Since Lending Club first went public we have been reviewing their quarterly earnings and have also begun covering OnDeck’s earnings. However, there is a third online lending company in China that is listed on the NYSE called Yirendai (YRD). They are a subsidiary of CreditEase, one of the largest companies focused on fintech in China. Yesterday the company announced Q4, 2016 earnings and full-year 2016 results and today the company held their earnings call. The Chinese market is fascinating and Yirendai is a company that is leading the way. Going forward we will be covering their earnings releases.

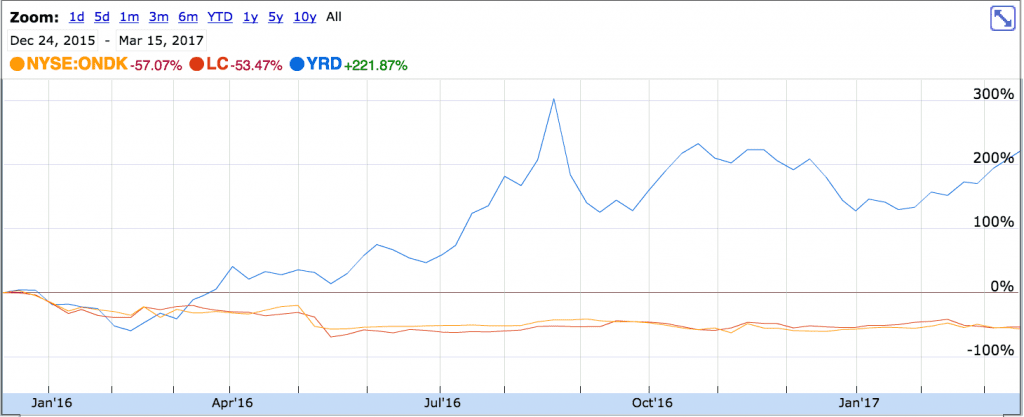

Looking strictly at the stock price since its IPO Yirendai has performed much better than the public online lenders in the US. Their stock is up over 200% at time of writing while both Lending Club and OnDeck have seen decreases of over 50% to date. It’s important to remember that the Chinese market is much different than the US but it’s interesting to see just how well Yirendai has done over the past two years.

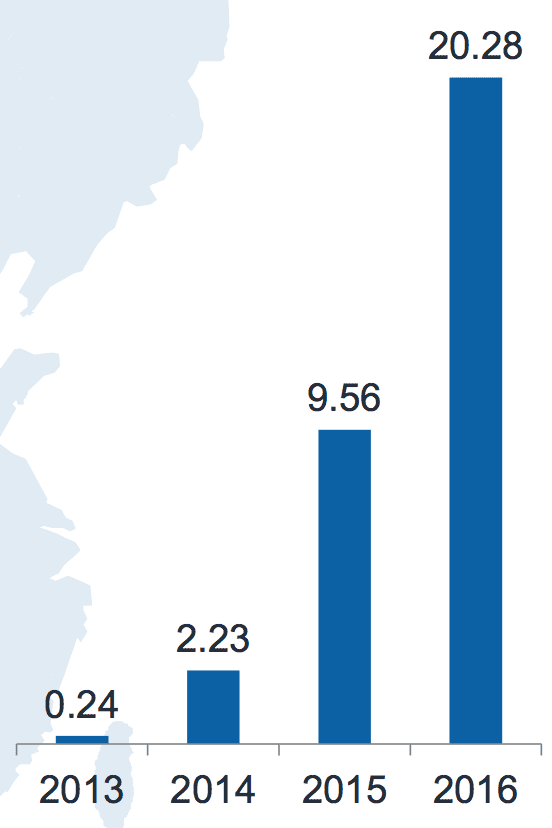

Yirendai continues to post impressive origination growth. Below is a chart taken from their earnings presentation showing loan volume growth since 2013 in billions (RMB). The company originated 20.28B RMB or $2.9 billion USD in loans in 2016, growing over 100% year over year.

There are several things that make Yirendai and the Chinese market unique and one of them is the focus on mobile. For the fourth quarter, 37% of loan volume was originated from online channels and 98.8% of the online volume was facilitated through Yirendai’s mobile application. Yirendai expects the mix to be closer to 50% of loans coming from online channels going forward. Eighty-five percent of the 194,505 investors in Q4 2016 invested through their mobile application.

Regulation of online lending in China has also begun which has resulted in consolidation of many platforms who were running operations that did not meet the regulator’s requirements. These companies according to Yirendai typically offered lower quality loans. Yirendai positions themselves differently, focusing on prime borrowers and mass affluent lenders. According to Yihan Fang, CEO of Yirendai, this consolidation will benefit stronger players such as Yirendai.

The discussion of cross selling is often talked about and Yirendai is focused on expanding their offerings not only on the borrower side, but also on the investor side. In 2016 they launched several new products including offering life insurance and are also cross selling wealth management products to investors. This includes funds to help with an investors overall asset allocation. They are also offering new products for borrowers who are acquired offline. New products in the works could include offerings specific for borrowers who own cars or properties.

On the earnings call the company highlighted that more partnerships are coming and they are looking at banks as a funding source. This will broaden their investor mix. Last week Yirendai announced Yirendai Enabling Platform (YEP) at LendIt USA. The platform will enable partners to use Yirendai’s data, anti-fraud technology and customer acquisition capabilities. Since data is often an issue in China this program could end up being beneficial for many companies. One use-case could be passing off customers that Yirendai doesn’t target which will provide a better user experience to borrowers.

Below are revenue and net income highlights for Q4, 2016:

For the fourth quarter of 2016, total net revenue was RMB 1,071.1 million (US$154.3 million), up by 137% from the same period in 2015; net income was RMB 379.8 million (US$54.7 million), representing an increase of 356% from the same period in 2015.

Yirendai is projecting continued growth for 2017 with total loans facilitated estimated to be in the range of RMB 33,000 million to RMB 35,000 million (US$4,753 million to US$5,041 million). Total net revenue will be in the range of RMB 4,400 million to RMB 4,600 million (US$634 million to US$663 million).

Conclusion

While many of our readers are familiar with companies in the US there is a lot happening in China and Yirendai is one of the companies that continues to innovate. The company has been profitable since Q4, 2014 and the growth speaks for itself.

Disclosure: Peter Renton, the founder and CEO of Lend Academy owns YRD stock.