Small businesses have better access to financial tools than ever before. Leading the way here is Square Banking, an integrated suite of fintech products for small business owners.

Hindenburg's tale of fraud and manipulation has dirtied Dorsey's rose-tinted vision of economic empowerment.

American Express and Square announced on Nov. 16 a plan to launch a new credit card explicitly built for Square sellers on the AmEx network.

In 2021, firms who had stayed alive through the initial pandemic became giants: fintechs became banks, banks became super apps, and super apps became some of the most successful public companies in the world.

This week saw three fintech firms representing payments, debit, and credit post results. Although each saw momentous growth year over year, in some cases, it was not enough to outpace expectations after this bull run of a year for fintech.

Colombian fintechs have been very active in the VC space in 2024, with a number of startups raising over $150 million in funding so far.

Block's Q4 2022 earnings surpassed market expectations. Dorsey outlined the future focus for the business.

Once small startup Pinwheel raised a $50M series B at a $500 million valuation, all in the name of helping partners turn the paycheck-to-paycheck lifestyle into an outdated past.

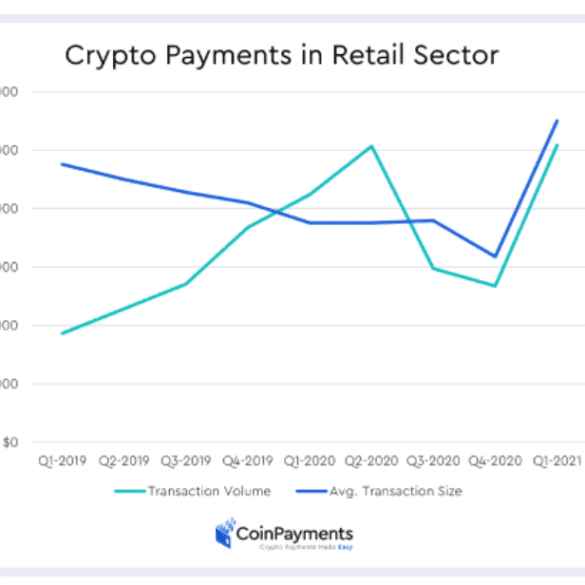

In this discussion, we explore ways that Stripe — arguably the best American fintech company full-stop, although who would want to mess with Square — could be entering the crypto space. We consider approaches similar to the payment onramps, then discuss the underlying market structure powering those experiences, and highlight more generally the role of gateways relative to protocols. We touch on the role of custodians, banks, and wallets, as well as Square’s attempt, the tbDEX, where KYC/AML comes down to forms of opt-in identity. Finally, we address questions about Circle and USDC, and how stablecoins differ from the rails on which they travel.

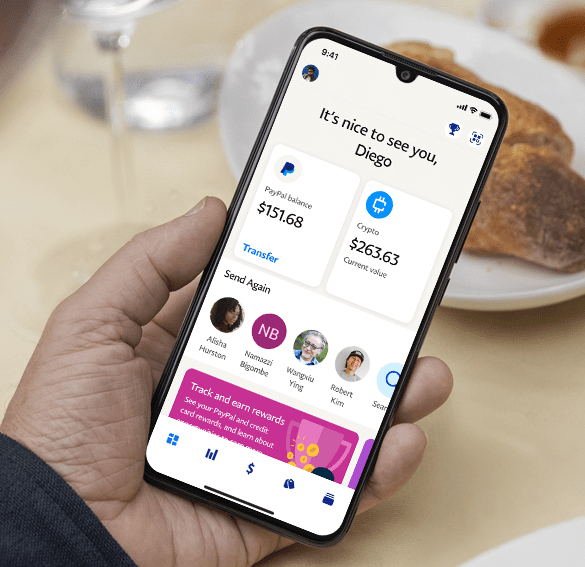

PayPal just launched what it calls a super app. It has a cash account with a 0.40% interest rate, direct deposit, money movement, bill pay, and remittance features. It also integrates shopping functionality with rewards and cash back. In this analysis, we compare this offering with Google Pay and Square Cash App, as well as trace the DNA of PayPal to understand whether such an offering will succeed where others failed.