Fintech Nexus discussed Walmart's fintech strategy in Mexico with Marcelino Herrera, Chief Financial Services Officer at the retailer.

Through Walmart2Walmart, customers can send money from any U.S. Walmart to any Walmart store in Mexico for as little as $2.50 per transaction.

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

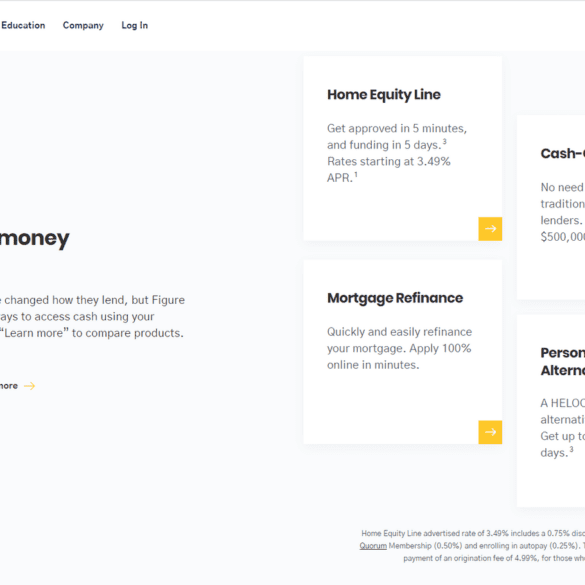

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

Green Dot’s Founders & CEO Steve Streit left the company in December 2019 as they were transitioning from prepaid card...

Like many areas of fintech, earned wage access (sometimes called earned income access or payroll advances) wasn’t really a thing...

Walmart Mexico announced the acquisition of payments startup Trafalgar to strengthen its digital wallet initiative.

Yesterday, Bloomberg broke the story that two senior Goldman Sachs executives were leaving to work on the new Walmart fintech...

Walmart and Green Dot first partnered in 2006 with the Walmart Moneycard, this January they extended that partnership another seven...

In his LendIt Fintech USA 2019 keynote, CEO and Co-founder of Affirm, Max Levchin, had some harsh words to say...

At the CB Insights conference last week Max Levchin, the CEO and Co-founder of Affirm, talked about the status of...