We are all aware that the coronavirus is having a dramatic impact on consumers as over 30 million people are...

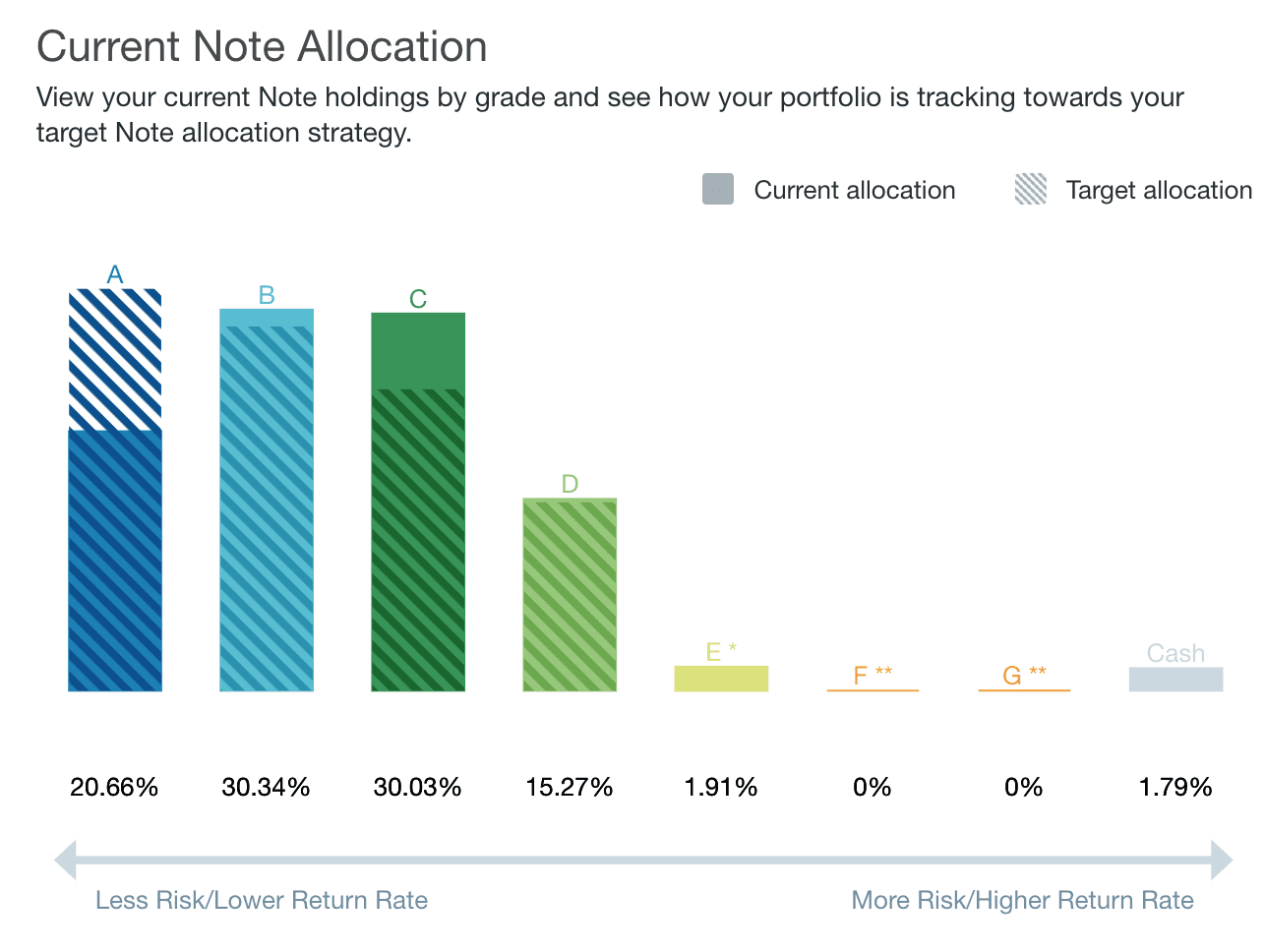

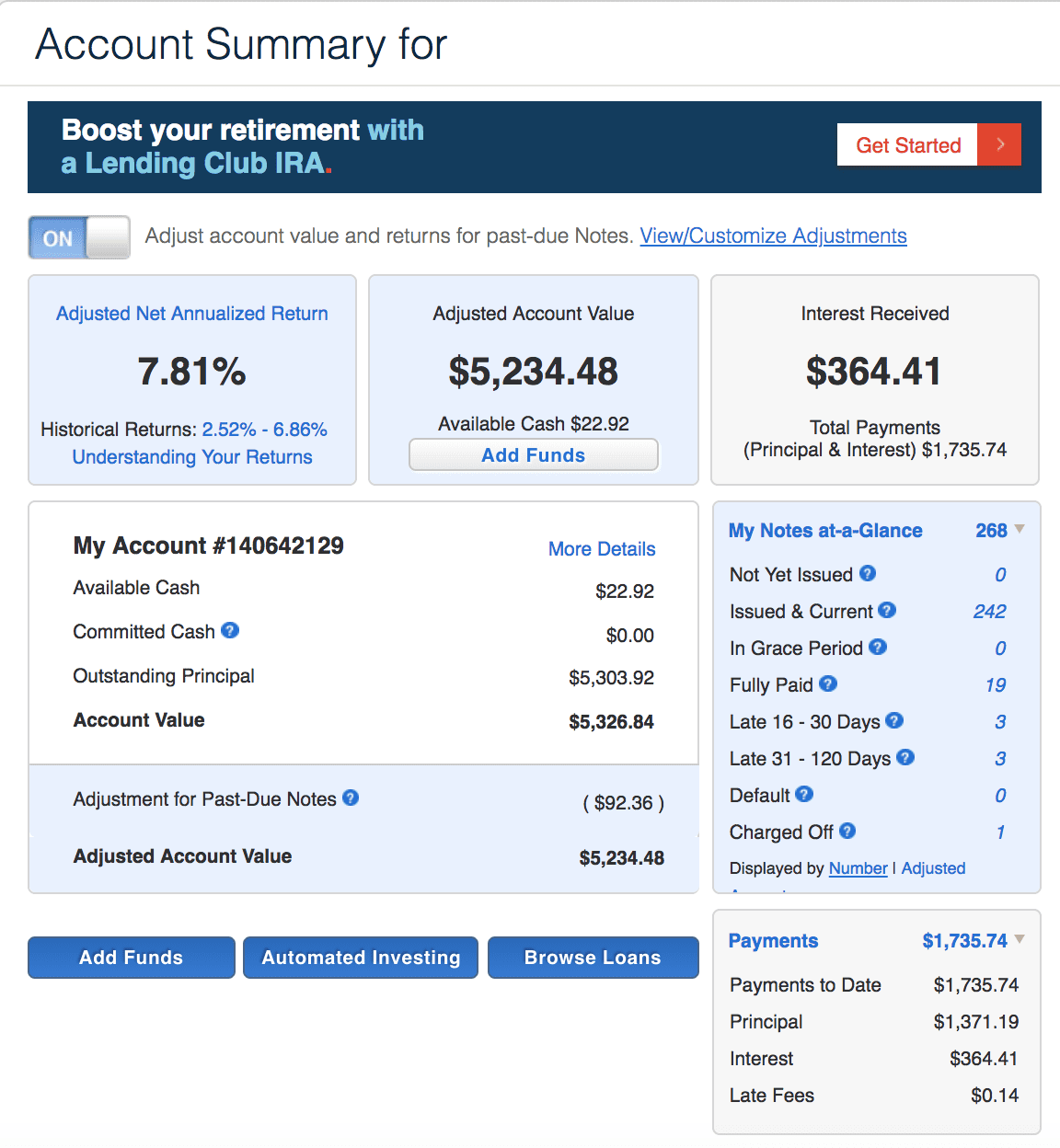

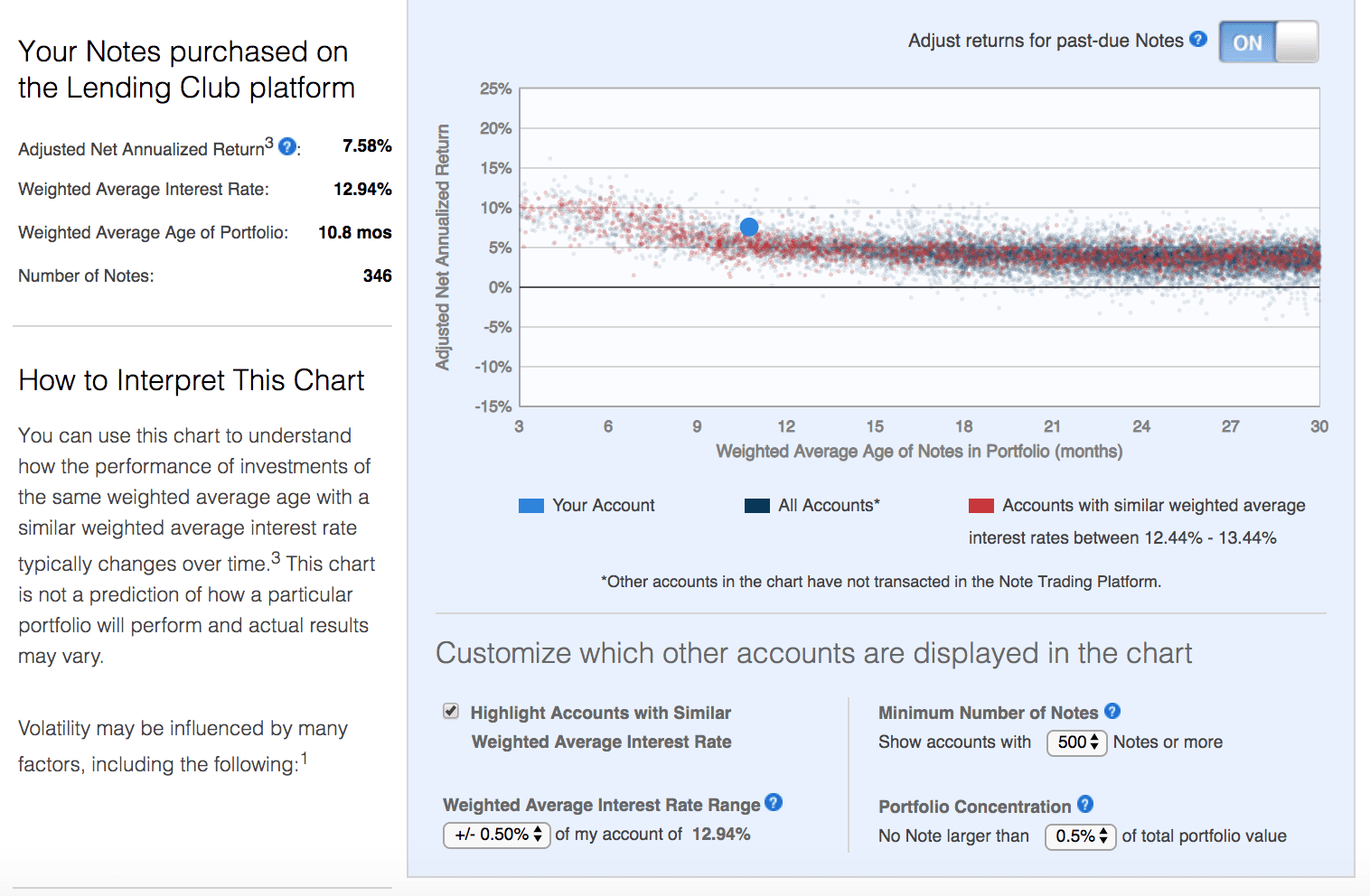

