Every quarter we get together with three other families for a dinner party. While all professionals no one is in the finance space except for me. But at our last gathering this past Sunday night the conversation turned to bitcoin. In the last month or two bitcoin has made the jump from esoteric financial instrument into a dinner party discussion subject.

We first covered bitcoin in a two part series on marketplace lending with bitcoin three years ago. It provides a good primer to what bitcoin is, the definition of a blockchain and how it works for lending.

Back in late 2014 bitcoin was nothing more than a curiousity – you could barely even call it part of finance – it was a strange hobby that a few tech people were engaged in. Today, bitcoin is making an appearance regularly on the front page of the Wall Street Journal as its meteoric rise has captured the imagination of the general public.

Depending on the day (or the hour) bitcoin has a market cap of around $300 billion which is close to the value of Bank of America, one of the top 10 largest companies in the United States. According to Coinbase, the largest bitcoin exchange in the world, the price of bitcoin is up over 2,000% in the last 12 months and that is why everybody is talking about.

We have read articles about someone buying two pizzas for 10,000 bitcoins back in 2010 (around $170 million in today’s value) or another person throwing away 7,500 bitcoins. There are now bitcoin billionaires and many other stories of people who have become insanely rich because they got into bitcoin early. This is what captures the imagination of the public. If only we had invested just a few hundred dollars back in 2011 or 2012.

The Rise of Cryptocurrencies

Bitcoin is not alone. While it was the first to launch back in 2009 it is part of a growing group of cryptocurrencies that have been created in the past few years. According to Coinmarketcap the top five most valuable cryptocurrencies in the world are (in order): bitcoin, Ethereum, Bitcoin Cash, Ripple and Litecoin.

Bitcoin is by far the largest of these currencies with a market cap far exceeding the total of the next four. But this has been such a volatile space this could change very quickly. For example, Ripple has rocketed past Litecoin this past week as it has risen from $0.22 a week ago to over $0.80 today. That is quite the move even in the highly volatile crypto space.

Sharing My Cryptocurrency Portfolio

My entry into the cryptocurrency space began back in early 2015. We had just published the two-part series on bitcoin marketplace lending on Lend Academy and I was discussing bitcoin with the founders of NSR Invest. Michael Phillips introduced me to Coinbase as an easy way to buy and hold bitcoin. So, I deposited around $2,000 and bought 10 bitcoin. Then I promptly forgot about it.

I started paying attention in late 2016 when I could see the price going up substantially from the $199 I paid for it to over $750. Then 2017 happened. I still cannot believe the rise we have seen this year. I have sold around 4 bitcoin for a total realized gain of less than $10,000 but the value of the remaining bitcoin I hold is now over $100,000 depending on the day.

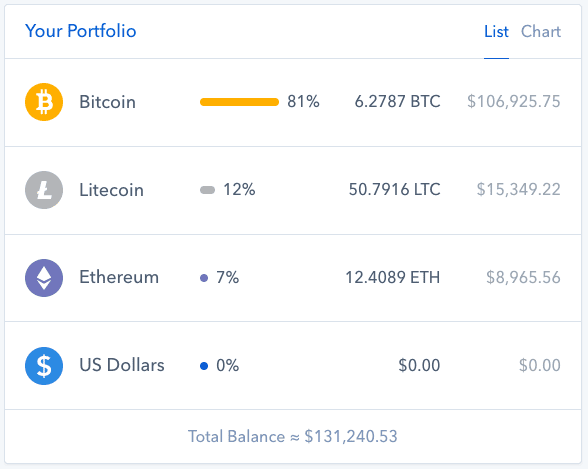

Here is a screenshot of my Coinbase portfolio today. You can see that I also hold Ethereum and Litecoin.

Three months ago I transferred in another $10,000 into Coinbase with the express purpose of buying other cryptocurrencies. Since then I have bought some Ethereum (at $258) and some Litecoin (at $55).

Not included in the Coinbase graphic is Ripple. Ripple was actually started by the former CEO and co-founder of Prosper, Chris Larsen. I got to know Chris while he was at Prosper so I have been following his journey at Ripple since he started back in 2012. I own around 10,000 Ripple that I bought at $0.20 each earlier this year but since Coinbase doesn’t support Ripple I had to use another exchange to buy it. I actually have what is called a private Ripple wallet and I sent bitcoin from Coinbase through Changelly to this private wallet. It was a little complicated but I wanted to own Ripple and this was the easiest way I could find.

I also hold some Bitcoin Cash courtesy of a hard fork earlier this year. This is supposed to show up in my Coinbase account in January.

I am looking to continue to expand my cryptocurrency portfolio to a couple more currencies. I am going to exchange some bitcoin for a small amount of money in even more speculative cryptocurrencies.

Buy, Sell or Hold?

Anyone who thinks they know what the future holds for bitcoin or other cryptocurrencies is fooling themselves. Bitcoin is now officially the biggest bubble in history, eclipsing the tulip mania of the 17th century. I have seen predictions of bitcoins future value ranging from zero to $1 million in the coming years. And nobody knows for sure which end of the spectrum bitcoin will move towards.

Here is what I think. Bitcoin is a store of value like gold but in digital form. I am not sure if it has much utility beyond that, I don’t believe it is going to be a payments mechanism. As a digital store of value, though, it is too volatile to attract serious long term investors right now. The fantastic run up we have seen this year is being fueled primarily by speculative individuals.

If you got lucky, as I did, and bought some bitcoin early you would be foolish to think the party is going to keep going on forever. If bitcoin ever hits $100,000 that would imply a market cap of around $1.7 trillion and at $1 million the market cap is $17 trillion. That is a significant percentage of world GDP and I think it would make governments very nervous. They would want to regulate it before it gets anywhere near the $1 million mark. They simply could not afford to have an unregulated currency pose a systemic risk to the economy. If you want to learn what governments around the world think you should read this post from Chris Skinner.

Now, I don’t think bitcoin is going to zero either. Even if governments do try to regulate it, unless most of the world’s governments completely outlaw bitcoin, it is so widely held today that I think it will have value for a long time to come. In the long run governments will probably try to issue their own digital currency that will compete with the likes of bitcoin.

Having said all that, as I discussed earlier it is all guesswork as to the future of bitcoin. Which brings me to what I am doing with my holdings. I don’t intend to move any more fiat money into cryptocurrency but I will likely move some money out of bitcoin into other currencies as time goes on. And I will also continue to withdraw small amounts if the price of bitcoin continues to go up.

Everyone says by the time your taxi driver or dinner party guest starts talking about an investment it is time to get out. I will not be getting out but my eyes are wide open knowing that these investments could all be worth a fraction of their value by this time next year. Or they could double. And that is the fun of cryptocurrencies today.

One last thing. If you are interested in learning more about bitcoin, cryptocurrencies and blockchain technology you should come to the BlockFin Summit that will be part of LendIt USA 2018.