Every quarter I share my marketplace lending investment returns with the world. I started doing this back in 2011 with just my LendingClub and Prosper accounts. Today, I share my returns from 14 different accounts across a variety of investment vehicles and platforms.

If you have been reading these posts in the past year or so you will have noticed a steady decline in my returns, primarily caused by underperformance in my LendingClub accounts. That trend has continued with my latest results with my worst performance ever since I started investing in LendingClub back in 2009.

From the beginning I have focused my investing primarily in the highest risk notes and this is the segment that has been hit hardest by defaults. Earlier this year I adjusted my strategy and started investing across the entire risk spectrum but it is a bit like steering a battleship. Given my many thousands of notes it takes a while for any changes to show up in my portfolio returns.

The only good news on this front is that recent vintages at LendingClub appear to be performing better so I am hopeful I can turn this battleship around in the next quarter or two.

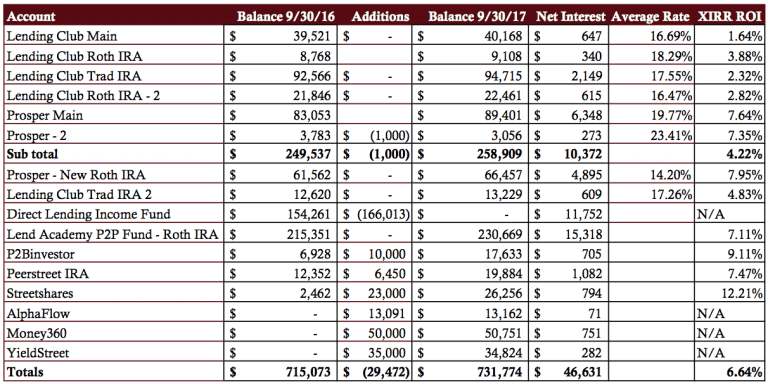

Overall Marketplace Lending Return at 6.64%

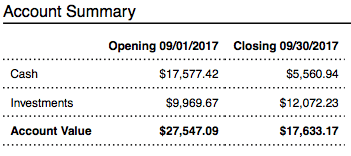

My trailing 12 month returns for the year ended September 30, 2017 across all my accounts was 6.64%. This was my first quarter without the Direct Lending Investments (DLI) fund. As I mentioned in my last update I was redeemed from that fund on June 30. This has been my best performing investment of the last four years and it will be very difficult to replace it with investments of similar yield. This will also provide a drag on my returns going forward.

I have used the proceeds from DLI to increase my positions at a couple of platforms and have started deploying into new investments. With this edition I am sharing three platforms where I have made new investments: AlphaFlow, Money360 and Yieldstreet. You can read more information about these and all my other investments below.

Now on to the details. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way for individual investors to determine their actual return.

- The six older accounts have been separated out to provide a level of continuity with my earlier updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

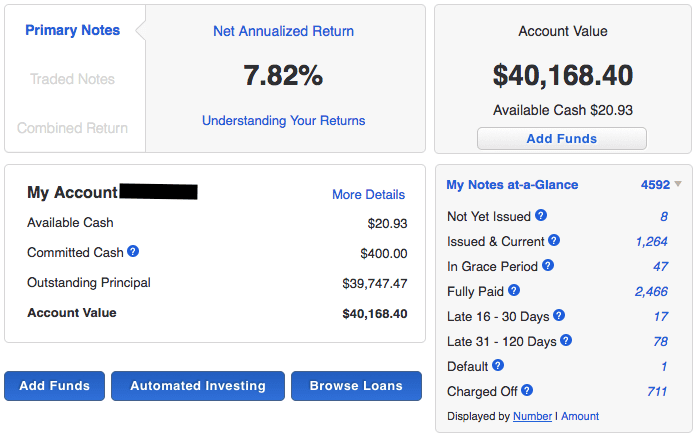

LendingClub

My main LendingClub account has performed poorly over the past 12 months. My TTM return is at a paltry 1.64%, my lowest return ever. All of my LendingClub accounts are below 5% and all have shown reduced returns over the past year. While I used to think I had a solid diversified strategy in reality I was focused almost exclusively on the higher risk grades: C-G. I had less than 2% of my portfolio in grade B and virtually nothing in grade A. With a more balanced portfolio I could have reduced the hit I have taken here but after 6+ years of outsized returns I didn’t think I needed the lower risk loans. In hindsight that was a mistake because, as we showed in our analysis earlier this year, grade B has been the best performing loan grade from the 2015 and 2016 vintages. LendingClub launched a new credit model just a couple of months ago and many investors are bullish that this new model will provide more predictable and better performance.

