While Brazil's PIX has achieved great success, it is not alone. UPI has thrived in India, ushering millions into the digital economy.

Afterpay comes to physical stores in the US How Retailers Are Cashing In On A US Coin Shortage Google to...

Harit Talwar, the head of Marcus since joining Goldman Sachs in 2015, is in the running for one of the...

PayU is a largest payments processor in India and it is continuing its moves into lending in that country with...

The CEO of NITI Aayog, a policy think tank of the Indian government, said that the fintech market in India...

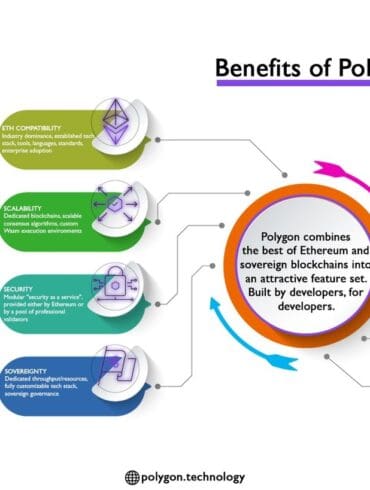

In this conversation, we chat with Sandeep Nailwal – The Co-Founder & COO at Polygon (previously Matic Network). Sandeep is a long time developer who’s been dabbling in the space since way back in his college days. Originally known as the Matic Network, Polygon rebranded with the aim to reach a global audience and they’ve certainly done just that.

More specifically, we touch on Sandeep’s intriguing entrepreneurial journey, developing a blockchain startup in India, DApps, Scalability & Interoperability of Layer1 and Layer2 blockchain solutions, Zero-knowledge Rollups, NFTs & Gaming, and so much more!

ICICI Bank, one of the “Big Four” banks of India introduced banking services on WhatsApp just three months ago; the...

Last year the amount of global investment in Chinese fintech companies reduced dramatically to $4.9 billion, down from $34 billion...

Open is based in Bangalore and is looking to replicate a strategy which has been successful in other regions; their...

TransUnion’s innovation lab is entering its third year and is now planning to expand in Canada and India; participants get...