Today, Lending Club announced a new credit model in an email to investors. According to the email, this is the most advanced and predictive credit model ever used on the Lending Club platform. This is Lending Club’s fifth generation model that began to go in effect on September 8, 2017 and will roll out to all borrowers in the coming days. While Lending Club historically has made improvements to their credit models, the new model caught our eye for a few reasons.

The company outlines that the model further leverages machine learning along with the 10 years of data on 1.5 million borrowers they have accumulated. The new model is 24% better at differentiating the likelihood of a borrower charging off compared to the fourth generation model. It also includes more data points, and uses new custom attributes that Lending Club states are predictive in assessing risk. Lending Club provided the two below examples for these custom attributes:

- Instead of using aggregates, the new model uses very granular views of credit data which discern individual borrower actions vs. a simple aggregate (e.g. a borrower’s credit card balance per credit card vs. his total credit card balance).

- The model makes more extensive use of trended data, which provides insight into a borrower’s credit behavior over time rather than a snapshot into a borrower’s credit behavior at a point in time. Dozens of new custom variables like these improve the model’s predictive power and are proprietary to Lending Club.

It also appears that Lending Club is continuing to tighten their credit criteria for higher risk borrowers with a shift to higher quality loans:

We expect loan volume to shift toward higher quality grades (grades A and B) because some borrowers will qualify for lower interest rates under the new model, and other higher-risk borrowers, who may have received an offer previously, will be screened out.

Lending Club has made a lot of changes to both credit criteria and interest rates over the last couple of years. We shared the trend of increasing interest rates in a blog post earlier this year. Following poor loan performance that started late 2015, the company began increasing interest rates. They also publicly announced that they identified pockets of loans that were underperforming last year. Lending Club is now tightening credit even more with the reduction of higher-risk borrowers.

LendingClub also noted that they are seeing lower delinquency rates across grades and terms in the existing loan portfolio than in the second and third quarters of 2016. This is good news for investors.

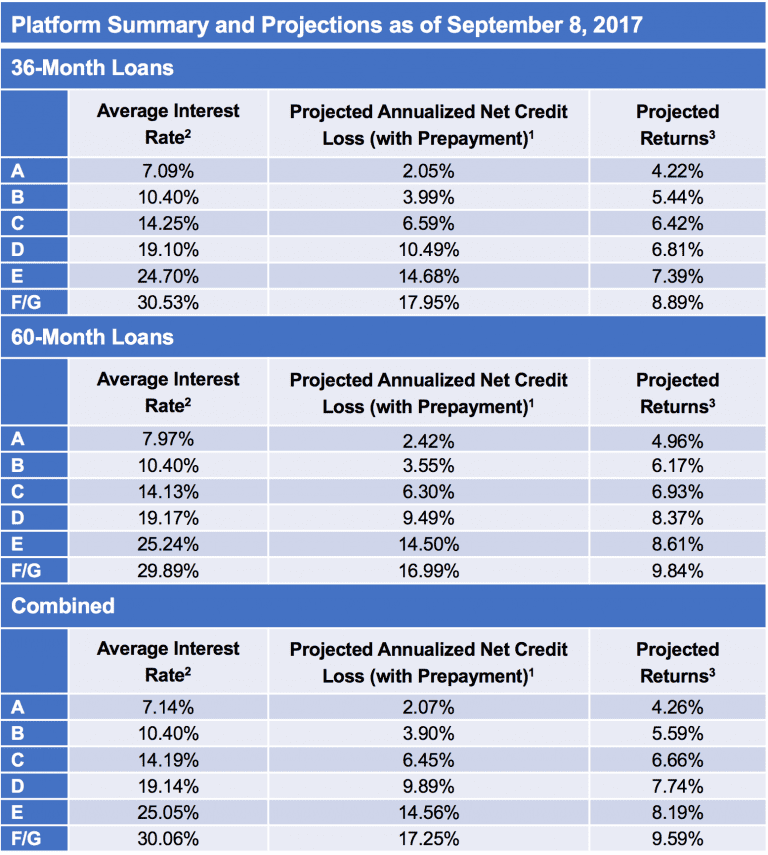

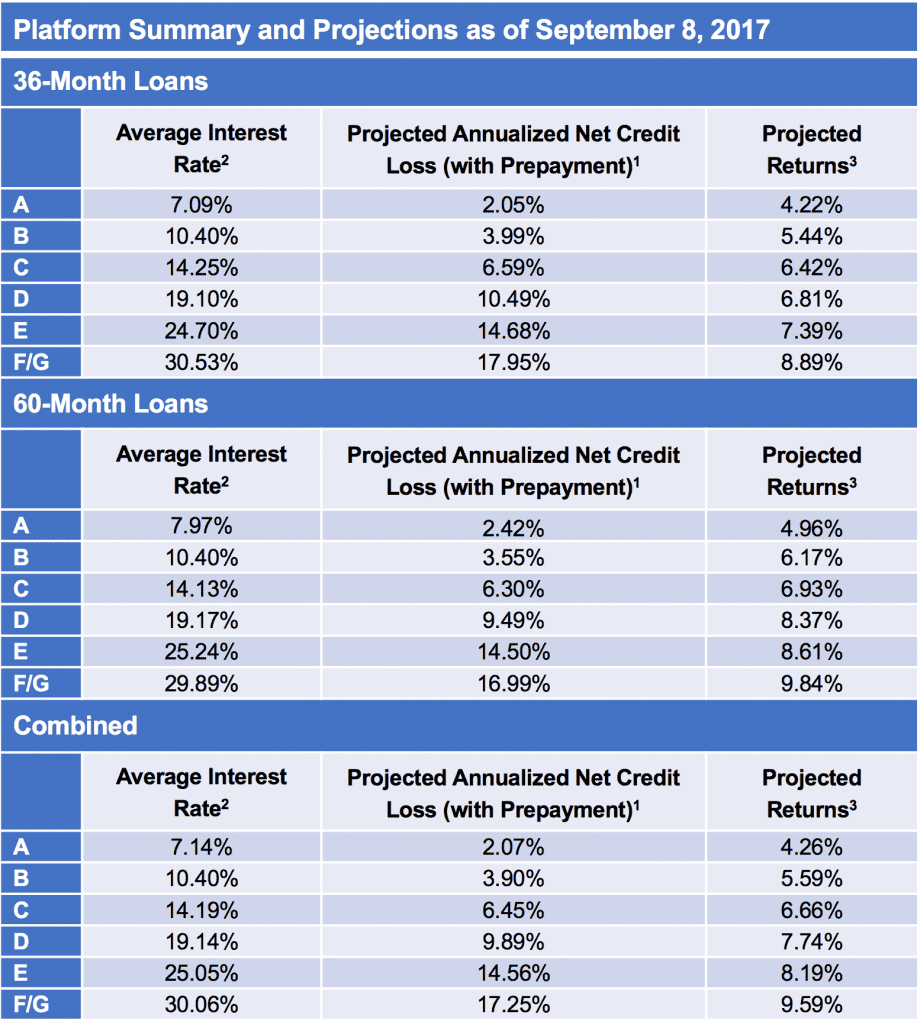

In a blog post, Lending Club provided updated projected returns based on the changes. Returns range from 4-9% and expected charge-offs platform wide have decreased from 6.2% to 6.0%.

Conclusion

One of the main advantages that Lending Club has over their competitors is the amount of data that their 10 year history provides. It appears they have taken a closer look at their underwriting models which now is leveraging machine learning even more. We’ll have to wait and see whether these recent changes provide a meaningful increase in returns for investors. It will also be interesting to see how the platform mix changes and how originations are affected in the coming quarters.