The beginning of February '22 will be remembered for one thing: Facebook — and the tech market it has come to represent — had a terrible quarter.

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

Facebook announced last week that their digital payments platform, Novi, is nearly ready to launch across multiple states, having passed regulatory checks. Novi will use a stable cryptocurrency called Diem to launch payments across borders for the 2.7 billion users of the social network.

In this conversation, we talk with Robert Leshner of The Compound Protocol about the early days of crypto and how a fascination with Ethereum smart contracts drove him to build one of the largest DeFi projects to date.

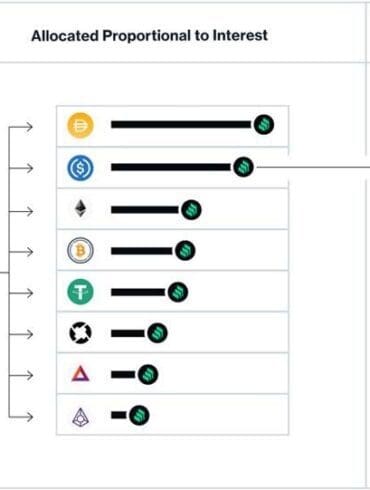

Additionally, we explore the nuances of lending and interest rates, consumer privacy software and data monetization, floating interest rate pools of capital across different token pairs, DAO evolution and its influence on mechanism design, the role Compound plays in chain interoperability, and the discovery of yield farming as a means for user incentivisation.

WhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

Silvergate, a US-based crypto bank that first partnered with the Facebook venture to create a stable coin last May, said in a release they paid $182 million for the operations infrastructure.

"We're aware that some people are having trouble accessing our apps and products," Facebook said in its first public comment on Twitter. "We're working to get things back to normal as quickly as possible, and we apologize for any inconvenience."

Facebook is building towards a Metaverse version of the Internet, in both its hardware and software efforts. What are the implications? And further, how does one acquire status, work, and social capital in such a world? We explore the recent NFT avatar projects through the lens of Ivy League universities and CFA exams to understand some timeless cultural trends.

artificial intelligencebig techdigital transformationenterprise blockchainidentity and privacyIndiaregulation & compliancetelecom & infrastructure

·This week, we look at:

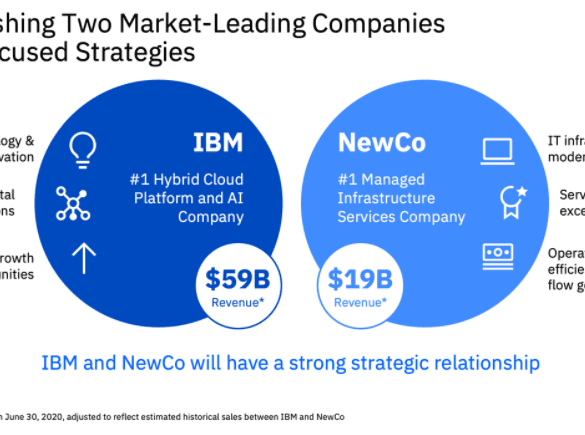

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

The role that technology infrastructure plays in the delivery of financial services

Facebook is launching a WhatsApp-based digital payments service for the messaging app’s 120m Brazilian users; users will be able to...