In his latest piece, Ron Shevlin digs into the looming PPP forgiveness nightmare; the second round of the Paycheck Protection...

Kabbage is one of the leaders in small business lending and recently announced custom loans for their Kabbage Payments customers....

[Editor’s note: This is a guest post from Shaun O’Neill, President of Concord Servicing Corporation. Founded in 1988, Concord is...

The LendIt Fintech News team has long featured reviews detailing the process for borrowers applying for loans through companies like...

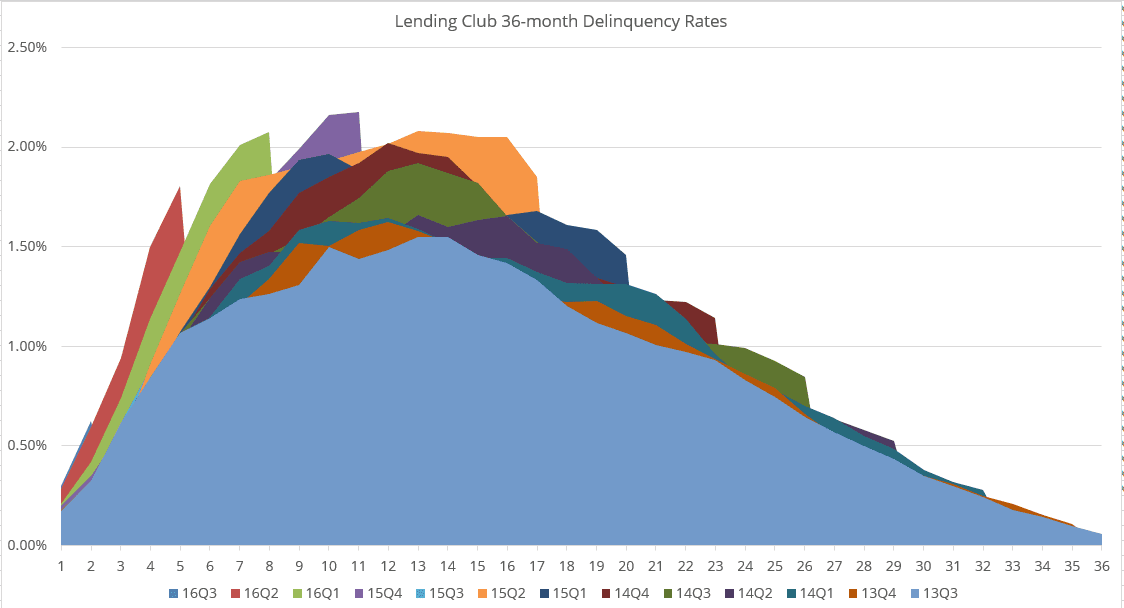

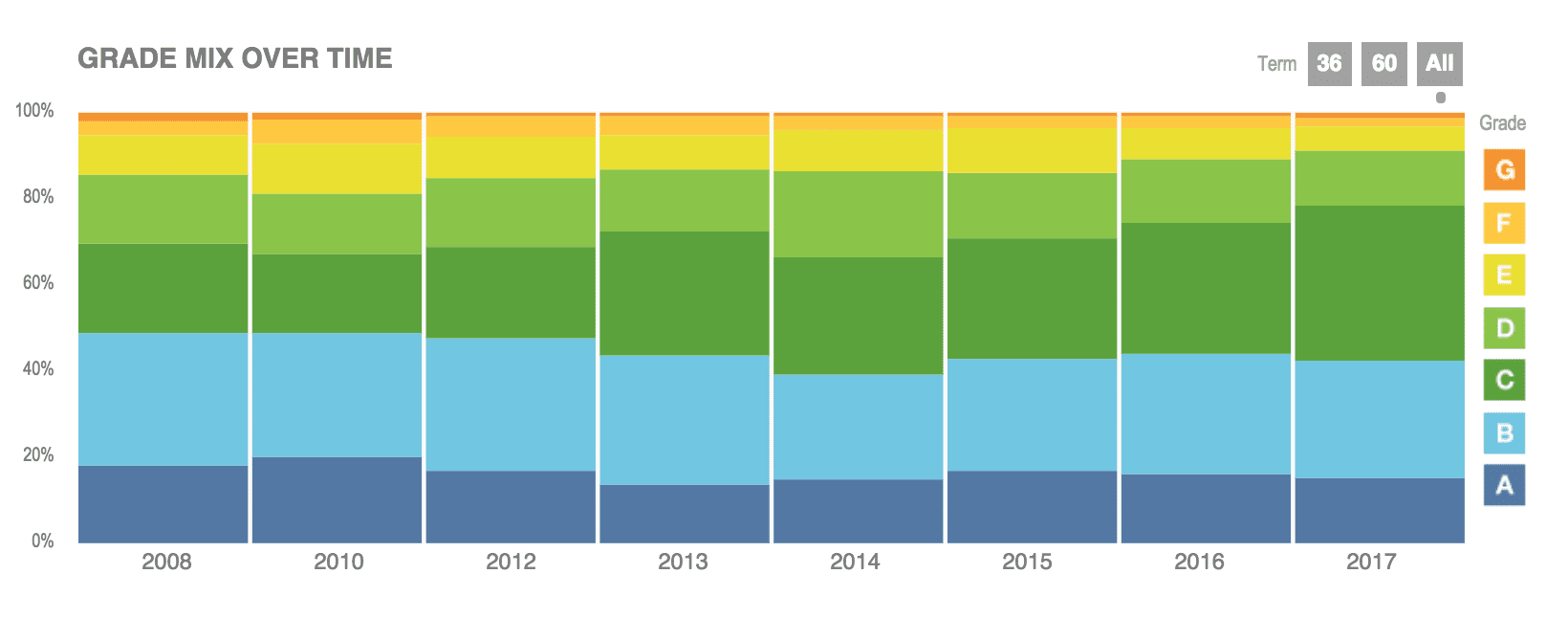

In part one of this series we explored the interest rate movements at Lending Club over the past year. In this post...

Businesses around the United States have been significantly impacted by the coronavirus; at LendIt Fintech we postponed our USA event...

The deal marks the first blockchain powered sustainable “Schuldschein” loan and totaled €220 million; the funds will be used for...

Investments in fintech are a common occurrence, but it’s not often we learn of a relatively unknown company raising...

A recent post on the Lend Academy Forum spurred a discussion about the potential future of LendingClub, particularly as it...

Even Financial is a supply-side platform for online financial services, they have integrated with the top online lenders and affiliate...