[Editor’s note: The founder of this blog has been a Prosper investor since 2010 and has over $300,000 invested in multiple p2p lending accounts. You can view Peter’s p2p lending accounts and returns here. Review last updated in June 2015.]

Prosper was the first p2p lending platform in the U.S. when it launched back in 2006. It has been a trailblazing company and, after some hiccups in the early days, has established itself as one of the two main players in the industry.

Along with this detailed review, Lend Academy also has provided the video below that gives you an inside look at a Prosper account. There is also a demonstration of basic filtering on loans on Prosper and more information for new investors. If you can’t see the video below, then you can also watch it on YouTube here.

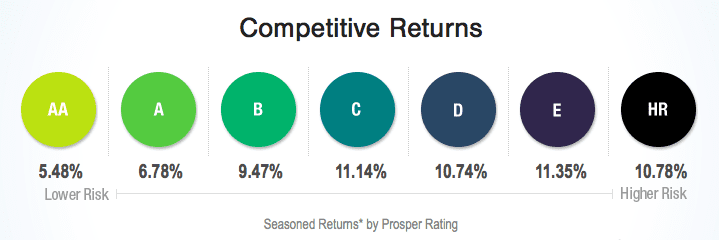

When investors consider Prosper as an investment, they need to remember that there have really been two iterations of the company. Prosper 1.0 was from their beginning in 2006 to 2008 when underwriting standards were very lax (the minimum credit score was 520) and investor returns, on average, were negative. Prosper 2.0 is from 2009 to the present day when underwriting standards improved dramatically (minimum FICO score is now 640), and returns for investors have been much better. Below is the graphic that shows the average seasoned returns for investors since 2009, broken down by loan grade.

Loan Grades and Prosper Scores

As you can see in the above graphic Prosper has seven loan grades called Prosper Ratings: AA, A, B, C, D, E and HR where AA is the lowest risk down to HR which actually stands for high risk. Rates start at 5.99% for a 3-year AA loan up to 31.72% for an HR loan. For a complete table of interest rates you should go to the Prosper borrower help page and click on the “What are the loan interest rates?” section under Applying for a Loan.

One unique part of the way Prosper ranks borrowers is that they use more than just a loan grade – there is also a Prosper Score ranging from 1-11. This is a score that they have developed internally based on the payment history of actual borrowers on their platform. They use both the Prosper score and the borrowers credit information to determine the interest rate and the estimated loss rate.

Investor Eligibility

Not everyone can invest at Prosper. There is a list of requirements that all investors must meet before they can open an account:

- Individual investors must be 18 years of age or older, have a valid Social Security number as well as a checking or savings account.

- You must reside in an eligible state. As of this writing residents in the following states may invest: Alaska, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New York, Oregon, Rhode Island, South Carolina, South Dakota, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin and Wyoming.

- Some states, Alaska, Idaho, Missouri, Nevada, New Hampshire, Virginia and Washington, have financial eligibility requirements of a $70,000 annual gross income and a $70,000 net worth. Also, no residents of these states may invest more than 10% of their net worth in Prosper notes.

California investors have their own specific requirements. For a complete list of eligibility rules you should check out the Investor Help section on Prosper’s website.

How It Works

Investing at Prosper is a relatively simply process. It begins when the borrower applies for a loan. If the borrower meets Prosper’s underwriting criteria, such as a minimum FICO score of 640 (for a new borrower) then the loan will be listed on the platform for investors.

There are two distinct platforms at Prosper, the whole loan and fractional loan platforms. The whole loan platform is for very large investors, usually funds or other institutional investors, where loans are made available in their entirety. Investors can not invest in a part of the loan, they must take the entire amount.

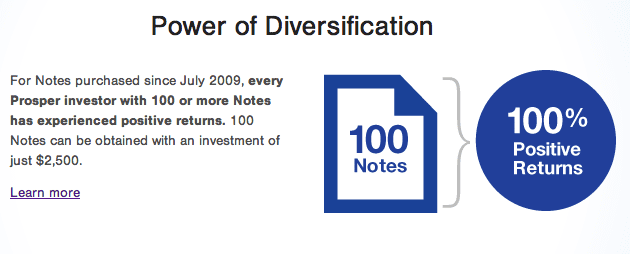

This review is most concerned with the fractional loan platform where investors can invest in small portions (fractions) of loans. Investors can open an account with as little as $25, which is also the minimum investment per loan. This way investors can build a portfolio of loans, taking just small fractions of each loan. Prosper likes to promote the fact that every investor since 2009 (Prosper 2.0) that has invested in at least 100 loans has made a positive return.

Once an investment has been made, the amount is pooled with other investors. Assuming the loan is fully funded and the borrower passes all verification steps then the loan is issued to the borrower, less Prosper’s origination fee (up to 4.95% depending on loan grade). Then within 30-45 days investors should start seeing payments showing up their account, as principal and interest payments are made every month over the life of the loan. You can read about the fees that Prosper charges to investors in this post.

What are the Risks?

Prosper does offer the possibility of an excellent return on investment. So, the question most prudent investors should ask is: what about the risks? Investing with Prosper has a number of risks:

- Borrower defaults – the loans are unsecured so an investor has little recourse if the borrower decides not to pay. The annual default rate across all grades at Prosper is 3-4% with higher risk borrowers having a higher default rate.

- Poor loan diversification – This is related to borrower defaults but many new investors get caught in this trap so it is worth emphasizing here. New investors should take advantage of the $25 minimum investment. Investing in 20 loans at $250 has a much higher risk than investing in 200 loans at $25. With 20 loans one default could wipe out most of the investment gains. You can learn more on basic portfolio diversification and then read a statistical analysis of p2p lending diversification.

