Today, LendingClub was hit by a complaint from the FTC which alleged multiple violations of federal law protecting consumers. There are four claims against the company and LendingClub has responded to each claim in this blog post also published today. Not surprisingly, LendingClub is disappointed in the FTC’s actions given they were not able to resolve the matter constructively without the action. Transparency is something that LendingClub has always prided itself so this action attacks the core of who they are as a company. They are also a co-founder of the Marketplace Lending Association a trade organization that promotes transparency and responsible growth of marketplace lending.

This Bloomberg article summarizes the claims, one being that LendingClub advertised “no hidden fees” while deducting up-front fees from loans. This claim relates to origination fees, which are common practice for many lenders, not just marketplace lenders. LendingClub also allegedly shared with prospective customers that investors had backed their loan even though the loans had not been approved. The article also shared that LendingClub withdrew double payments and also charged borrowers who had paid off their loans which resulted in overdraft fees.

A spokesperson from LendingClub shared with us this statement:

We support the important role that the FTC plays in encouraging appropriate standards and best practices. In this case, we believe the FTC is wrong, and are very disappointed that it was not possible to resolve this matter constructively with the agency’s current leadership. In our decade-plus history we have helped more than 2 million people access low cost credit and have co-founded two associations that raised the bar for transparency. The FTC’s allegations cannot be reconciled with this longstanding record of consumer satisfaction that’s reflected in every available objective metric.

