Scott Stewart is the CEO of the Innovative Lending Platform Association or ILPA; ILPA members include many of the large...

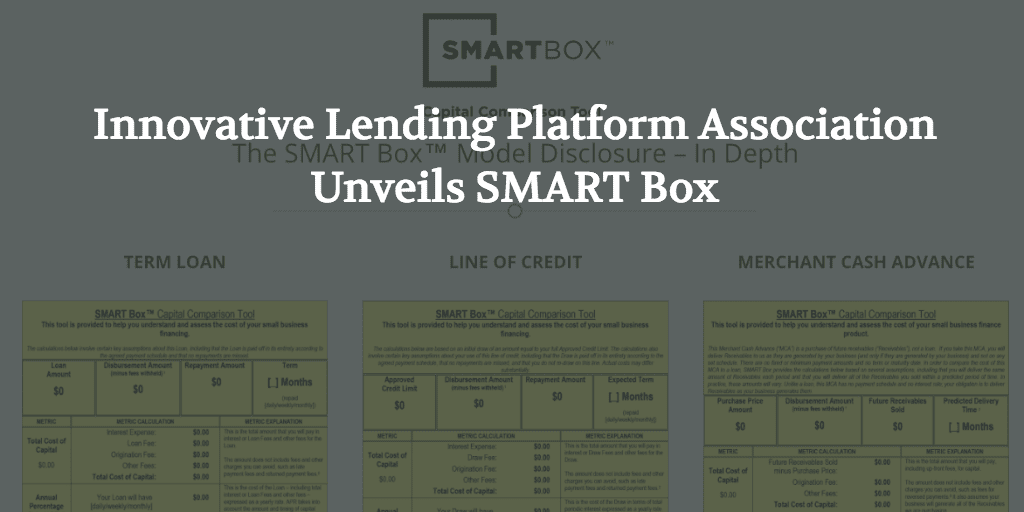

Yesterday, the Innovative Lending Platform Association (ILPA), made up of small business online lending leaders OnDeck, Kabbage and CAN Capital,...

The new CEO of the Innovative Lending Platform Association has written an op-ed focused on the Madden decision and how it could be fixed by Congress to better serve small businesses. Source

The last 12 months has seen a lot of movement on the industry association front. Last year the Small Business Borrowers’ Bill...