- Prosper bankruptcy – There are two legal entities at Prosper. There is Prosper Marketplace Inc. that runs the platform and all administrative functions and then there is Prosper Funding LLC that holds all the loans. This two part structure provides a level of bankruptcy protection in that if Prosper were to go bankrupt the loans are held in a separate entity and should be free from claims by creditors. Prosper continues to grow rapidly and recorded their first profitable quarter in Q3 of 2014.

- Interest rate risk – the loan terms are three or five years so during this time interest rates could increase substantially. Rates on FDIC-insured investments could rise dramatically in this time. Also, as investors, we are relying on Prosper to price these loans with an appropriate interest rate commensurate with the risk.

- Liquidity risk – While there is a secondary market on Prosper an investment here should not be considered liquid. It is true that loans can be bought and sold on this secondary market but it is by no means a very active market. Also, Prosper does not allow any late loans to be listed on their trading platform which further reduces investor liquidity.

The Investment Platform

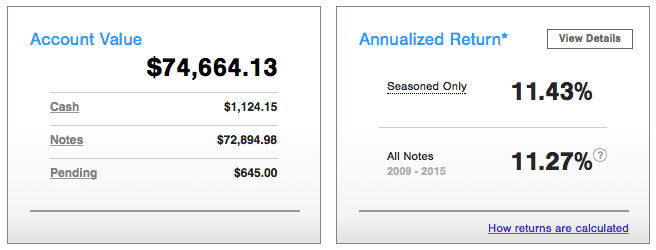

At Prosper new loans are added on to the platform seven days a week. They are added in batches at 9am and 5pm Pacific Time every weekday and at noon Pacific Time on weekends. Each loan will stay on the platform for up to two weeks or until it is 100% funded. The above screenshot is from my main account summary page – this is the page you will see when you first login.

Making an Investment

Prosper makes it relatively easy for investors to put their money to work. When investors click on Browse Listings from the main Prosper screen they are first presented with what Prosper calls Featured Listings. These are a subset of all available loans and provide an easy way for investors to choose loans. These are loans that are fully verified for the most part and ready for investor money. However, few serious investors use this feature, it is there just to present some easy options for the newer investor.

Filtering Loans

When investors click the View All Listings link from the Featured Listings screen all available loans are displayed. Here investors can view each loan one by one or apply some filters to make the list a bit more manageable.

Prosper provides a rich list of filters for investors with over 40 different options. Most investors start with Prosper Rating, but there are many more choices about every borrower and their credit history. Don’t know where to start? In this post I share some very simple filtering techniques and here is how I have been investing lately. You can also view my simple Prosper strategy filter criteria directly on NSR.

I encourage you to spend some time understanding more about filtering. The way I learned about it was to analyze the loan history of Prosper. The best way to do this is to use one of the third party sites such as NSRPlatform. Time spent running queries on this site will give you a feel for the different drivers of investor return.

Once you have setup some basic filters you can save these for later use. This way, every time you login you can quickly find the available loans that meet your criteria. Also, you can use a Prosper feature called Quick Invest that will take your loan criteria and invest your available cash in just a couple of clicks. If you are unsure how filtering works then be sure to watch the above video where it is demonstrated in detail.

The Importance of Being Quick

Today, p2p lending is becoming very popular with investors. So much so, that there is an oversupply of investor dollars particularly when it comes to the higher interest loans. Investors that are only interested in loan grades AA and A will have no problem finding loans to invest in but for other grades there can be a great deal of competition.

The higher loan grades (C, D, E & HR) are very popular among investors and some of these loans become fully invested within a minute of two of being added to the platform. So, if an investor wants to have the most choice when choosing loans it is best to pay close attention to the times listed above.

Automated Investing

Not every investor wants to login at specific times every day to invest. Luckily, there are automated options within Prosper itself and through their API:

1. Automated Quick Invest (AQI) – If you have set up your saved search as described above this is very simple to implement. Whenever you run a Quick Invest from a saved search you are actually presented with the option to turn that into Automated Quick Invest. Once this is done your filters will be applied every time loans are added on to the platform.

2. The Prosper API – Prosper has an API (Application Programming Interface) that it makes available to all investors. However, one needs to have considerable technical skill in order to use it so it is not a realistic option for everyday investors. I mention it here because as of today it is the fastest way to invest your money. API investments are run even before AQI investments. If you don’t have the technical skills, the below third party tools are also options.

4. NSRPlatform (https://www.nsrplatform.com) Has a complete suite of useful tools for Prosper investors. There is a back testing and filter feature that provides a front end to the entire loan history of Prosper broken down by loan grade. Investors can test various filtering strategies to determine the best historical returns. Using their portfolio analysis tool, investors can run an analysis on their current Prosper portfolio. NSR can also be used for order management and automation.

5. LendingRobot (https://www.lendingrobot.com) LendingRobot provides order execution for Prosper and allows you to create filters to narrow your investment criteria. Besides filter based investing, they also offer a fully automated selection, which will invest in loans for you based on whether you seek a conservative or aggressive investment approach. They also provide data on order history, sell history and provide a cash-flow forecast.

6. PeerCube (https://www.peercube.com/) PeerCube focuses on analysis and order execution for Prosper. With PeerCube, you can identify loan attributes that have historically provided higher returns and view past performance. Through their analysis tool, you can look into return variability as well as performance by vintage.

Conclusion

In January, 2013 Prosper received a large round of funding led by Sequoia Capital. At the same time a new executive team was put in place. This new team has executed at a very high level and it shows in the dramatic growth Prosper has experienced since then. They have since raised an additional $165 million in financing, which values the company at $1.7 billion. Prosper is a strong company that is providing great returns for p2p lending investors. This is why I continue to invest my own money. If you want to take the plunge and open an account then just click the link in the box below.