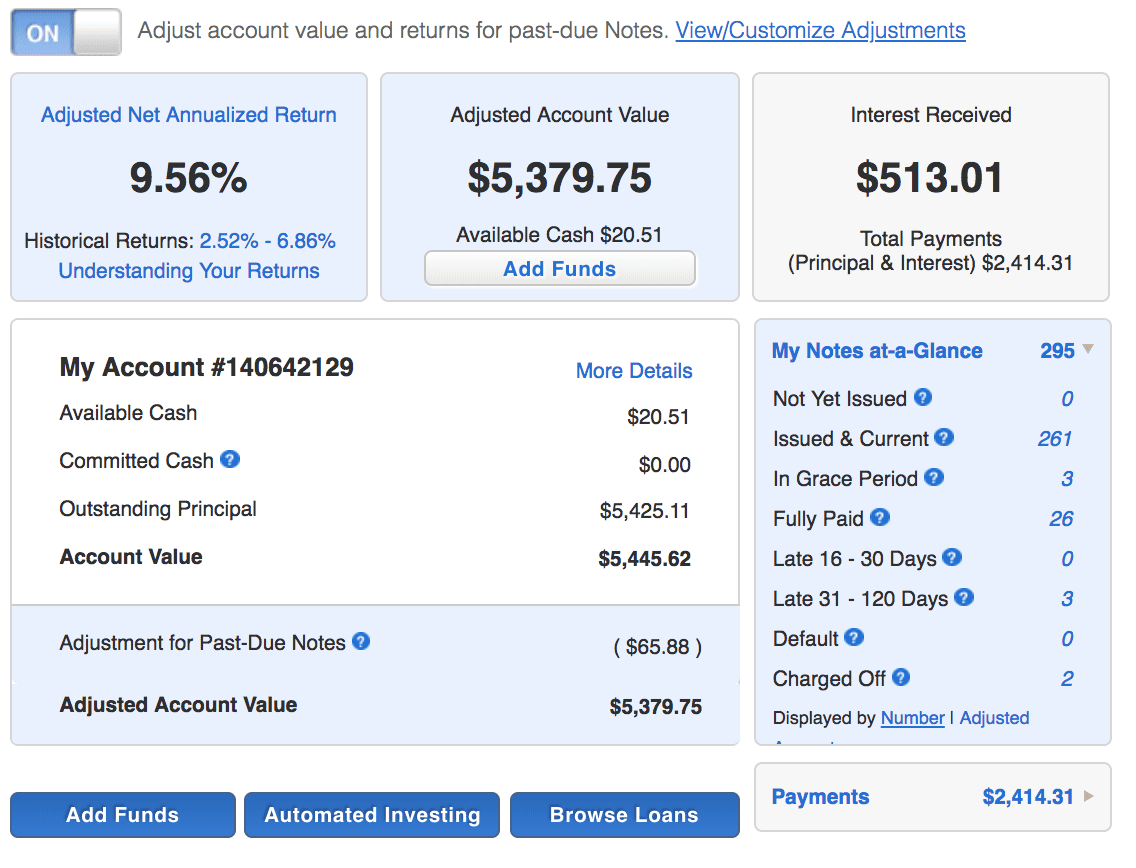

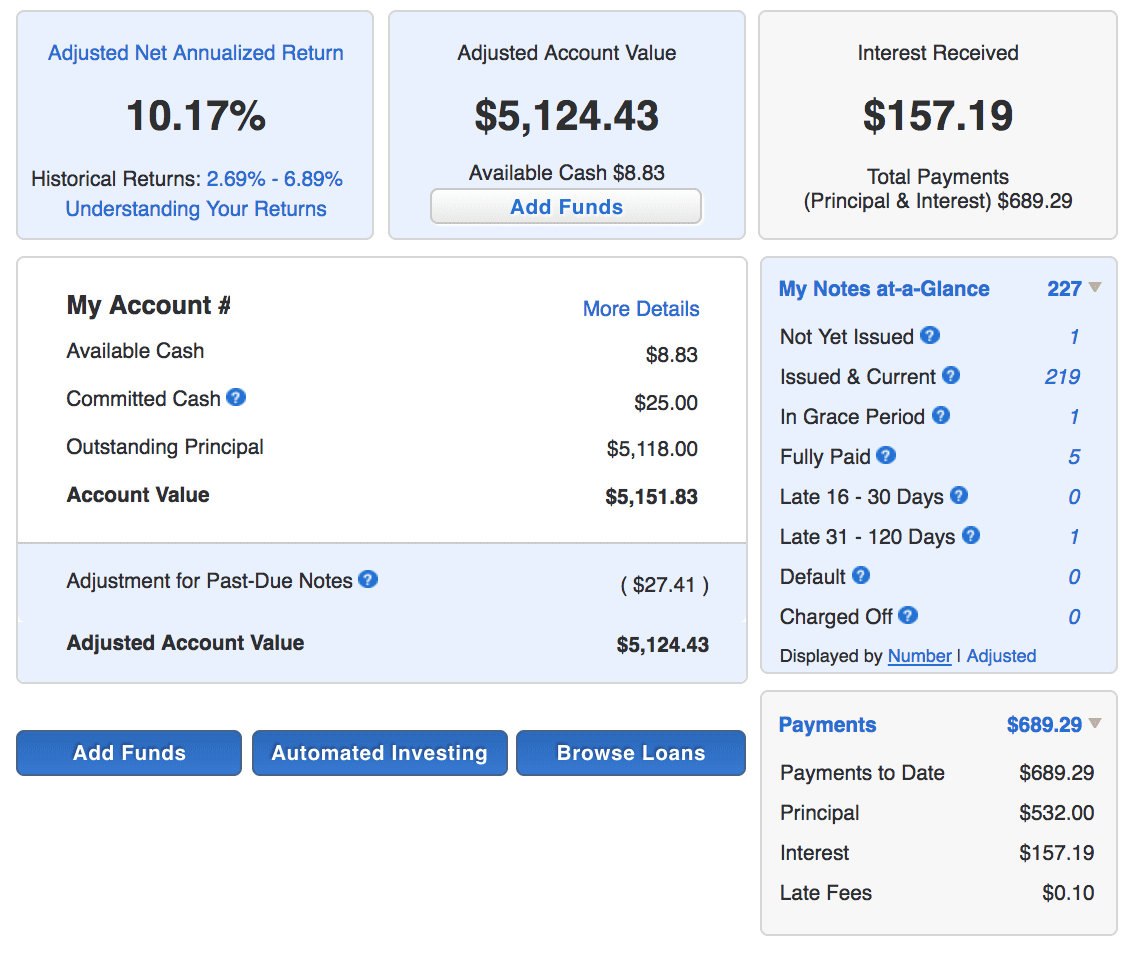

In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status...

New York Fed’s Center for Microeconomic Data recently released their quarterly report on household debt and credit; in Q4, household...

