Plaid is becoming the glue that connects so much in financial services. Here is a rundown of just some of their recent developments.

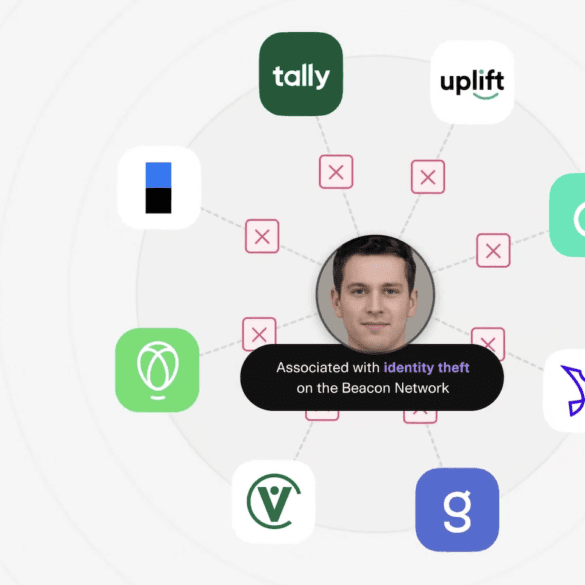

An announcement from Plaid, launching their collaborative fraud fighting network, Beacon, which is designed to "stop the chain reaction of fraud."

After avoiding section 1033 of Dodd-Frank for 12 years, in October the CFPB announced proposals for action. Plaid now offers their advice.

Despite the continuing bear market, consumer interest in crypto remains high. Plaid found that increased trust could be the key to adoption.

Stripe announced an open banking product called Financial Connections sparking a testy Twitter tussle with Plaid CEO Zachery Perret.

Card payment fees have been a long-standing issue for businesses. Pay by bank could be a solution. Plaid joins Adyen to make it possible.

In the space of a week, Petal and newly-formed spin-off, Prism Data have made two significant announcements, super charging open banking.

The economy has faced waves of challenges and fintech may be feeling the strain. Plaid investigated customer behaviour within the sector.

Acre Homes aims to build a modern home ownership experience, and with the help of data from Plaid, applications are a breeze. Learn how.

LendIt Fintech held the 5th annual industry awards to celebrate the top fintech influencers and innovators.