Upstart is gearing up for growth. One of the newer marketplace lenders announced some big news today. They have closed a $35 million Series C led by Third Point Ventures. This is the largest funding round ever for the company and will provide them with the resources they need to scale. Ryan wrote a detailed investor review of Upstart a few weeks ago and we introduced them to Lend Academy readers here.

I caught up with Upstart CEO Dave Girouard earlier this week to talk about this funding round and to get an update. He told me that Upstart has been growing steadily. After launching in May last year they have issued nearly 9,000 loans totaling more than $125 million. They are up to 65 employees now and with this new round they are “doubling down on data science and engineering” according to Dave.

One of the unique things about Upstart is that they have done a lot of analysis around education – their use of the school and major of a borrower, along with traditional credit data, is an integral part of their underwriting model. But they are looking at other data sources as well.

The goal of any underwriting model is to predict future behavior. Upstart is looking more closely at employer information now. Certain companies will have more layoffs in a downturn, so they are looking to add these kinds of signals to their underwriting.

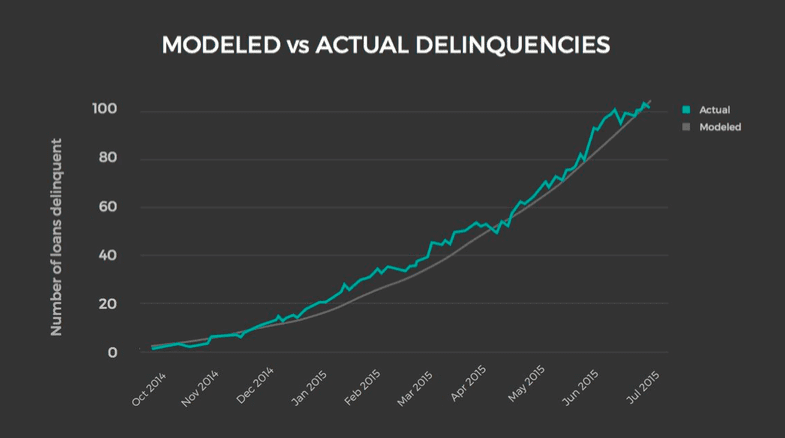

While just over a year of track record is not a long time it is enough to give us some idea as to how Upstart are doing. They are the only company that publishes their results on actual versus predicted delinquencies. You can see how they are doing in the chart below.

A New Self-Directed IRA

When I asked Dave about the investor mix he said that institutional investors fund the vast majority of their loans. He admitted they had not put a lot of effort into retail investors but that was about to change. Later this month they will be introducing a self-directed IRA product for retail investors, which is a step in the right direction.

Upstart is going about the business of creating a new kind of marketplace lending platform. They are a data driven company that is pushing the industry forward.

You can read more details about Upstart’s announcement on their blog.