[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. You should seek professional advice before taking action on any of the ideas presented here.]

For new investors in LendingClub or Prosper, it’s important to understand the documents you receive come tax time. For existing investors it’s important to be aware of any changes LendingClub and Prosper have made in their documents or the way the information is reported. Over time the documents have evolved, with both companies now providing a tax guide for their investors.

Note that investors who invest through a retirement account do not have to worry about tax reporting. Here at Lend Academy we believe there is a strong case for investing in marketplace lending through a product like an IRA. Here is our 2018 post on that topic if you’re interested in learning more about taxes and marketplace lending.

As you’re looking at the documents provided by LendingClub and Prosper you should understand at a basic level how profits and losses are reported. The interest or income from loan payments is taxed as ordinary income. Losses are either short or long term capital losses. Copied below is how LendingClub summarizes the tax treatment of investing in loans on the platform:

Generally, gains and losses from recoveries, sales or charge-offs related to LendingClub Notes are reported for tax purposes as capital gains or losses, rather than ordinary gains or losses. Generally, LendingClub Notes are considered capital assets because they are owned for the purposes of investment (similar to a stock or a bond). Generally, realized capital losses are first offset against realized capital gains. For individuals, any excess capital losses can be deducted against ordinary income up to $3,000 ($1,500 if married filing separately). Capital losses in excess of this limit may be carried forward to later years to reduce capital gains or ordinary income until the capital losses are fully utilized.

Now that you have some background on the tax treatment, we can move into the details on how profits and losses get reported at LendingClub and Prosper.

Filing Taxes for a LendingClub Account

Note: If you plan to use TurboTax to file your taxes, LendingClub has a step-by-step guide on importing your forms here.

