Moven is winding down their personal financial management offering due to the current market; going forward Moven will now focus...

Amid the current pandemic consumers in the United States are facing a new reality, one that increasingly means transacting online...

The division will focus on corporate compliance and consumer issues and Katherine A. Lemire, a former assistant US attorney has...

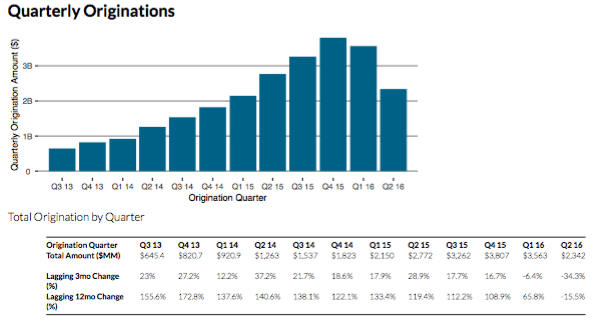

Out of all the service providers in the marketplace lending industry Orchard has the broadest set of data on online...

Now more than ever it is important to bring the fintech community together. Many readers are already aware that we...

After the great recession economic researcher, Dr. Dan Geller, created the Money Anxiety Index to measure consumer spending and savings...

For online platforms there is considerable cost to be able to accept retail dollars. This is one of the reasons that Lending...

At 23 years old, Paul Gu has attended Yale, been awarded a $100,000 grant as a Thiel fellow, co-founded Upstart,...