Typically the fintechs in Africa getting a lot of attention center around those focusing on payments; however Quartz reports that...

Interest rates, the stock market and the effects of China on our economy have been all over the headlines as...

Today, Lending Club is available to investors in 26 states on their retail platform (they do allow investors in 17 more states...

Today the Dow Jones Industrial Average was up another 200 points, continuing its almost constant move upwards over the last...

Last week LendingClub held their very first Investor Day in New York. I was lucky enough to be invited along...

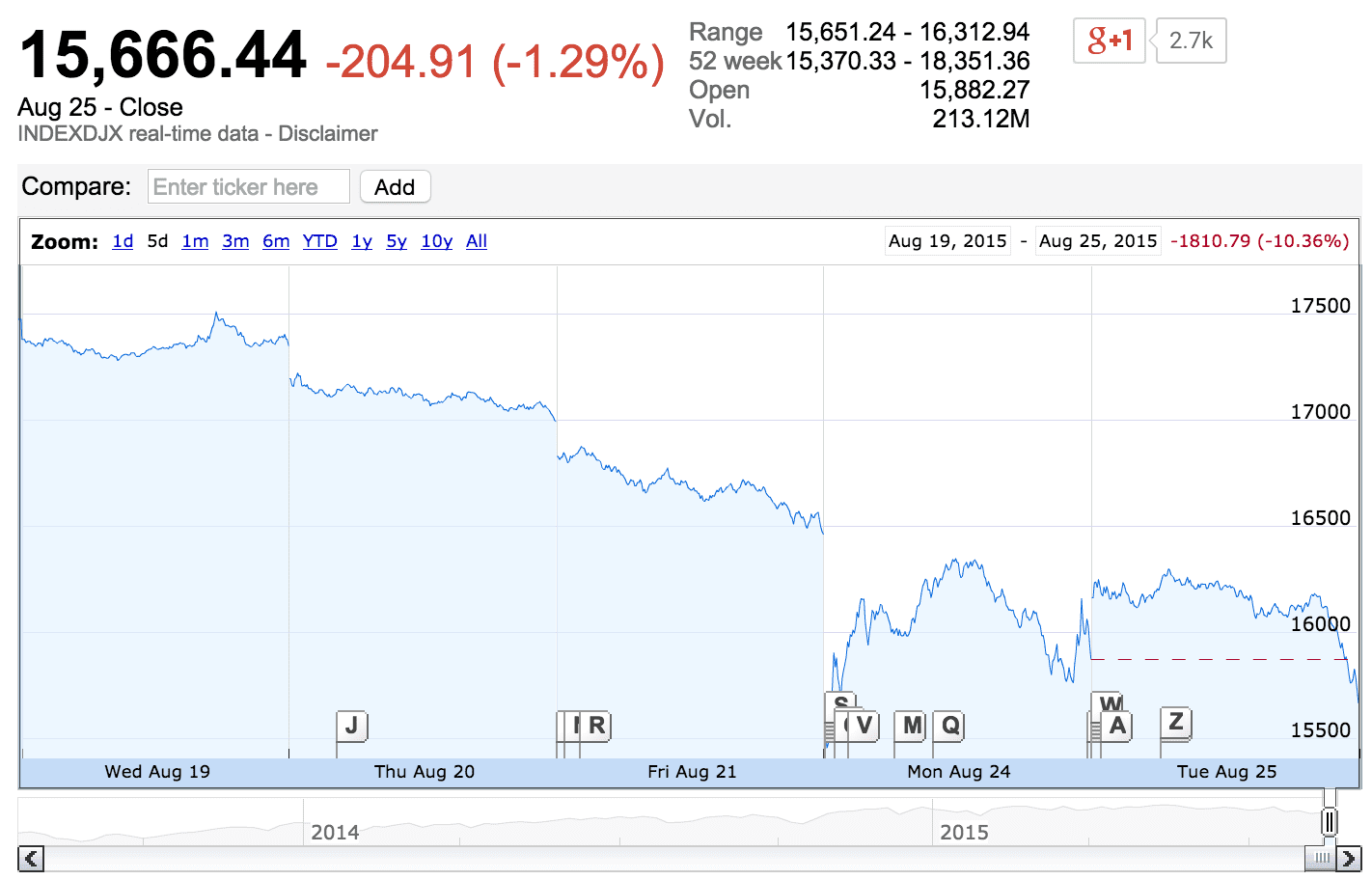

In the past five days the Dow Jones Industrial Average has slipped 10.36% and the past two days we have...

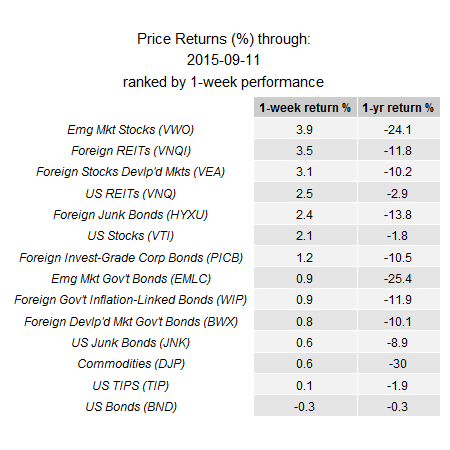

With the stock market down almost 20% from its April high one has to wonder how this will impact peer...