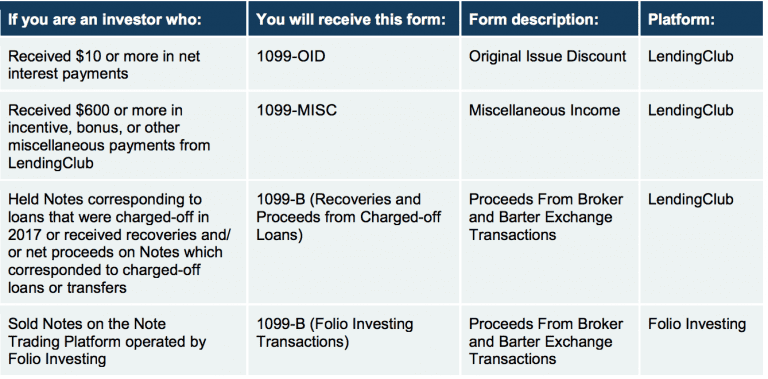

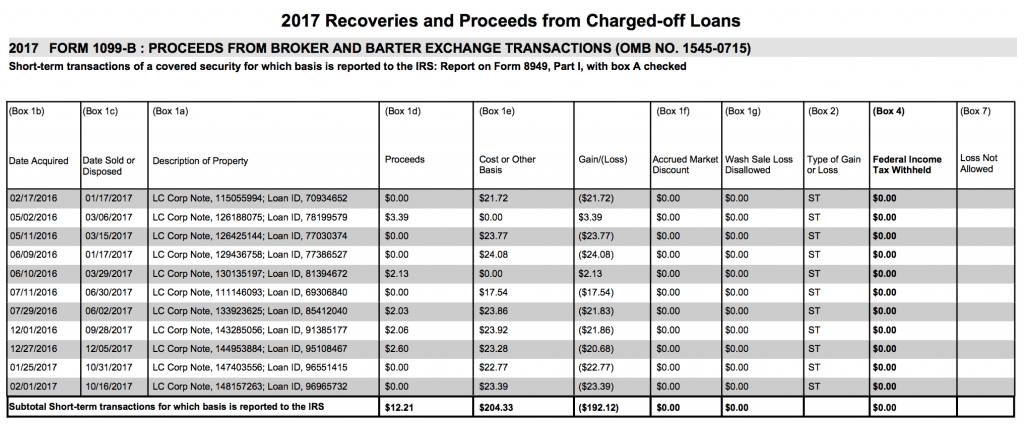

First you’ll want to navigate to “Statements” after logging into your LendingClub account. This can be done by clicking your name in the top right of the landing page once you login. On the next screen you will see a menu bar item titled “Tax Forms”. Clicking on the link will take you to another page which will include a link to your 2017 – 1099 Consolidated Package. Linked below your tax document you’ll find LendingClub’s provided 2017 Tax Form Guide. The guide does a great job of outlining which forms you will receive and where you should report this information when filing your taxes. The below table taken from the tax guide shares which forms you will receive.

My account is seasoned and I also participated in the secondary market in 2017 which means I received Form 1099-OID, Form 1099-B and Form 1099-B Folio Investing. It is summarized at the top of my personal tax document shown below.

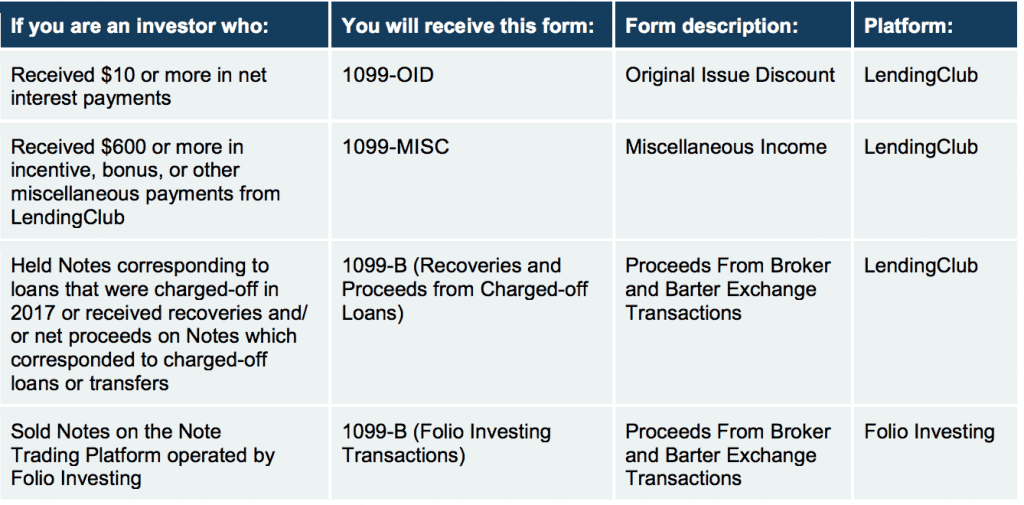

My 1099-OID includes the total interest I received for the year which in my case is $2,058.76. As mentioned above, losses and proceeds are included in the 1099-B, split into short and long-term transactions. I’ve included my 1099-B for short-term transactions below. The long-term losses form is similar, but includes a fair amount of more loans and in turn a higher amount of losses. You can see below I had $12.21 in proceeds (recoveries) from loans that were charged off which is offset by the cost basis of charged off loans, $204.33. This resulted in a net loss of $192.12. On my 1099-B outlining long-term transactions I had proceeds of $109.64 with a cost basis of charged off loans of $1,469.02 resulting in a net loss of $1,359.39. The short and long-term transactions roll up on the 1099-B summary shared above (middle box). Ignoring taxes, I earned a profit of about $500 on my LendingClub account for the year.

