Back in the old days, as in last year, Lending Club regularly had more than 1,000 loans and sometimes 2,000 loans available to investors on their platform. But in 2013 that has changed. Today, there are rarely more than 500 loans available at any one time. What gives?

This is particularly curious when you consider that Lending Club has issued over $76 million in new loans this month and we are not even half way through the month. And yet as I write this there are only 323 loans available to investors.

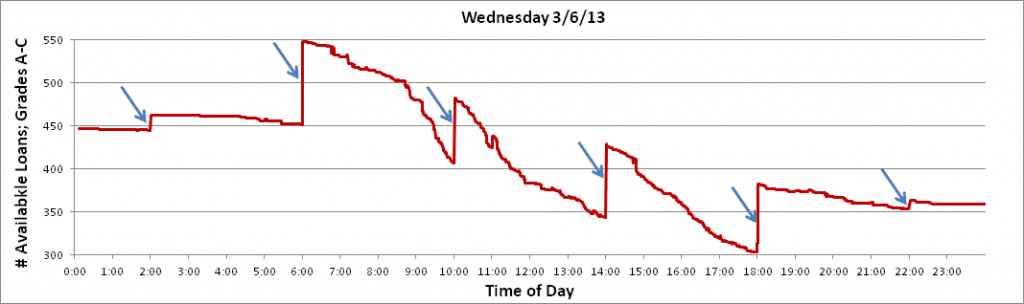

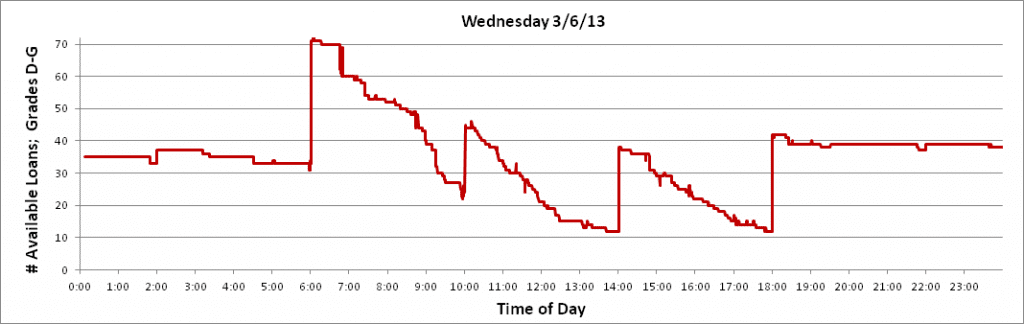

Take a look at the charts below. They show the loan volume activity of a typical day at Lending Club taken on Wednesday of last week. The top chart is for loan grades A-C and the bottom chart is for grades D-G (click on the charts to see them at full size).

As many investors know Lending Club adds loans to their platform in batches at 6am, 10am, 2pm and 6pm (Pacific time) every day. You can see these spikes in both graphs. The 6am addition is usually the largest as you can see but it also generates the most investment activity.

So, what is happening is that investors are gobbling up loans just as fast as Lending Club can put them on the platform. The result of all this is that some loans are now being funded within minutes and most loans are funded within 24-48 hours.

This morning I followed the loans that were added at 6am very closely. At 5:59am today there were 353 loans on the platform. At 6am 89 new loans were added. By 6:03am 14 of these new loans were at least 50% funded. Interestingly, all of these loans that were immediately funded were grades C4 or below – as in the higher risk loans. By 8am 25 of the 89 new loans had been fully funded and by 10am that number was up to 35 with the vast majority being the higher interest loans.

How Are These Loans Funding so Quickly?

It is no secret that there are some large investors now investing at Lending Club. But what has changed in the last few months is that many of these investors are no longer using the LC Advisors funds as their investment vehicle, they are investing directly on the platform.

Now, Lending Club does have a whole loan program that many of these large investors take advantage of but they also invest in loans on the main platform. However, they don’t use the regular Lending Club website like most investors, they invest through the Lending Club API, which is actually still in beta and not available for general release yet. These large investors have programmed the API with their investment criteria and it runs within minutes of new loans being added to the platform.

How can individual investors compete? Well, the good news is that these large investors are limited to a maximum of 75% of the total loan amount so if you are quick you can still invest in any of the loans. I had no problem at 6am this morning investing in all eight loans that met my criteria and the large investors had touched only two of my eight.

Lending Club Needs Automated Investing for All Investors

But what would really level the playing field more is if Lending Club allowed automated investing within their platform in a similar vein to Prosper’s Automated Quick Invest. I have been told such a tool is in development, so it will be very interesting to see whether this tool really does even the playing field for the retail investor. Because at Prosper the API investors take their large bites out of each loan before Automated Quick Invest is run.

Others are not waiting for Lending Club. I know of a couple of different tools in development that will allow investors to take advantage of the Lending Club and Prosper APIs. I will certainly write about these tools when they become available.

The industry is maturing before our eyes as the volume dramatically increases. The speed of investing has certainly quickened this year and I don’t see that changing any time soon. Regular investors who want to have as much choice as possible need to get in the habit of logging in at those times when Lending Club adds new loans to their platform.

Hat tip to Viking, a regular participant on the Lend Academy forum, who created these charts that prompted me to write this post.