[Editor’s note: This is a guest post from Ryan Metcalf, Head of Public Policy & Social Impact at Funding Circle.] The Paycheck...

The second (third?) round of the Paycheck Protection Program kicked off today and it was very different to when the...

[Editor’s note: This is a guest post from Susan Doktor. She is a journalist and business strategist who hails from...

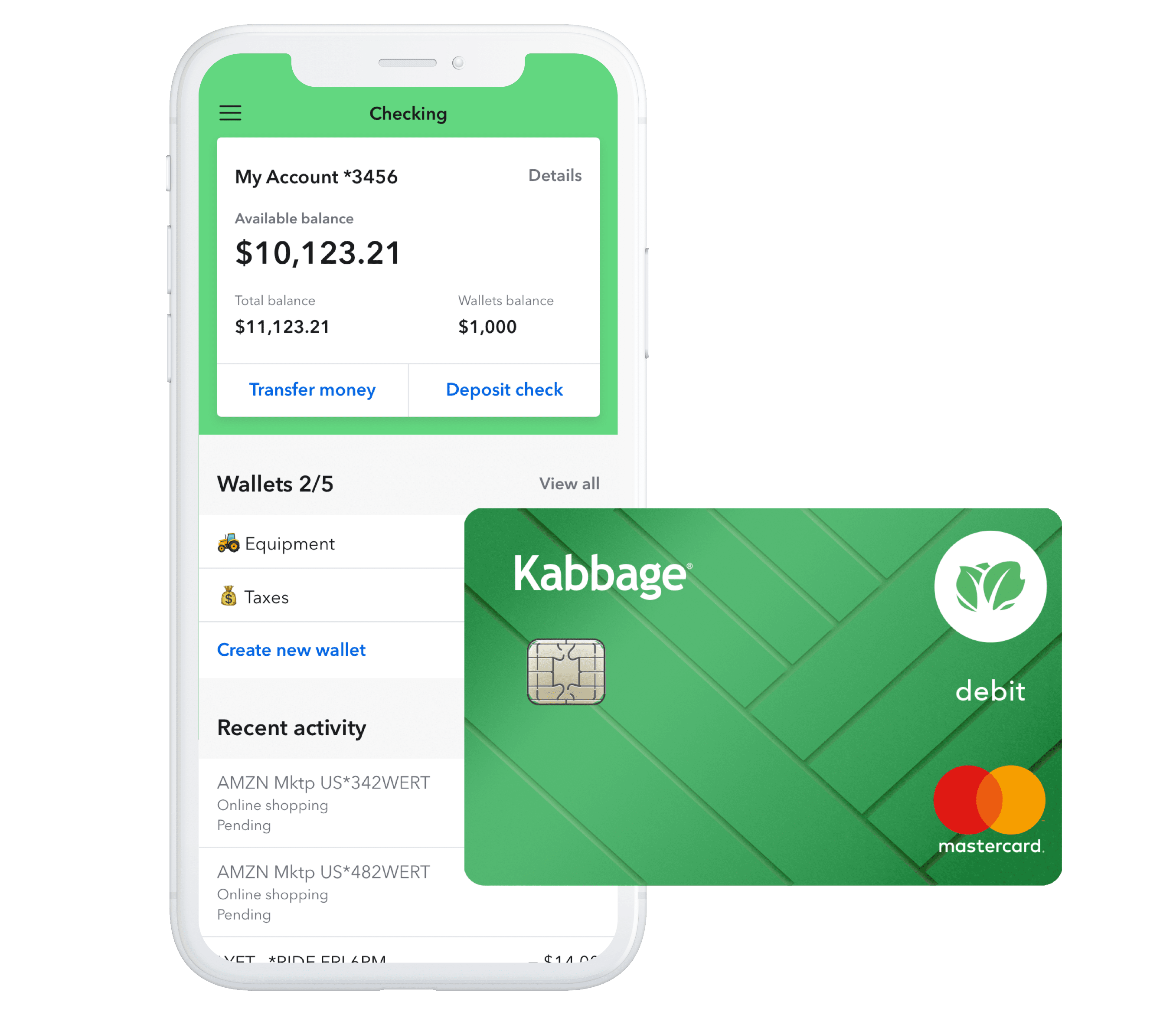

Today, Kabbage announced the launch of their new small business checking account called Kabbage Checking; it is being offered in...

Many (perhaps most) small businesses are not well served by their bank. This was made clear during the Paycheck Protection...

[Editor’s note: This is a guest post from Ryan Metcalf, Head of Public Policy & Social Impact at Funding Circle.] Fintech...

Last night Congress finally passed a new round of stimulus funding. The $900 billion Covid-19 relief package included $285 billion...

Writing in Forbes, the CEO of Lendio, Brock Blake, argues that small business loans obtained through the Paycheck Protection Program...

Congress wants to extend PPP, lenders ready to move on Groundfloor Says Q2 was a Record Quarter Broadhaven Ventures’ Michael...

The COO of cloud-based payroll and benefits provider, Gusto, discusses how they were able to pivot so quickly to offer...