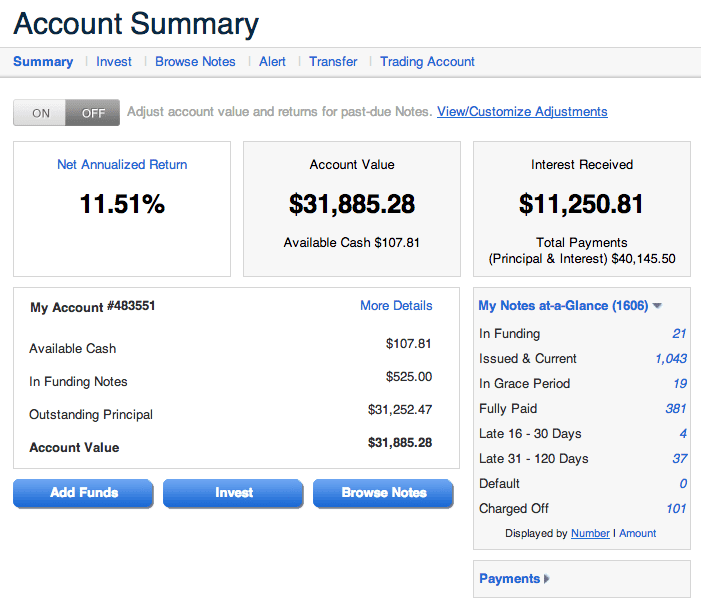

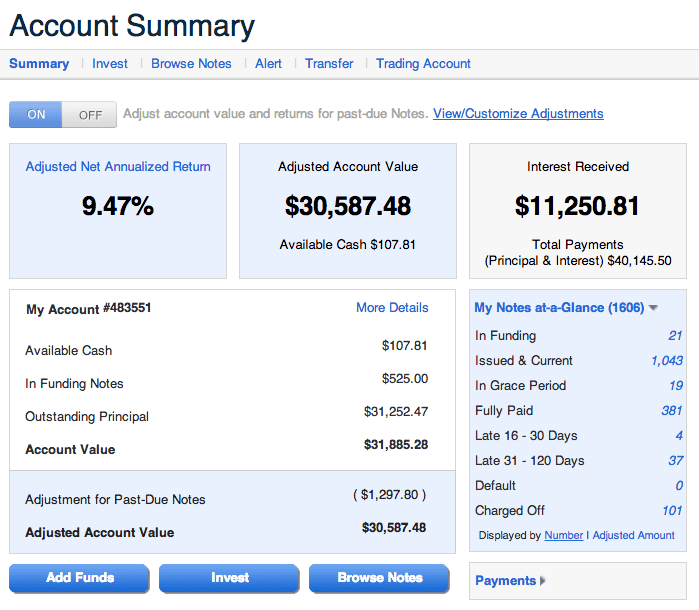

There are more changes happening at Lending Club today. Just yesterday I published an article discussing changes to their trading platform and last night Lending Club rolled out some changes on their main account screen. They introduced a new concept, something called Adjusted Net Annualized Return (NAR). As you can see in the screenshot above there is now an On-Off button on your main account screen. Click the On button and your account screen changes to the one below.

Your NAR box changes to blue and you get an adjusted NAR. As you can see in the screenshots here my NAR dropped from 11.51% to 9.47%. That is not the only change. Your Account Total box has been moved into the middle (now called Account Value) and it adjusts along with the NAR to reflect future potential losses. Basically, what Lending Club is telling me here is that $1,297.80 of my total account value of $31,885.28 is likely to be written off and based on this fact my NAR is really more like 9.47%.

Customizing the Adjustments

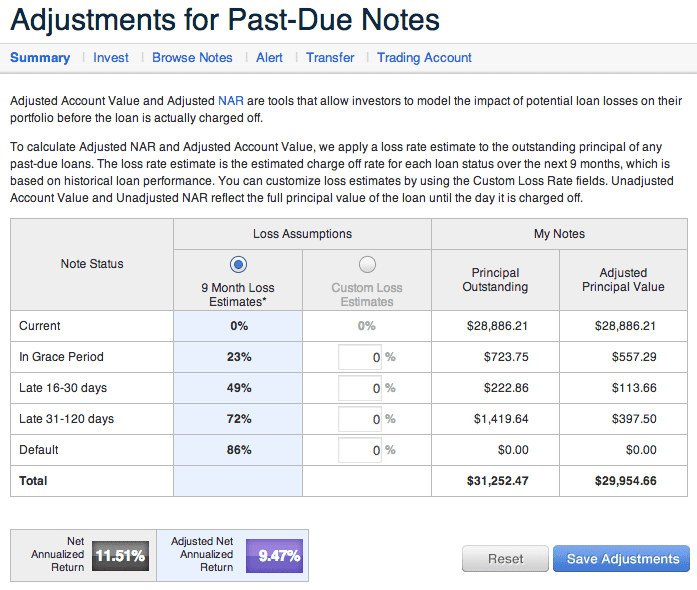

So how does Lending Club calculate this adjusted NAR? It does what statistics sites like NickelSteamroller.com and Lendstats.com have been doing for years. It adjusts the principal amount of past due notes with a formula that reduces the value of notes in your portfolio based on how late each note is. Basically, late notes are valued at less than their face value on a sliding scale. This is explain in detail when you click on the new View/Customize Adjustments link. You will see a screen that looks something like the screen shot below.

You can see the breakdown Lending Club uses above for this sliding scale. Each status has its own loss ratio that reduces the amount of your outstanding principal to the expected loss you will receive from each note. They use data based on their own calculations of principal recovery over a nine month period. But the great thing here is that Lending Club allows you to edit these loss estimates so if you think they are a little too conservative or aggressive then you cam change them. Interestingly, if you look at the loss rates that Lendstats has been using since 2010 Lending Club’s rates are remarkably close with the exception of notes in default.

Real Time Net Annualized Return

Lending Club has a short blog post where they detail this change to Adjusted NAR. But one thing they do not mention is that NAR is now calculating in real time. So you should see your Adjusted NAR change throughout the day as notes in your portfolio move into a late status or payments are made.

While I spoke with Lending Club at length last week about all these changes they did not mention any changes to their Browse Notes downloadable file. But sure enough we are now on version 7 of this file and there is one field missing: Employment Status. I have no idea why they removed this data point because it doesn’t seem to have any privacy issues. But it is now gone and people who have relied on the download file to do analysis or automated investing will have to adjust accordingly.

There have also been some adjustments to the loan history file where a couple of the esoteric credit analysis fields have been removed and some new ones added. It is hard for me to judge whether those changes are significant for anyone but it certainly doesn’t impact my analysis.

My Take On the New Adjusted NAR

In my first visit to Lending Club’s office back in June, 2011 I remember sitting down with Scott Sanborn and one of the topics we discussed was NAR. Even back then I felt like this number should be improved upon. At the time Sanborn agreed that changes could be made to improve NAR. So, Lending Club has been mulling this change for several years.

My take on these changes today can be summed up in two words: about time. Investors now have a more accurate return number that should provide more realistic expectations for investors. What I really like about this change is that it is “sticky”. So, if you click the ON button to choose Adjusted NAR, Lending Club will remember that so next time you login you will see your Adjusted NAR on your account screen.

I will be changing all my accounts to display Adjusted NAR. I want to have a more realistic return expectation for my accounts. What about you? Do you like these changes or will you stick with the regular NAR calculation? Please let me know in the comments.