AlphaFlow is a tech-driven investment manager, providing professionally managed portfolios of real estate loans to institutional investors; they are looking...

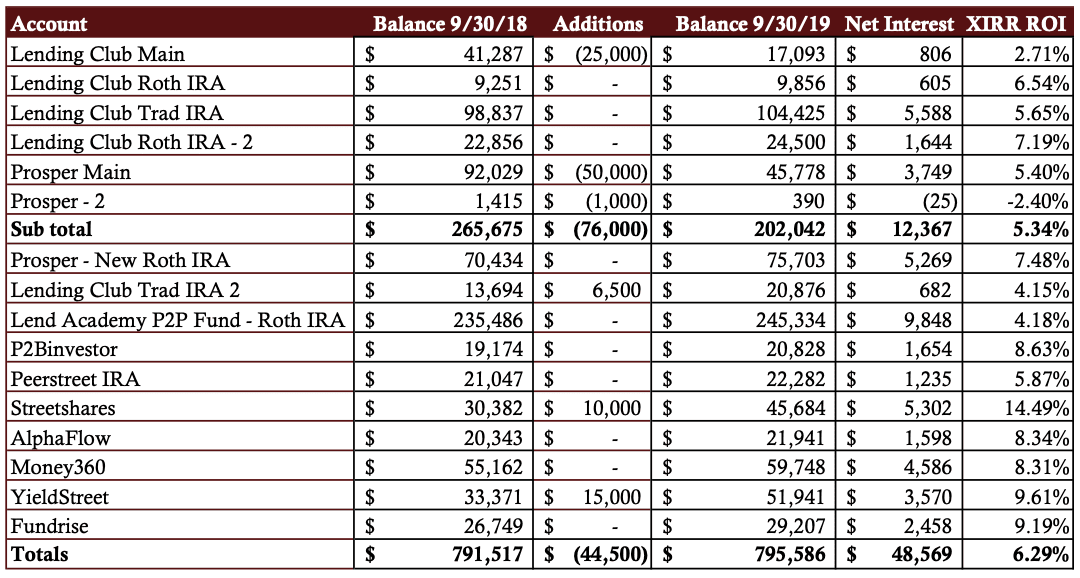

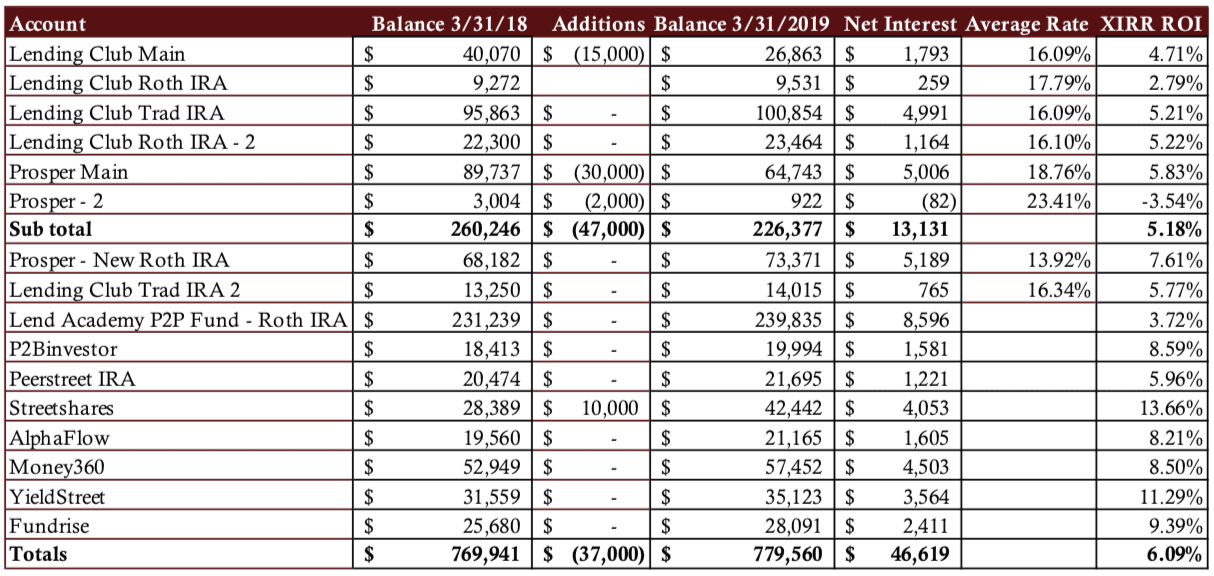

Every quarter Peter Renton, Founder of Lend Academy and Co-Founder of LendIt Fintech shares his investments in various marketplace lenders;...

The real estate crowdfunding space has been an interesting one to watch. Just a few short years ago, in 2015...

Peter Renton shares returns from his marketplace lending portfolio as of Q3 2017; overall returns for Renton’s portfolio was 6.64%; declining performance in the portfolio is primarily due to LendingClub loans; new additions to his portfolio for the quarter include AlphaFlow, Money360 and YieldStreet. Source

Real estate alternative investment platform AlphaFlow raised $4.1mn led by Resolute Ventures and Point72 Ventures; they plan to use the funds to scale partnerships with lenders and investors, accredited individual investors and investment managers; they also plan to hire more individuals for the data science and engineering division and potentially look at more asset classes int the future. Source.

Every quarter, LendIt co-founder Peter Renton shares his marketplace lending returns; in this blog post he shares his Q4 2019...

I am certainly late with this but I have finally found the time to bring you my quarterly returns report...

Put this in the “better late than never” department. Yes, I know it is late July and I am only...

AlphaFlow is an investment platform for real estate that allows investors to easily build a diversified portfolio; Sturm shares what platforms they are working with, their due diligence process, the types of loans they invest in, how they’re planning to work with offline hard money lenders and more. Source

AlphaFlow has announced the launch of AlphaFlow Managed Portfolios; created by Ray Sturm, co-founder of RealtyShares, AlphaFlow has been managing real estate investments that allow investors to invest in loans across multiple real estate crowdfunding platforms since its launch in 2015; the introduction of the AlphaFlow Managed Portfolios is an effort to better meet the needs and demands of the firm’s investors; the new platform will provide investors with a real estate portfolio of 75 to 100 real estate loans; the portfolio will be driven by AlphaFlow Advanced Analytics and targets returns of 8% to 10% with a 1% fee on assets under management. Source