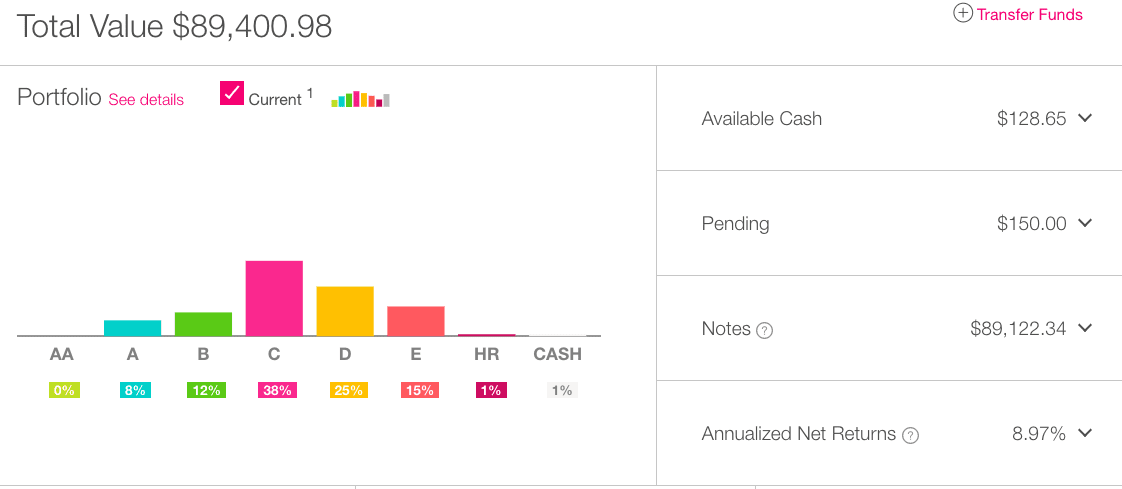

Prosper

Prosper continues to perform quite well. I have not suffered the same downturn here that I have in LendingClub. My three accounts are all returning between 7% and 8% which I consider quite respectable. My main Prosper account was opened in 2010 and as you can see by the grade breakdown above it skews towards a more aggressive strategy. My average interest rate of the loans I have invested in is just under 20% but returns have been quite consistent recently in the 7-8% range. I have made one minor change at Prosper, I have decided to slowly liquidate my smallest Prosper account that was started with $2,000 back in 2011. It is such a small account and it is taxable so I have decided to simplify a little and not reinvest anymore. I will be slowly withdrawing the cash as it builds up.

Prosper continues to perform quite well. I have not suffered the same downturn here that I have in LendingClub. My three accounts are all returning between 7% and 8% which I consider quite respectable. My main Prosper account was opened in 2010 and as you can see by the grade breakdown above it skews towards a more aggressive strategy. My average interest rate of the loans I have invested in is just under 20% but returns have been quite consistent recently in the 7-8% range. I have made one minor change at Prosper, I have decided to slowly liquidate my smallest Prosper account that was started with $2,000 back in 2011. It is such a small account and it is taxable so I have decided to simplify a little and not reinvest anymore. I will be slowly withdrawing the cash as it builds up.