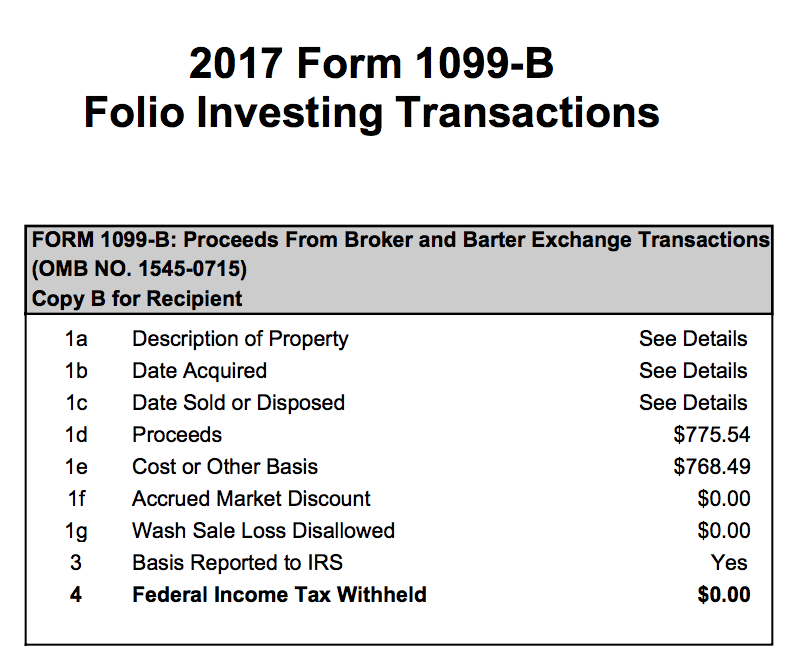

My 1099-B for Folio Transactions is also split out between short-term and long-term transactions. To keep things simple, I’ve only included only the summary below. You can see that I earned a slight premium on the notes that I sold on the secondary market in 2017.

It’s worth sharing the below statement from the LendingClub tax guide related to cost basis and the secondary market which is applicable to those who purchased notes in 2017:

Please keep in mind that Notes purchased on the Folio Investing Note Trading Platform may have been purchased at a discount or premium relative to outstanding principal plus accrued interest at the time of purchase, and additional information is provided in order to help you determine the cost basis for transactions involving these Notes. However, investors are ultimately responsible for tracking their tax cost basis. The basis reported on Form 1099 may differ materially from an investor’s tax cost basis, depending on the investor’s personal tax situation. For more information, please consult your financial or tax advisor.

Now that you understand the documents you have received you need to know where to report these numbers when filing your taxes. The LendingClub tax guide does a great job of outlining this. Interest reported on your 1099-OID is reported on Form 1040 as shown below.

