Secretary of Treasury Janet Yellen spoke at American University for the first time about financial innovation and the government’s role in creating cryptocurrencies or CBDCs on Thursday.

Yellen made public remarks in front of a crowd of students at the Kogod School of Business regarding the Biden Executive Crypto Order.

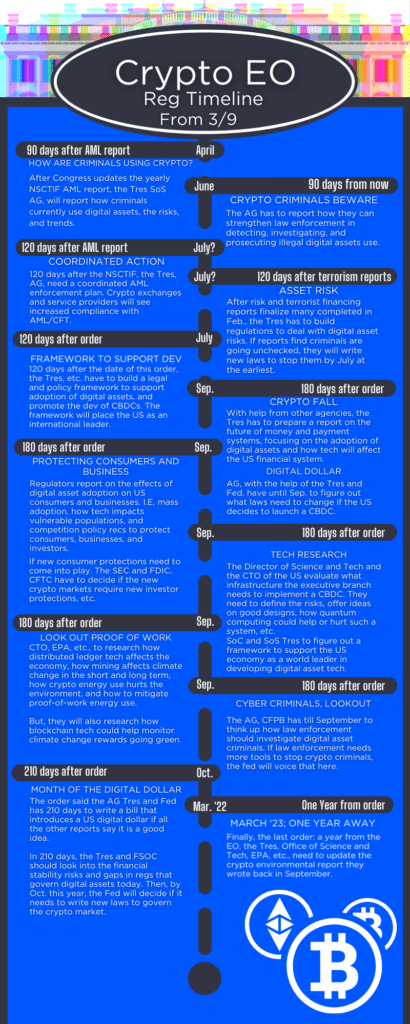

The Order directed executive agencies to research how new tech could affect the current U.S. financial system.

Yellen said that directive came after the explosion of virtual assets in the past years, expecting the government to uphold six policy objectives in advancing the executive discourse on crypto:

- protect consumers, businesses

- safeguard financial stability

- protect national security

- promote US leadership and competition

- promote equity

- support responsible innovation that protects privacy, human rights, and climate.

After that list of six, she had her own five “lessons” that apply to the navigation of emerging technologies for the crowd of students.

‘Our system benefits from innovation’

As Yellen described, the U.S. has reacted successfully to financial tech updates repeatedly. In the past 70 years alone, the currency went from coins and cash in the 1950s then credit cards and debit. Finally, the internet age and smartphones: the US has risen to the occasion before.

“Seventy years ago, most Americans used coins, cash, and checks to manage most aspects of their financial lives. Then, in the 1960s, an engineer from IBM attached a magnetic strip to a plastic card and sparked a new category of payment products: credit and debit cards. Those innovations facilitated the growth of other technologies, like ATMs, which made cash available 24/7.”

These changes, while revolutionary, do elevate everyone: Yellen said good innovation is responsible innovation. Overdraft and rollover fees are a scourge of the modern banking system.

“Estimates suggest Americans spend $15 billion or more each year on such fees and services — essentially a tax of about 100 dollars per working American,” Yellen said. “Due mostly to inefficiency, and disproportionately borne by people with lower incomes.”

Yellen said remittance fees sending money abroad is also a problem skewed at the lowest rung of the financial inclusion ladder. A CBDC could address these concerns, and time will tell if the EO research recommends the U.S. establishes one of its own.

‘When regulation fails, vulnerable people often suffer’

Yellen described the 2008 financial crisis as one where “shadow banks” created dangerous levels of risk, and large institutions faltered.

She mentioned that the collapse of highly regulated investment banks like Lehman Brothers were underwriting the mortgages and selling the securities to the evil “shadow banks” is beyond the point.

When the going gets tough, Yellen said the most vulnerable, least banked, are hurt the most.

“The S&P 500 fell by more than half, and household net worth dropped precipitously,” Yellen said. “The resulting economic distress was most acute and long-lasting for Black Americans and other Americans of color.”

The conversation led to stable coins that hopefully bring all the fun of liquidity without the messy speculation. Still, Yellen said the stable coins already exist might not be all that backed and all that stable.

“To peg their stable coin to a dollar, most issuers say they back their coins with traditional assets that are safe and liquid,” Yellen said. “This way, whenever you want to trade your stablecoin back into a dollar, the company has the money to make the exchange. But, right now, no one can assure you that will happen. In times of stress, this uncertainty could lead to a run.”

Yellen said a stable coin run has already occurred in Jue 2021. She must have been talking about the TITAN coin run through stablecoin provider Iron Finance, which saw a Defi coin backed by “USD” and other coins jump from $10 to $64, leading to the loss of about $2 billion for holders.