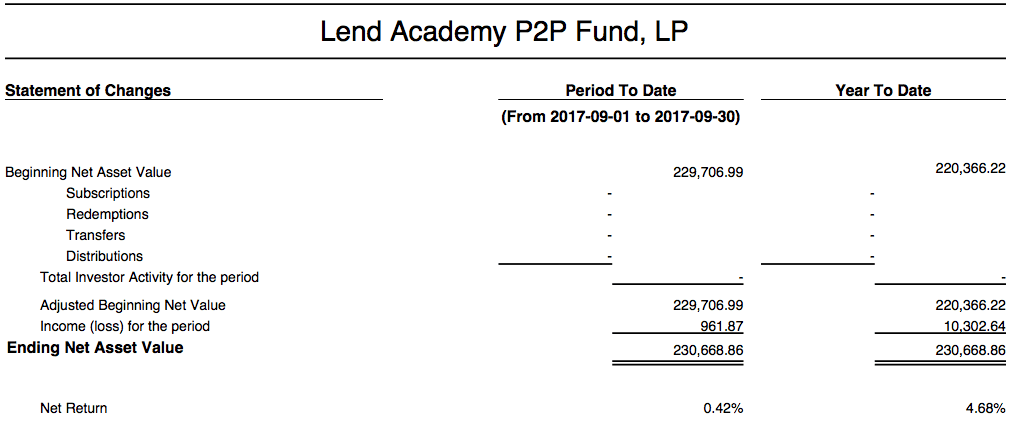

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by the team at our sister company NSR Invest, invests in Lending Club, Prosper and Funding Circle loans and has a small position in Upstart as well. I am pleased by how the fund is performing given my own combined Lending Club and Prosper investments have returned 4.22%. The fund has been consistently returning around 7% for some time.

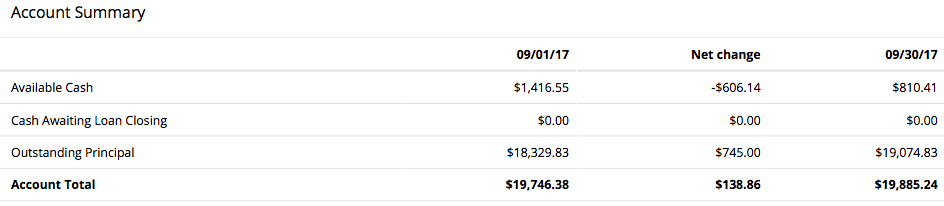

P2Binvestor

P2Binvestor is an asset-backed working capital platform for small businesses based in Denver, Colorado. Full disclosure, I am on the advisory board of this company and have known the founders since before they began operations. I have added to my position there in the last quarter. I originally was going to add $20,000 but then changed my mind and decided on a $10,000 addition. It continues to be a consistent and predictable performer for me.

PeerStreet

PeerStreet is a real estate platform focused on fix and flip properties. These are short term loans, typically between 6 and 24 months, and they are backed by the property. I use their automated investment tool to invest in only those loans that are paying 8% or more, up to a 75% LTV and a duration up to 24 months. Best of all I like that I can invest in a minimum of $1,000 per loan.

Streetshares

Small business lender Streetshares has been one of my best performing investments. So, I added another $20,000 to this investment after I was redeemed from the DLI Fund. Last quarter Streetshares introduced a new product: contract financing which is a factoring type product aimed at government contractors. These are on the lower side of the yield curve at Streetshares but I love this product because these are invoices backed by the US government.