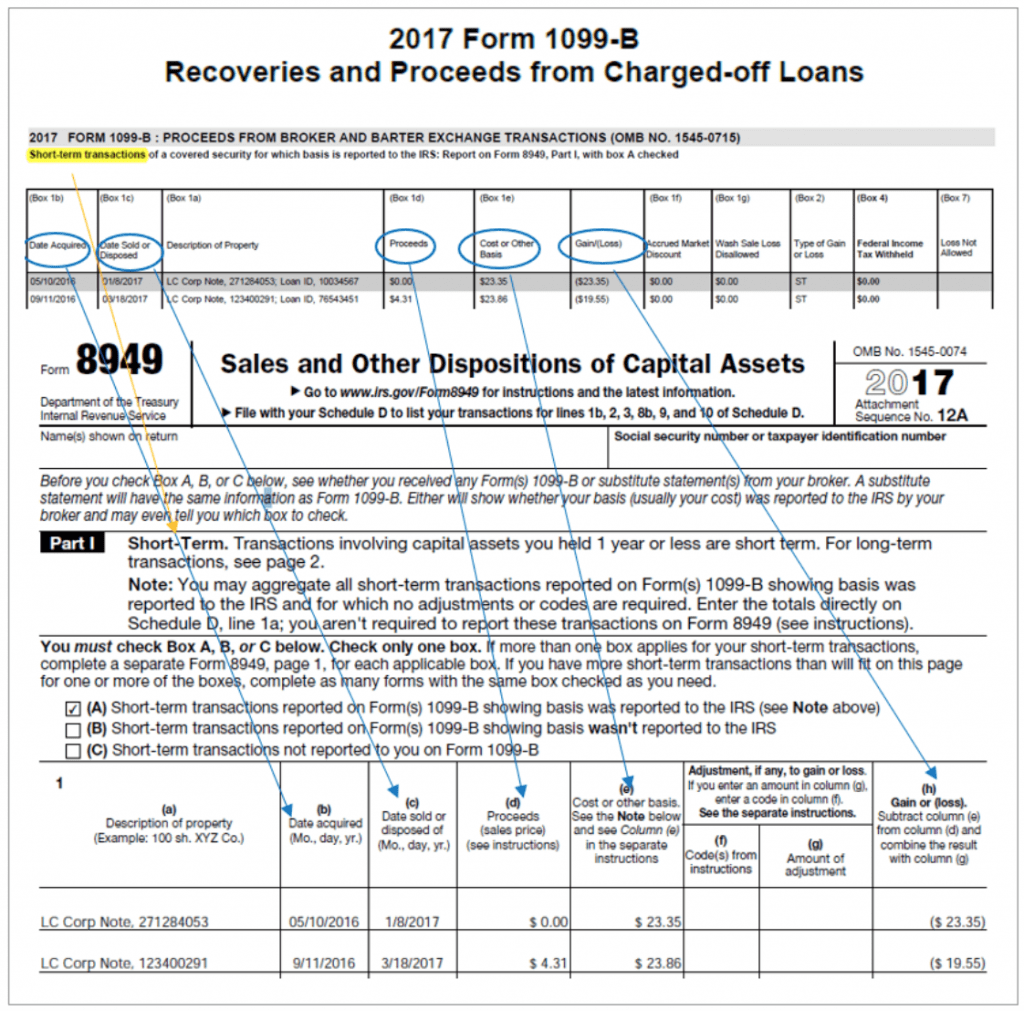

Information from your 1099-B related to recoveries and proceeds from charged-off loans are reported on Form 8949. An example of reporting for short-term transactions is shown below, but long-term transactions are also reported on the same form in Part II (example included in tax guide).

Filing Taxes for a Prosper Account

Although the tax treatment with Prosper is the same, they share the information in a different format than LendingClub. After logging into your Prosper account you’ll want to click your name in the top right corner and select “History”. Next click on “Statements”. You may find that you have a corrected 1099-B as shown below which was issued on 2/27/2018. You’ll want to use the corrected version of the 1099-B.

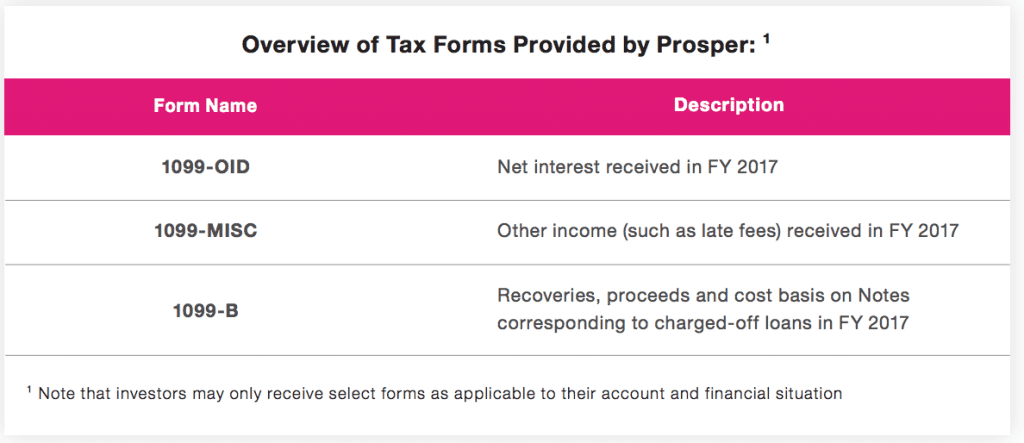

Similar to LendingClub, Prosper has created a tax guide for their investors. Below are the forms you may receive and a description of each.

