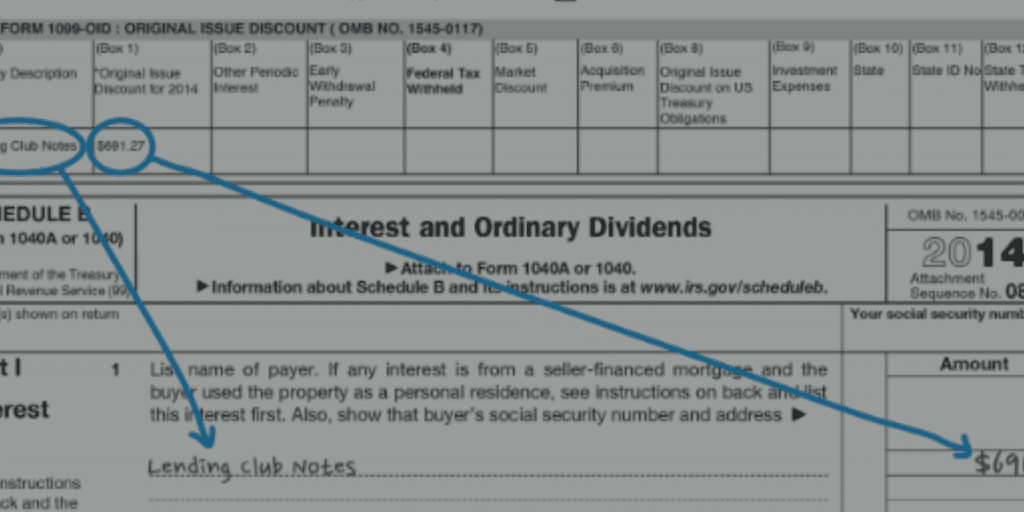

This year Lending Club has shown generally where numbers go on forms like the 1040 and 8949. Since they cannot provide tax advice, the verbiage isn’t definitive. Regardless, the tax guide could be extremely helpful for investors who do their own taxes. I’ve included the below screenshot, which shows where information related to charged off notes is reported. Keep in mind that neither Lending Club nor Folio Investing report information about charged off loans to the IRS.

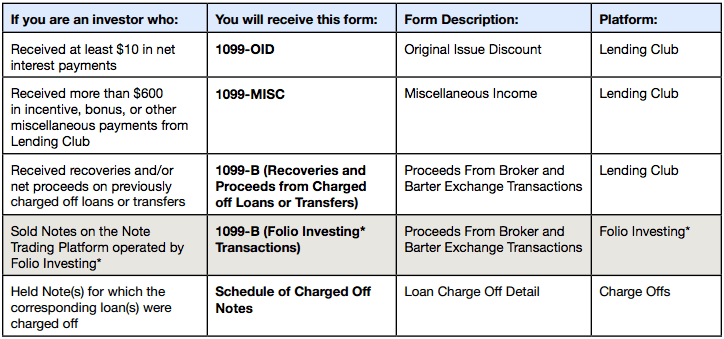

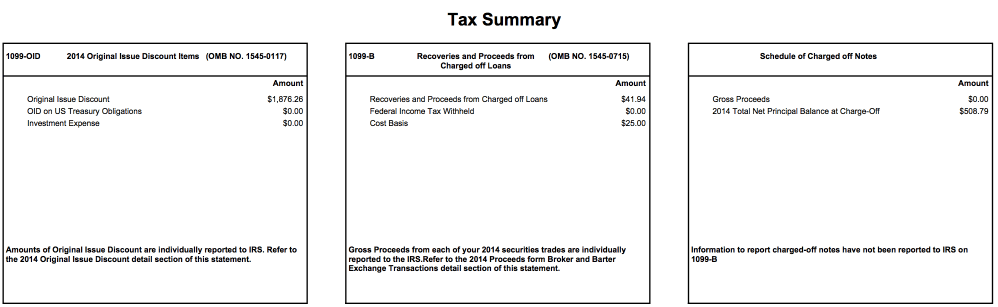

If you have losses and recoveries, Lending Club will actually report these as short and long term separately. Below is my Lending Club tax summary, which provides a great overview of my account for the year.

