E-commerce fintech SellersFi secured a $300 million credit facility from Citi, leveraging the increasing popularity of alternative payments.

In the biggest webinar of the new year, three credit experts went live Thursday in front of the LendIt audience to talk about the future of AI analytics in credit.

Last year will be known for a myriad of events. While the institutionalization of crypto might not make it to...

Google announced a new group of bank partners for their checking account, expanding on the initial announcement last year with...

Robo advisors have quickly become a must have product for banks as they look to offer their customers comparable products...

As the digital asset market has matured, incumbents are starting to take notice. Citi announced a partnership with METACO to establish digital asset capabilities.

The paper found 34 percent of Americans are considered financially healthy: leaving out 187 million who are still getting by or vulnerable.

big techdigital lendingdigital transformationInvestingmega banksOpen Bankingpaytechroboadvisorsuper app

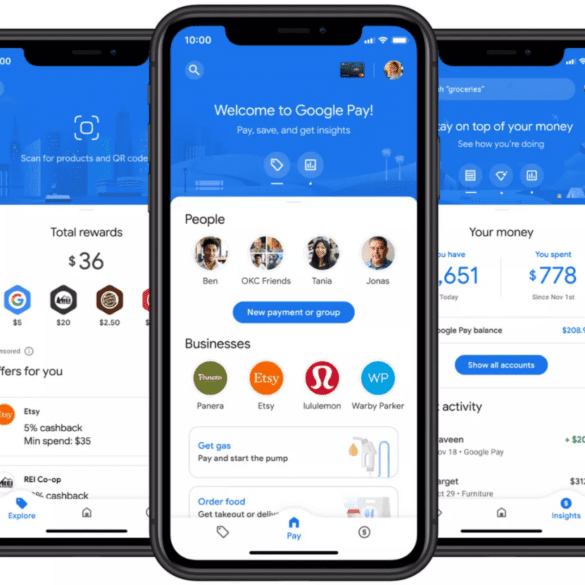

·Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

Google will offer a full suite of mobile banking services through new partnerships announced today with eight US-based banks; this...

Cloud providers Amazon Web Services, Google Cloud, Microsoft, and IBM have been working to convince more financial services companies to...