PayPal embarked on its Q2 2023 earnings call yesterday. Schulman highlighted, proprietary AI integration could drive future growth.

PayPal's upbeat earnings call came with the announcement of Schulman's departure and prudent guidance for 2023.

The news this week was dominated by the crypto crash as we heard about layoffs at Coinbase, problems at Celsius and a continued downturn in crypto prices. There was plenty of BNPL news as well.

On episode 40 I talk with John Paasonen of Maxwell helping lenders serve their communities by channeling mortgage and technology expertise.

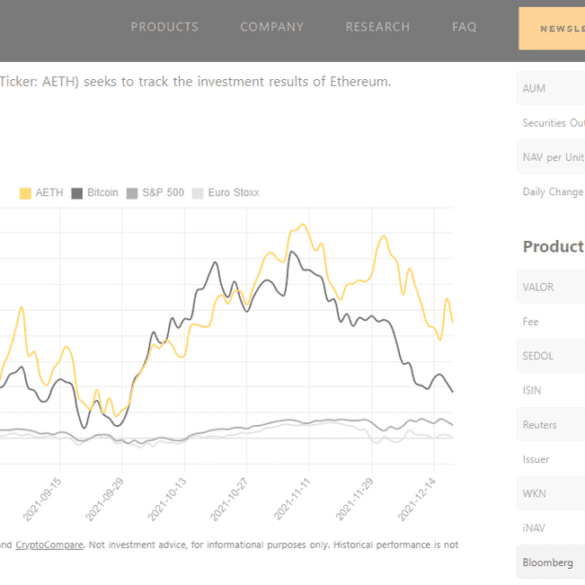

In this conversation, we chat with Hany Rashwan – the founder of Amun and 21Shares. Hany built the company that put out the first physically backed crypto Exchange Traded Product (ETP). In simpler terms, he created a vehicle for people to buy crypto assets, such as Bitcoin or Ethereum, on the stock market. Alongside Cathie Wood of ARK, 21Shares recently submitted a Bitcoin ETF to the SEC. While he waits for the US to get on board, Hany's products are already offered all over Europe, with more than $3 billion under management.

More specifically, we touch on his early entrepreneurial mindset which lead him to building successful businesses, how currency devaluation in Egypt pushed him to create 21Shares, what an Exchange Traded Product (ETP) is and how it related to Exchange Traded Funds (ETFs), the regulatory landscape for crypto-backed ETPs, and so so much more!

Most people likely assume their funds are kept in a traditional bank to be drawn upon when transacted because — let's be honest — no one reads the terms and conditions.

One security expert was surprised to learn multifactor authentication (MFA) is not mandatory for PayPal users after the company confirmed a data breach occurred in December.

Another busy news week in fintech with Apple causing quite a stir on the BNPL front. We also had big news from PayPal, the U.S. Senate, Custodia Bank, Checkout.com and more.

The beginning of February '22 will be remembered for one thing: Facebook — and the tech market it has come to represent — had a terrible quarter.

In this conversation, we chat with Elizabeth Rossiello – the CEO and founder of AZA, an established provider of currency trading solutions which accelerate global access to frontier markets through an innovative infrastructure. Elizabeth founded the company in 2013 in Nairobi, Kenya and has expanded it to 10+ markets across Africa and Europe.

Before founding AZA, Elizabeth was a rating analyst for microfinance institutions across sub-Saharan Africa, consulting for Grameen Foundation, Gates Foundation and the Acumen Fund, as well as working with regulators and policy-makers on legislation for financial innovations. Elizabeth co-chairs the World Economic Forum's Council on Blockchain and holds an M.A. in International Business and Finance from Columbia University.

More specifically, we touch on ratings agencies and the activity of rating intitutions, M-Pesa and how it influenced the thinking towards a crypto-centric future, Africa’s banking landscape and some of the outstanding issues it faces, Bitpesa and how it became Aza, banking infrastructure in Africa, and so so much more!