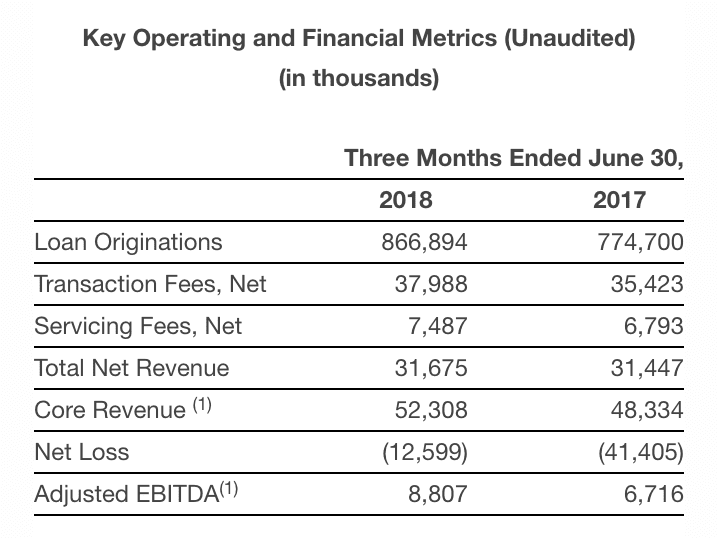

Yesterday, Prosper reported their Q2 2018 results. The company facilitated $867 million in loans for the quarter, up 12% from...

OnDeck has been working towards executing on their five strategic initiatives for 2018: grow responsibly, strengthened credit management, invest in high-growth...

Today, Prosper reported their full year results for 2017. Prosper is still a private company, but is regulated by the...

There has been a shift in focus at the large online lending companies over the last year and a half...

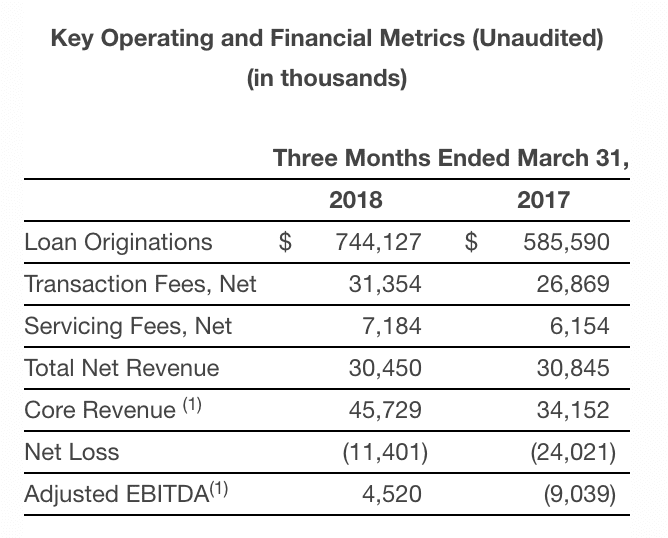

It was only a couple of months ago that we wrote about Prosper’s 2017 results. The major highlights were growing...

Prosper originated $2.9 billion in 2017 and now has surpassed $11 billion in total loans. Source

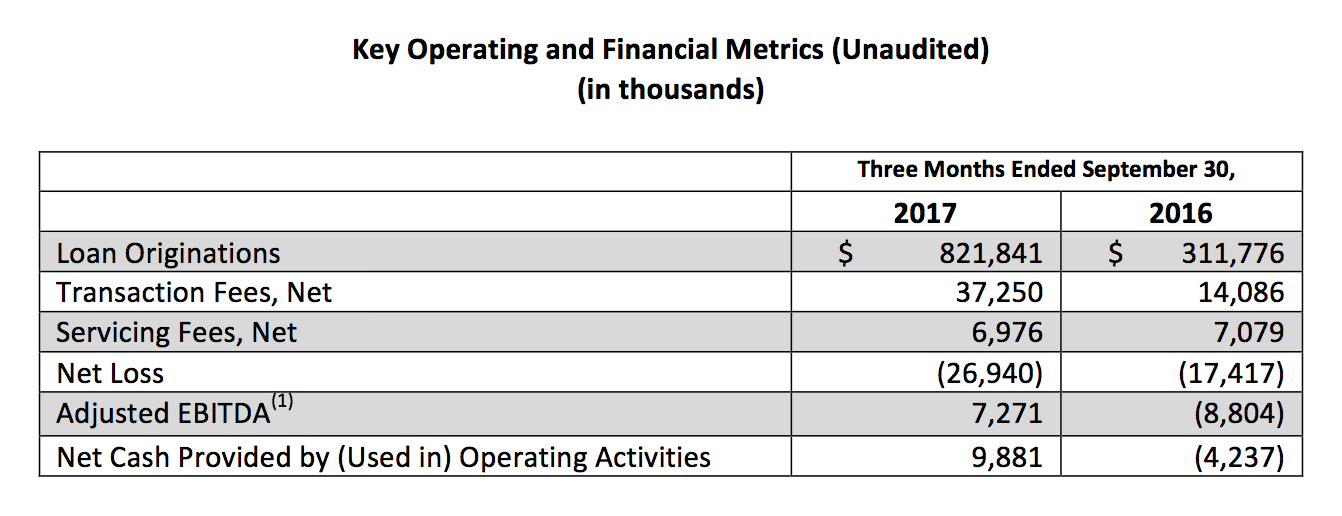

Prosper recently published their third quarter results; the company grew originations 6% from the previous quarter to $821 million; reported a net loss of $26.9 million largely due to non-cash charges related to warrants as part of the consortium deal announced this year. Source