In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling...

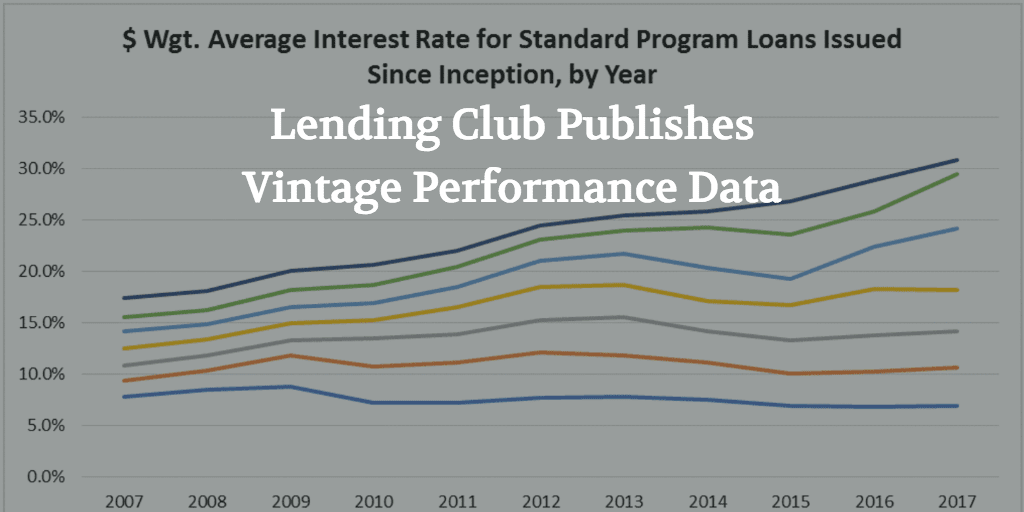

Peter Renton, Founder of Lend Academy and Co-Founder of LendIt Fintech shares his marketplace lending portfolio performance for Q1 2018;...

Visa and Mastercard currently rank 7th and 11th on the S&P 500; their stock prices have increased around 50% over...

In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status...

In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status...

Back in April 2018 we shared that LendingClub had provided us with $5,000 to start a brand new LendingClub account....

Yesterday Lending Club filed a S-3ASR with the SEC which provides comprehensive and updated information on the business. For those who are...