Discover the unique challenges digital lenders face with default payments as well as proactive steps to take to help mitigate the impact.

[Editors Note: This is a guest post from Christian Hamson. Christian is the Chief Credit Officer at NSR Invest. He has...

Most p2p investors will likely experience a borrower default at some point. I have been curious for some time to...

Bloomberg reports that the charge-off rate among card issuers in Q1 2019 increased to the highest level in almost seven...

If you have a well diversified p2p lending portfolio then defaults are annoying but they are unlikely to do too...

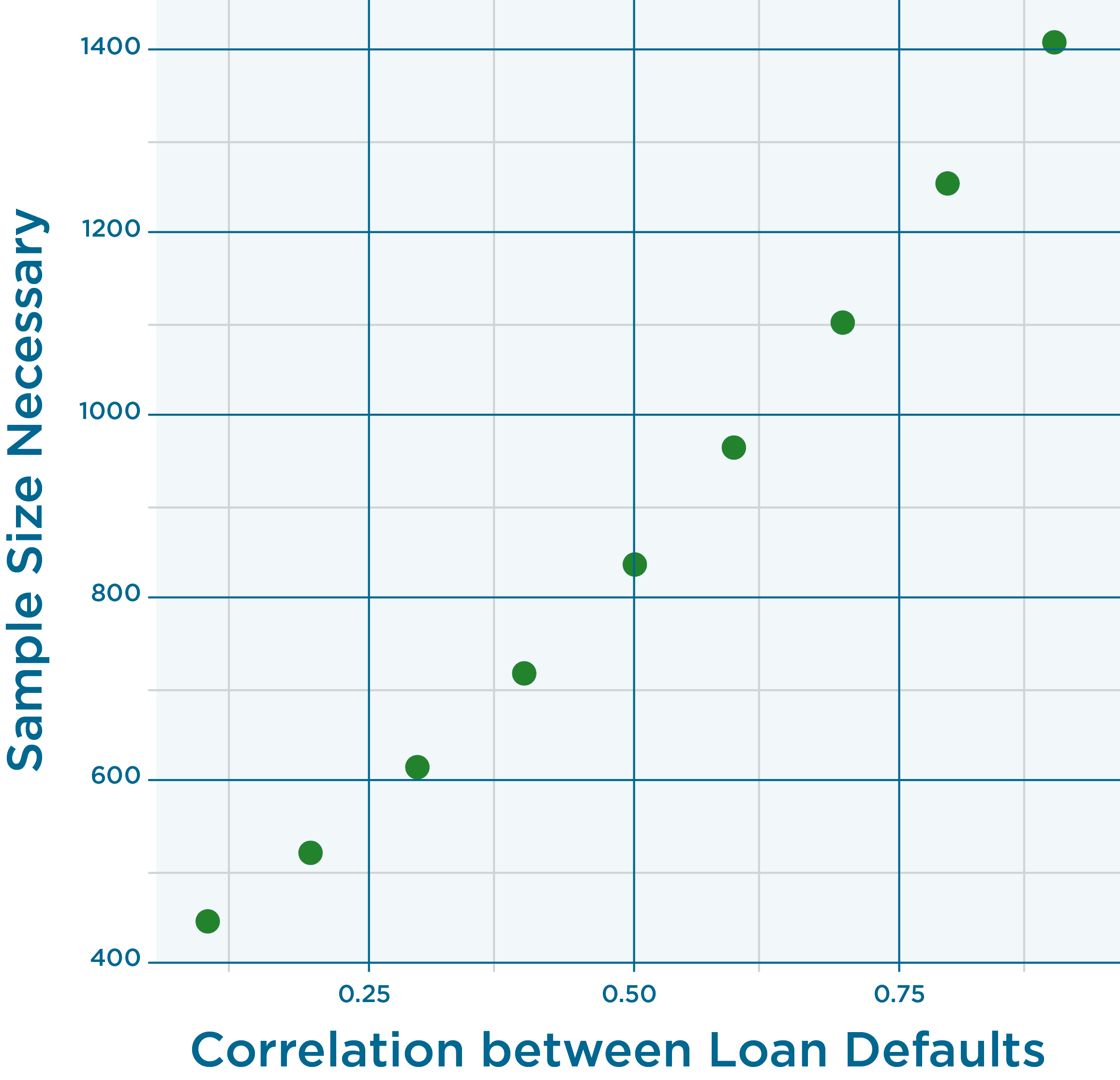

I was tooling around on Eric’s Credit Community last week when I came across the interesting chart above. It is...