Yellen said if these innovations are to be taken seriously and implemented, they have to safeguard even the most vulnerable, which means no bank runs on tokens.

‘Regulation should focus on risks, not tech’

Yellen said regulation should be “tech neutral” and serve consumers and citizens. In other words, just because blockchain sounds cool, it does not mean it should be the new financial system of the planet.

“For example, consumers, investors, and businesses should be protected from fraud and misleading statements regardless of whether assets are stored on a balance sheet or distributed ledger,” she said. “Under the Executive Order, we will work to make sure consumers, investors, and businesses have adequate protections from fraud and theft, privacy and data breaches, and unfair and abusive practices.”

Yellen pointed to recent executive action to prove her commitment, saying that the treasury sanctioned and shut down a portion of Hydra this past week, a darknet crypto marketplace based in Russia. In a joint effort from numerous agencies and the international community, the team shut down Hydra servers in Germany and confiscated $25M in bitcoin.

“The global threat of cybercrime and ransomware that originates in Russia, and the ability of criminal leaders to operate there with impunity, is deeply concerning to the United States,” Yellen said in a release. “Our actions send a message today to criminals that you cannot hide on the darknet or their forums, and you cannot hide in Russia or anywhere else in the world. In coordination with allies and partners, like Germany and Estonia, we will continue to disrupt these networks.”

The team also shut down a known ransomware supporting currency exchange called Garantex.

‘U.S. benefits from the central role of the dollar’

Yellen took students through a history of U.S. financial markets, showing the different points of view the past can paint.

From the Bank of the United States brainchild of Broadway’s favorite duelist Alexander Hamilton to printing “In God We Trust” on dollars during the Civil War, it took a long time to establish the U.S. dollar as the reserve currency.

“In 1790, Secretary Alexander Hamilton bemoaned what he called the ‘immense disorder’ of the U.S. monetary system. The proliferation of different forms of ‘money’ made it difficult to run the economy,” she said. “To help address these concerns, the Bank of the United States was formed in 1791 and issued notes that provided a relatively stable national currency.”

Then in 1792, the Coinage Act was passed, establishing the U.S. Mint, Yellen said, kicking off a century of debate about whether the dollar should be pegged to silver or gold.

But the bank did not last and neither did the union. By the mid-1800s, while fire eater enslavers argued for an evil institution’s extension, the country again relied on a fragmented system of private banknotes.

Yellen’s description begs the question: does social and political division dictate financial division? Do divided people breed divided money? Does one precede the other, or are they twins? Either way, the war brought the US together in bloodbath and bullion.

“A crisis catalyzed reform. Embroiled in the Civil War, President Lincoln and Treasury Secretary Salmon Chase needed to introduce more stability to our financial system,” Yellen said. “Congress passed the National Bank Act, which allowed banks to issue national banknotes, but the banks had to be adequately supervised, and the notes were required to be backed with US Treasuries.”

That sounds familiar, an act by Congress that required private institutions that were minting liquid currency to back their shares in US treasuries. At some point, the Federal Reserve Act institutionalized uniform, the government-printed money, and the rest is history.

Yellen skipped the next century, where U.S. naval trade dominance brought the most used currency, alongside two hard-won World Wars and a reconstruction paid for in dollars, up until petrol cartels and awakening secondary markets took the U.S. dollar down a peg. What matters is that the U.S. is still on top, and 60% of foreign reserves are held stateside.

Yellen said some consider a CBDC the next logical step, but her work this year will be to discover if that is true and the risks and rewards of such a step.

No matter what the financial future holds, the U.S. dollar must remain on top in every instance of adoption, Yellen said.

“The dollar’s international prominence is strongly supported by U.S. institutions and policies; U.S. economic performance; open, deep and liquid financial markets; the rule of law; and a commitment to a free-floating currency,” she said. “As citizens of this country, we derive significant economic and national security benefits from the unique role the dollar and U.S. financial institutions play in the global financial system.”

The EO asks the executors to consider whether and how the issuance of a public CBDC would support this role, Yellen said.

‘We need to work together to do it’

Finally, Yellen stated that the U.S. is best when working together in all things. To develop the next money, it will take all hands. Yellen said that the government’s role is one of the carefully responsible innovations.

“Many of the most groundbreaking innovations in our history have involved all of us: policymakers and businesspeople, advocates, scholars, inventors, and citizens,” Yellen said, “Think of the development of the national highway system, the space race, the creation of the internet, or the ongoing revolution in biotechnology. All of these innovations have transformed the way we live our lives.”

She said that innovation in financial technology would transform the way we live our lives, and the government should try to play the middle ground between revolution and restriction.