As the sun sets on 2020 and we look back at this past year nearly everything is viewed through the...

Here are the most read news stories from our daily newsletter today: OCC chief expects SWIFT-like bank-to-blockchain connections in 3...

Credit Karma CEO Ken Lin talked with Business Insider about the current crisis and what the company is doing to...

Fintechs PayPal and Intuit were the first two non-bank lenders to be approved to lend through the Small Business Association’s...

With their recent acquisition of Credit Karma still fresh in everyone’s minds Intuit is rumored to be eyeing more fintechs;...

This week, we look at:

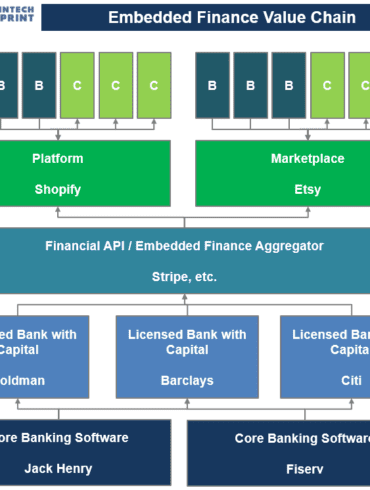

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

The leader in small business accounting, Intuit, has announced a new tech-enabled bank account with a rich set of features...

It was reported over the weekend that PayPal and Intuit gained approval to lend through the Small Business Administration’s Paycheck...

Bill Harris is the former CEO of PayPal and Intuit and is also the founder and CEO of Personal Capital;...

In this week’s PeerIQ Industry Update they cover the growing turmoil in the markets due to the spread of coronavirus...