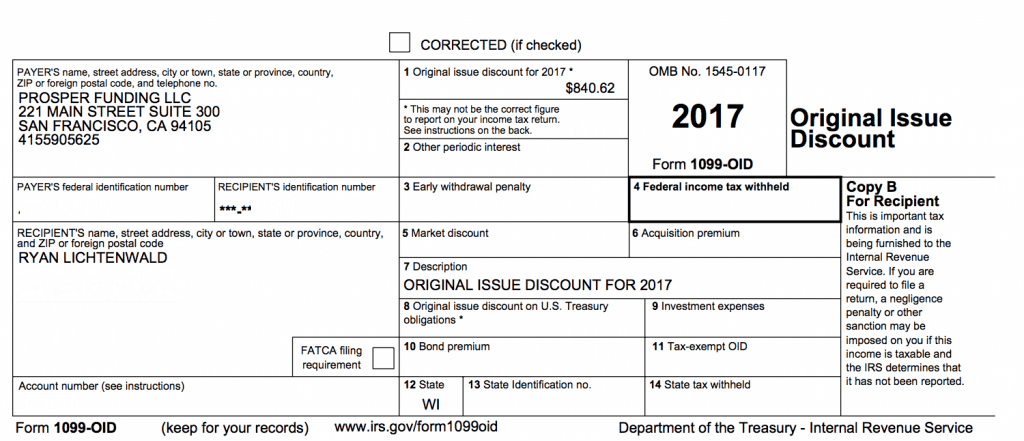

Below is my 1099-OID which includes the net interest of $840.62 I received for the year.

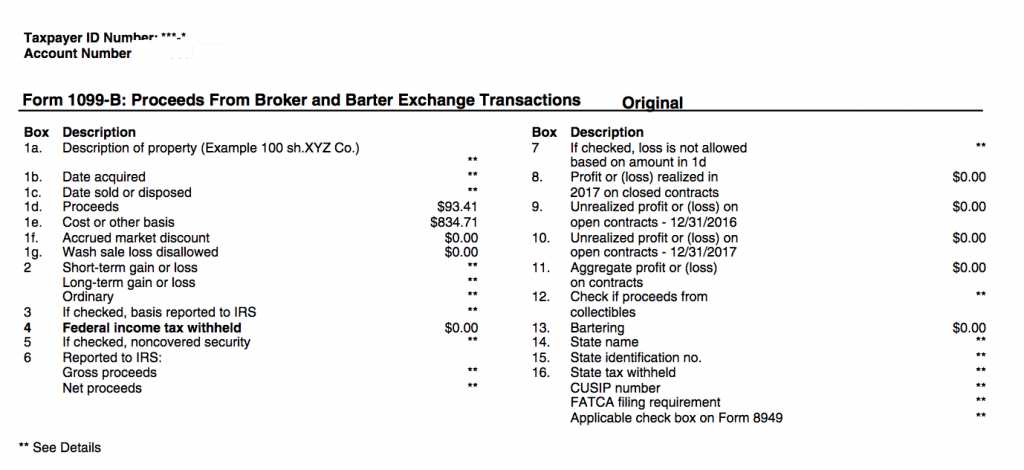

Prosper rolls up both short and long-term transactions on the first page of the 1099-B. They also display each loan in a different format resulting in a much longer document. My 1099-B was 29 pages and I have a relatively small Prosper account. In the below screenshot you can see I had a combined $93.41 in proceeds from charged-off loans. My losses totaled $834.71 which means I earned a net return of around $100 for the year.

Conclusion

The screenshots I’ve included in this blog post represent the high level details of the tax forms you receive. Both LendingClub and Prosper provide details on form 1099-B detailing at the loan level date purchased, date sold/disposed of, proceeds, cost basis, gain/loss etc. The explanations for each of these fields is provided in each of the tax guides. While the tax forms at first glance may be intimidating it is a relatively straight forward process once you dig into what the reported numbers represent and understand the difference in how interest and losses are reported. The provided tax guides go a long way in walking even the newest of investors through the process.