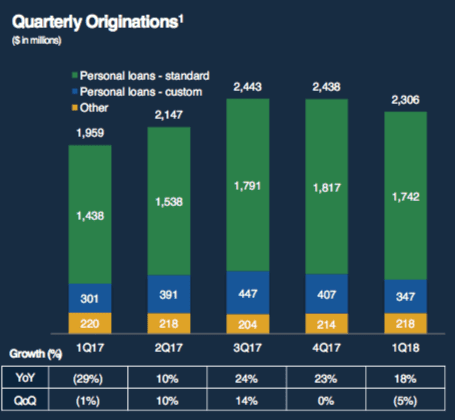

During the first quarter, LendingClub is typically affected by the seasonality of the lending business so it’s beneficial to look both at the last quarter as well as the prior year period. In the first quarter of 2018, LendingClub posted originations of $2.3 billion. This represents a 5% decrease from the previous quarter, but an increase of 18% from the prior year period.

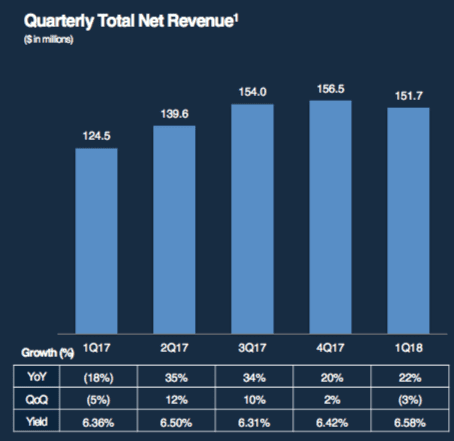

Revenue came in at $151.7 million, down 3% from the previous quarter but up 22% from the prior year period. They incurred a GAAP net loss of $31.2 million which included legal expenses related to legacy issues of $17 million.

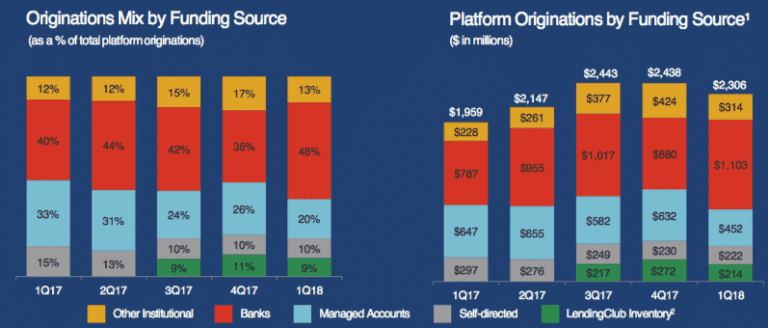

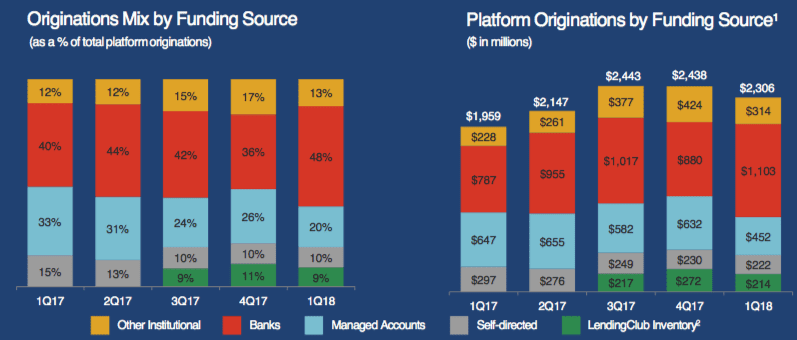

One of the most interesting things to look at every quarter is LendingClub’s platform mix. Below I’ve included data which includes platform mix all of the way back to Q1 2015. Together, these charts tell the story of LendingClub’s evolution over time. In Q1 2018 banks funded 48% of loans on the platform. Over time we’ve also seen loans funded by retail investors, marked “self-directed” below continue to fall to its lowest point in the data included below. Individual investors funded $222 million of loans in Q1 2018 or about 10% of originations.

LendingClub provided two operational highlights from their perspective which were included in the press release. One was the strong response to their Direct Payoff program where borrowers use funds directly towards their credit card balances. In exchange, borrowers receive a better rate on their loan. This feature has also increased conversion rates for the company. LendingClub is looking to make this program more broadly available throughout 2018.

LendingClub also touted the success over their CLUB Certificates which totaled $160 million in the quarter. These CLUB Certificates were first introduced in late 2017 and are a security which allows asset managers to purchase a pool of loans instead of participating in the whole loan program. One of the major benefits is the flexibility and liquidity that these securities provide.

There were several mentions of the FTC complaint which we reported on two weeks ago. Not surprisingly they weren’t able to comment much beyond their response to the complaint, but CEO Scott Sanborn emphasized that a majority of the items are pointing to issues that were self identified by the company that were remedied prior to any dealings with the FTC. One open item is the disclosure of the origination fee which LendingClub believes is unwarranted and that they are in compliance with current rules.

One analyst asked whether they had many any changes to applications, disclosures, promotional materials or the website as a result of the complaint. Sanborn noted that no changes had been made directly related to the complaint, but at any given time they have 80 or 90 tests going on for marketing purposes which look at user flow, product features presented etc. This is an area where we typically don’t get much insight into so it was interesting to hear that data point. LendingClub is constantly looking for ways to optimize the platform for the borrower. Sanborn also said that LendingClub has not seen any changes in terms of borrower behavior related to the complaint.

Also of interest was the increase in borrower activity. LendingClub noted that they have received 2.8 million applications, a 36% increase in activity. The vast majority of these applications are denied but this is a very exciting opportunity for potential growth in the future as LendingClub looks to monetize these declines.

Looking forward, LendingClub provided the below guidance for the second quarter and full year:

Second Quarter 2018

- Total Net Revenue in the range of $162 million to $172 million

- Net Income (Loss) in the range of $(20) million to $(10) million

- Adjusted EBITDA in the range of $12 million to $22 million

Full Year 2018

- Total Net Revenue in the range of $680 million to $705 million

- Net Income (Loss) in the range of $(70) million to $(55) million

- Adjusted EBITDA in the range of $75 million to $90 million

Conclusion

LendingClub is still facing some headwinds due to ongoing legal expenses related to legacy issues in 2016. Beyond these one off expenses, LendingClub delivered a strong quarter compared to the prior year period and clearly has developed some strong partnerships with banks which will likely serve them well over the long term. They are projecting an improvement in their net loss for next quarter so it is going to be interesting to see if they can deliver.