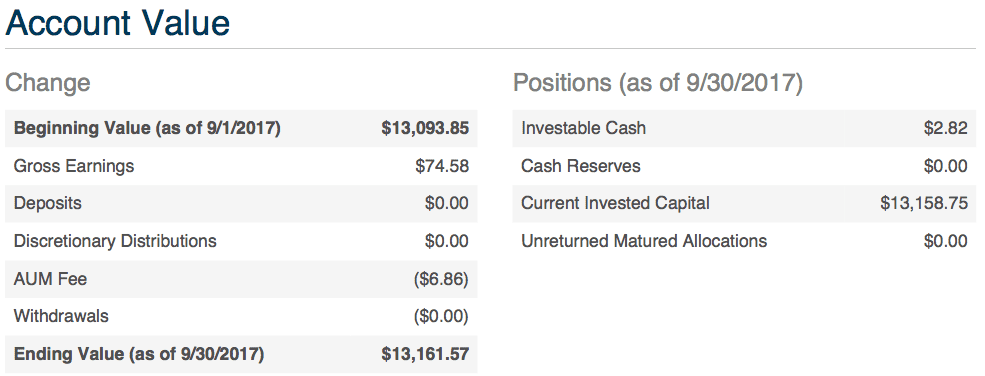

AlphaFlow

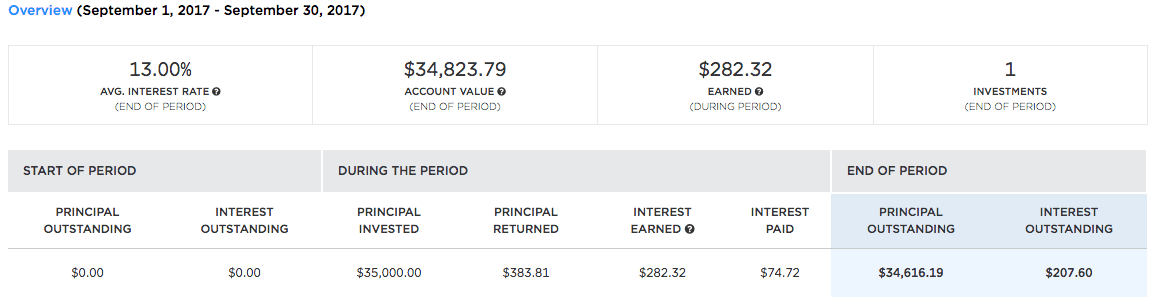

My first new entrant this quarter is AlphaFlow. They are a real estate platform that build diversified portfolios of fix and flip properties for you. What I like about AlphaFlow is that they deploy your money quickly, my entire investment was fully deployed in a matter of days. And they diversify across 75-100 properties, my own portfolio currently has 83 investments in 22 states with an average LTV of 68%. They work with a number of different online platforms and screen the best properties for you. I interviewed the CEO of AlphaFlow on a recent Lend Academy Podcast.

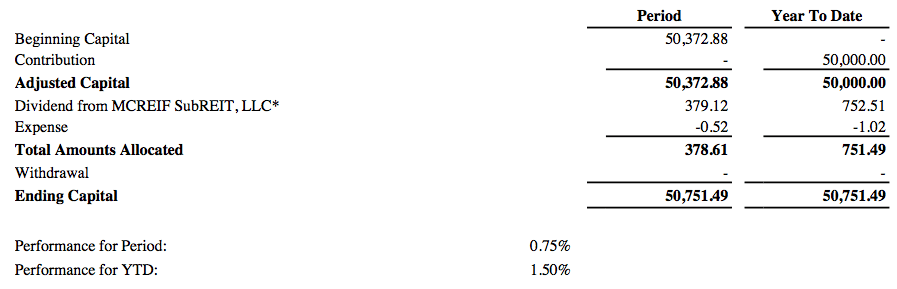

Money360

Money360 is another real estate platform but they are focused on a completely different segment of the market: commercial property. These are primarily bridge loans in the $1 million to $20 million range. I have invested in their M360 CRE Income Fund LP which is managed by M360 Advisors, LLC, their wholly owned investment management company. I like the fact that this is commercial real estate to give me diversification from the fix and flip platforms I have invested in.

YieldStreet

My final new addition this quarter is YieldStreet. This is an interesting company that has a range of asset-based investment products. They offer real estate loans, secured business loans and litigation finance. It is this last offering that interested me. Litigation finance is a new asset class for me and one that I was initially quite skeptical about. But after I did my research on the asset class and on YieldStreet specifically I was happy to make the investment. I have invested in “Diversified Pre-Settlement Portfolio XXIII” which is a portfolio of plaintiff advances related to 365 different personal injury cases. These advances are intended to help individuals pay for essential life expenses while they await the resolution of their personal injury lawsuits. One of the unique aspects of this investment is that you receive principal and interest payments directly back to your bank account as payments come in, so the principal balance will slowly decrease over time.

Final Thoughts

As you can see with my three new additions here I am focused most of my new investments in the asset backed space. I like real estate and feel that I have been underweight on this asset class so now I am fixing that problem. I am also adding to my positions in small business lending. While I still like consumer credit as an asset class I think I have been too concentrated there for some time.

I am confident that my LendingClub portfolios will rebound from their lows although I probably won’t see any improvement in my returns until some time in 2018. I am a patient investor and have not considered redeeming my money there. Having broad exposure to the entire cross section of the loan book has been the lesson I have taken away from my recent underperformance there.

Finally, as I do every quarter I want to end by highlighting the net interest number which for the last 12 months stands at $46,631. This number is going to be volatile for the next nine months or so as I reinvest the proceeds from the DLI fund across new investments.

As always, if you have any questions or comments I am happy to discuss in the comments section below.