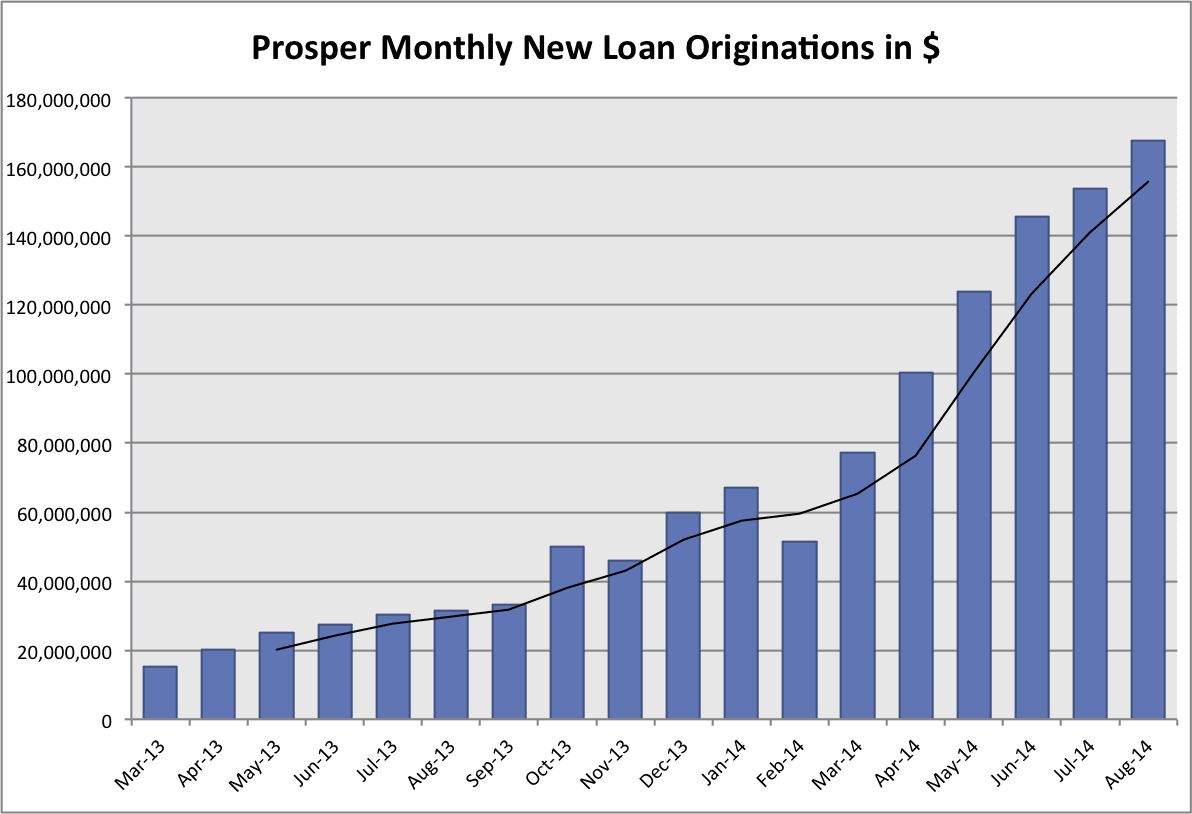

When you look at the graph above you can see the kind of year that Prosper is having. Apart from a hiccup in February, they have been firing all cylinders this year with some of the most impressive growth we have seen, at least in this country.

The numbers for August are in and Prosper recorded $167.6 million in news loans issued, an increase of 9% over the previous month and up a staggering 434% from August 2013. In the past 12 months they have issued almost $1.1 billion in new loans. Not even the most optimistic prognosticators would have predicted numbers like this 18 months ago.

Below are some of the key stats for last month. Everything is remaining very consistent and the key metric average dollars issued per day continues to show healthy growth.

Average loan size: $13,236

Average dollars issued per business day: $7.6 million

Percentage 36/60 month loans: 66.3%/33.7%

Average interest rate: 14.93%

Percentage of whole loans: 90.3%

Average FICO score: 700

Note: If you are wondering about the Lending Club numbers they have unfortunately stopped updating their new loan data in real time. Their origination numbers and new loan data for the second quarter were made available last month. I will have a post out shortly digging into their numbers.