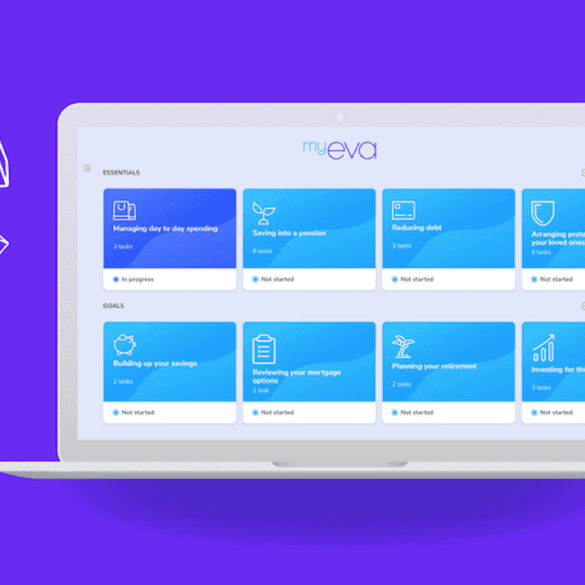

Long-term financial planning can be critical for mental health, especially in challenging times. MyEva could help employees manage finances.

Amid the current pandemic consumers in the United States are facing a new reality, one that increasingly means transacting online...

There are growing signs that a recession could be coming sometime in the next couple of years; most fintech firms...

Inflation rates hitting all-time highs strain the economy with SMEs as "the backbone." Experts weigh options to weather the storm.

After the great recession economic researcher, Dr. Dan Geller, created the Money Anxiety Index to measure consumer spending and savings...

Lending Club made news earlier this month when they announced they were increasing interest rates again. But what they also shared...