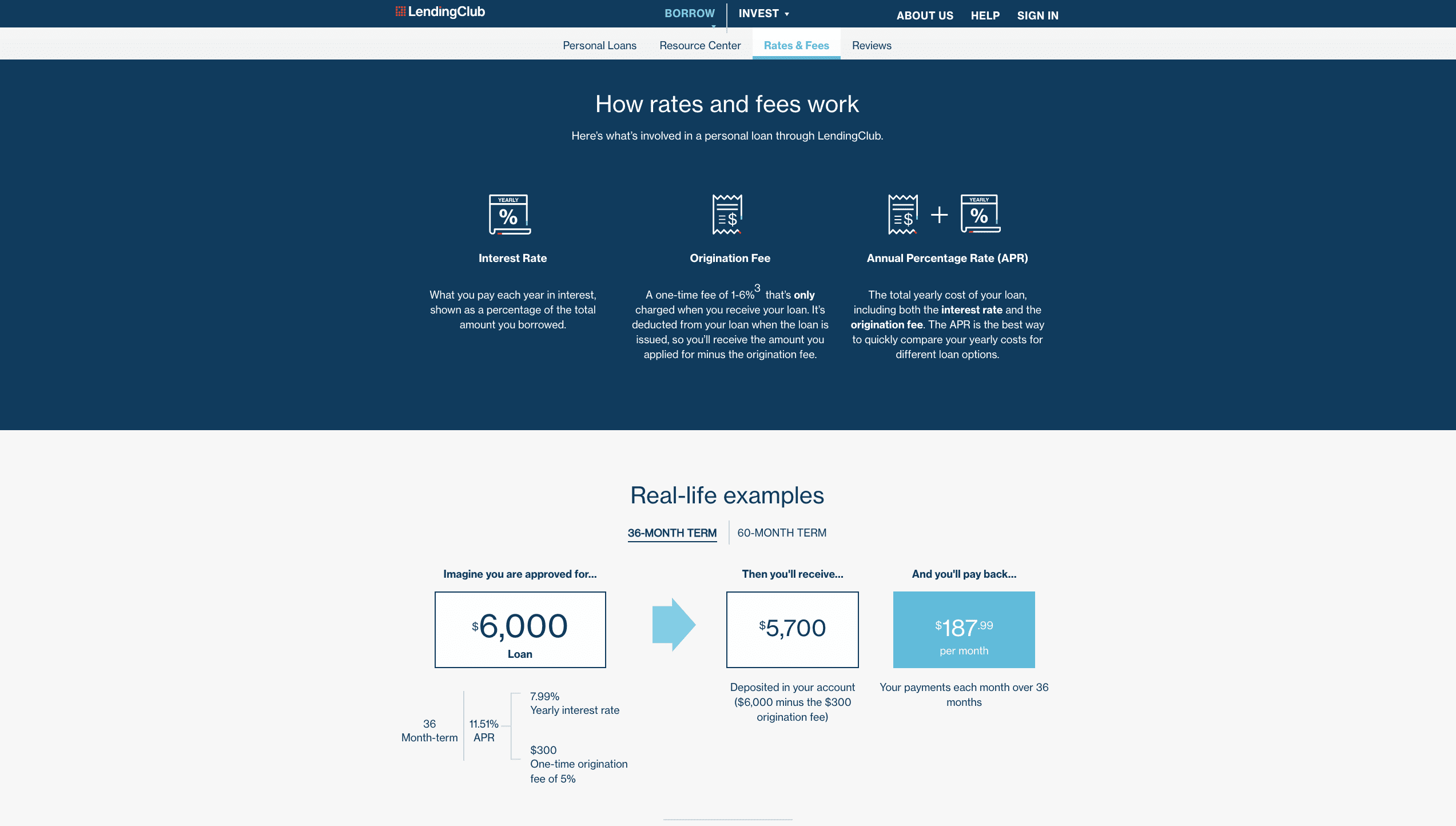

In LendingClub’s blog post they outline where their fees are disclosed on their website as a borrower applies for the loan. The below screenshot is just one place where the origination fee is disclosed. It is also included other fee disclosures throughout the process and also the Truth in Lending Act Disclosure. According to LendingClub, complaints on origination fees from their borrowers are a fraction of one percent. The company also shared that there have been fewer than 15 complaints registered with the CFPB related to origination fees.

Regarding the claims about loans being fully backed, LendingClub shared that these statements were included in emails which were sent in error back in 2015. LendingClub subsequently resolved the issue once the error was discovered. These emails were sent for 88 days. LendingClub shared their standard email which states that a loan is 100% backed, provided they finish the remaining items required from LendingClub.

In response to ACH withdrawals LendingClub shared that there were less than 300 complaints related to double payments. The company has safeguards in place to prevent against this happening including the manual checking of duplicate same-day withdrawals. An instance where a double payment could occur is if a borrower had mailed in a payment while an ACH payment was already scheduled. LendingClub shared that they issued refunds where they made an error “virtually every time” and that they also typically reimbursed overdraft fees if a customer incurred a fee.

The fourth complaint related to privacy notices is something the company addressed back in late 2016. Before 2016, LendingClub included their privacy policy on the footer of many of their pages, but did not provide a separate link when a borrower agreed to the terms of use.

My Take

I should preface these statements by saying that I have had a long, close relationship with LendingClub. I have been an investor in the loans since 2009, an equity investor since their IPO in 2014 and LendingClub has been a sponsor of every LendIt conference since 2013. So, I am hardly impartial in this matter. Having said that I have also studied the company in depth over the past several years and I have a good handle on their operations particularly when it comes to their loan originations.

When I first read the claims I thought the “hidden fees” piece was a bit of a stretch. As described above LendingClub discloses these fees in many places. Today, I went back and watched the Lend Academy video that we published in January 2016 that walks through the entire loan application process step by step. I didn’t remember how prominent these “hidden fees” were and sure enough around the 3:30 mark you see this fee highlighted multiple times on the Truth in Lending Act form.

I am wondering if there is something else going on here. The fact that this was the cornerstone of the FTC case and there had been just a handful of complaints over millions of loan applications seemed a little strange to me. So, I did a little digging into the FTC. Here is how their structure is supposed to work as per their About Page:

The Commission is headed by five Commissioners, nominated by the President and confirmed by the Senate, each serving a seven-year term. No more than three Commissioners can be of the same political party. The President chooses one Commissioner to act as Chairman.

Currently there are only two commissioners. Not only that, but one of the commissioners is leaving on Friday, so there will be just one commissioner in the job starting next week. My understanding from people close to the FTC investigation of LendingClub was that it was going well and all parties were working in a cooperative fashion. This announcement appears to have came out of left field this week right as one of the commissioners was getting ready to leave.

Regardless of the motivations, this is the reality that LendingClub must deal with now. I think this action was unjustified and the argument that LendingClub is deceiving customers feels like a stretch to me. I am confident they will be vindicated once this claim is resolved.