I spent some time researching why I had a cost basis in the 1099-B table. In my case, this was due to Lending Club giving me a credit for an ineligible loan that I invested in. For whatever reason, this specific loan was cancelled by Lending Club. It showed up as a recovery, but Lending Club included the cost basis to offset any gains.

At the end of the guide, Lending Club gives the following as a note on gains and losses.

Gains and losses from recoveries, sales, or charge offs related to Lending Club Notes are generally reported for tax purposes as capital gains or losses, rather than ordinary gains or losses. Notes are generally considered capital assets because they are owned for the purposes of investment (similar to a stock or a bond). Generally, realized capital losses are first offset against realized capital gains. For individuals, any excess capital losses can generally be deducted against ordinary income up to $3,000 ($1,500 if married filing separately). Losses in excess of this limit may generally be carried forward to later years to reduce capital gains or ordinary income until the balance of these capital losses is fully utilized.

Prosper Taxes

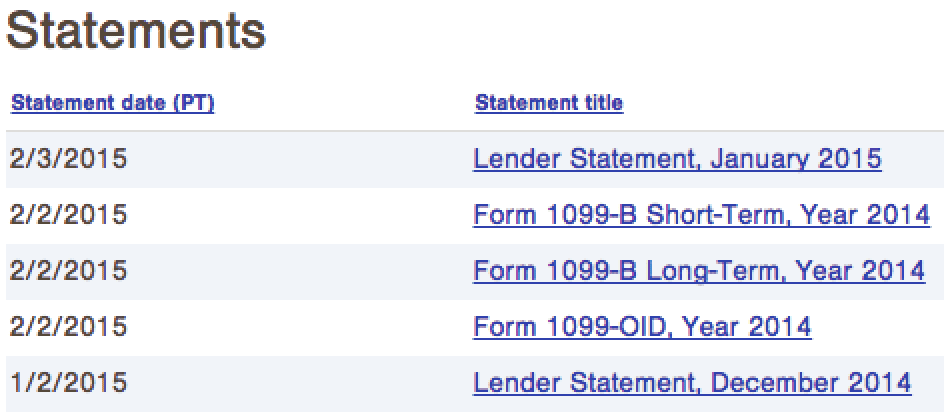

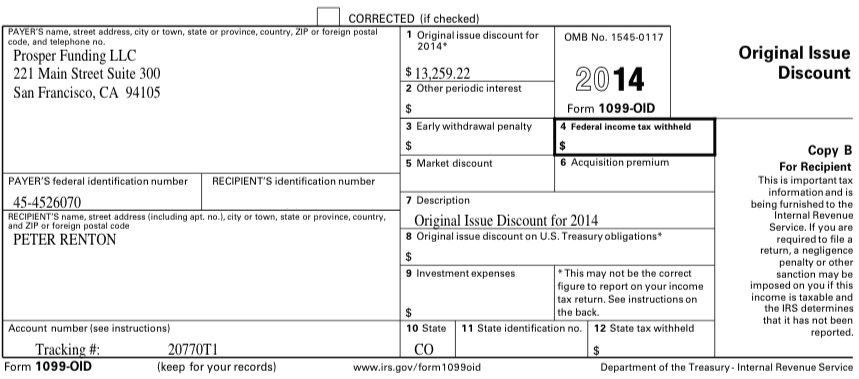

Prosper doesn’t provide a thorough guide like Lending Club, but does have a FAQ tax section, which answers many of the common questions. Your tax statements can be found under the “History” tab and then clicking on “Statements”. Please note that the Prosper screenshots are from Peter’s account. Since I did not incur any losses for 2014, I only received a 1099-OID.

Among the FAQ is a list of each form you may receive depending on your account. They are listed below for reference.

1099-INT

You will receive a form 1099-INT in each tax year that you earn $10 or more in interest on Notes purchased prior to 2009, unless you live in a state for which there is an applicable reporting exception.

1099-MISC

You will receive a form 1099-MISC in each tax year that you receive borrower late fees, referral awards, bonuses, incentives, and the like. Income shown on form 1099-MISC will be reported to the Internal Revenue Service and State tax authorities in the event applicable thresholds as established by them are met.

