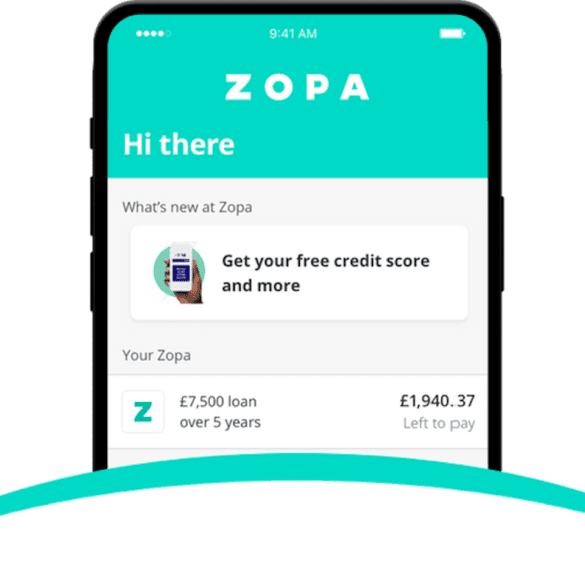

Fintech funding rounds of this size are few and far between- Zopa plans to use the investment to further its plan to "be Britain's best bank."

[Editor’s note: This is a guest post from Ryan Weeks, formerly with Dow Jones and AltFi, covering fintech. This is...

Cboe Proposes Plan That Could Curb Advantages of Fast Traders European banking needs a Big Bang Hong Kong-based EMQ raises...

AltFi has taken a look at where the founders from some of the top UK fintech companies went after leaving...

While leaving wide open the question of “what happens as we head into the summer and fourth quarter of 2020,”...

Worsening conditions for the public's financial health have caused the FCA to launch a consultation. The fintech sector is already way ahead.

Mobile bank Current launches a points rewards program for debit card users U.S. Financial Service Buckle Secured $31 Million Through...

Hot on the heels of their banking license approval last month, leading UK fintech Zopa has announced interest rates for...

Clearbanc just launched a valuation tool that its cofounders are calling a credit score for startups. Here’s what entrepreneurs need...

Zopa CEO Jaidev Janardana is bracing for a “moment of truth” for the peer-to-peer lending industry, which Zopa has led...