1099-OID

You will receive a form 1099-OID in each tax year that you have interest income on Notes originated in 2009 or later. Income shown on form 1099-OID will be reported to the Internal Revenue Service and State tax authorities in the event applicable thresholds established by them are met. This form details income reported on Notes that are subject to OID tax reporting.

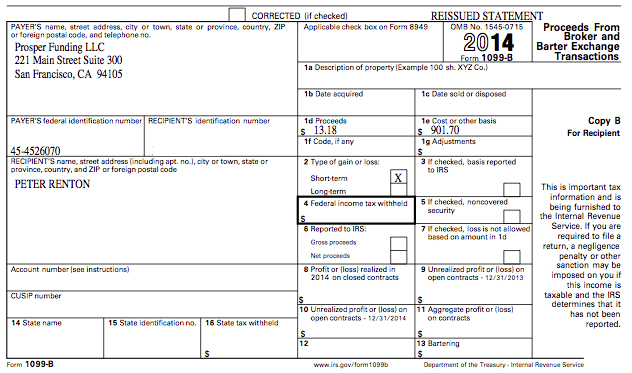

1099-B

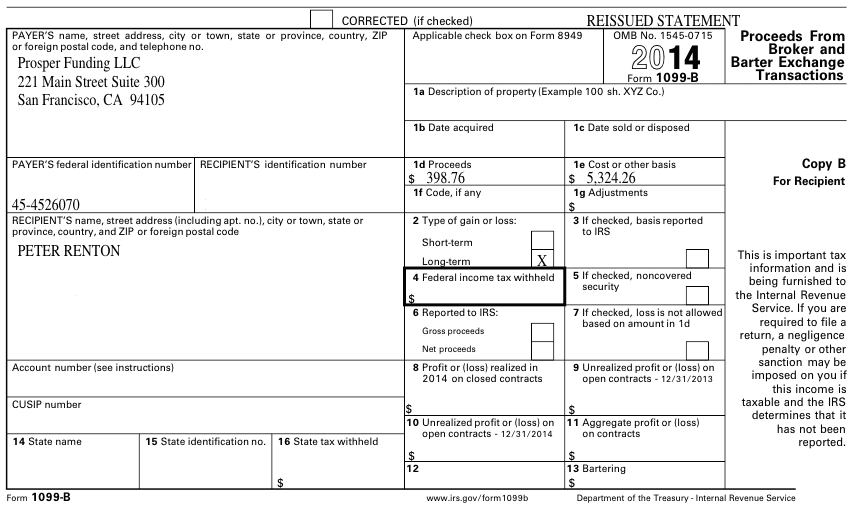

If you sold Notes on the FOLIOfn trading platform during the tax year, you will receive a Form 1099-B from FOLIOfn that shows your sale date, proceeds, and cost basis, broken down into short and long term gains. You will receive a Form 1099-B from Prosper for any Notes that were charged off/ discharged during the tax year or recovery payments received during the tax year. Note that these will exist for both long and short term losses/recoveries as shown below.

After the 1099-B overview page, you will see a detailed list of every every note that was charged off or had a recovery. You will not receive a 1099-B if you do not have any losses, which is common for new investors.

Deducting Losses

Many seasoned p2p lending investors are aware of the somewhat unfavorable tax treatment for p2p lending, but this only applies if you are investing solely in a taxable account. The base of the complaints comes from interest payments counting as ordinary income and the losses being considered capital losses. Each year, individuals are only able to deduct a maximum of $3,000 in capital losses, but the remainder may be carried forward to future years.

How can you work around the $3,000 deduction limit? If you had capital gains from stock sales, the capital gains can be used to offset the losses. Another way is to invest in Lending Club or Prosper notes in a retirement account. If you have a combination of taxable p2p lending and retirement accounts across all loan grades, it may be wise to invest in higher risk notes in an IRA. This way, you can have a more conservative strategy in your taxable account where losses are less, thus allowing you to have a larger investment account. Keep in mind that losses beyond $3,000 aren’t lost, they are simply carried into future years.

Hopefully this review helps you get a better understanding of each of the forms you may receive when investing in Lending Club and Prosper.

None of this information should be considered tax advice. I recommend consulting a tax professional before taking action on anything included in this post.