Executives at some Chinese banks and online lenders are reporting that more consumers are becoming delinquent on their credit card...

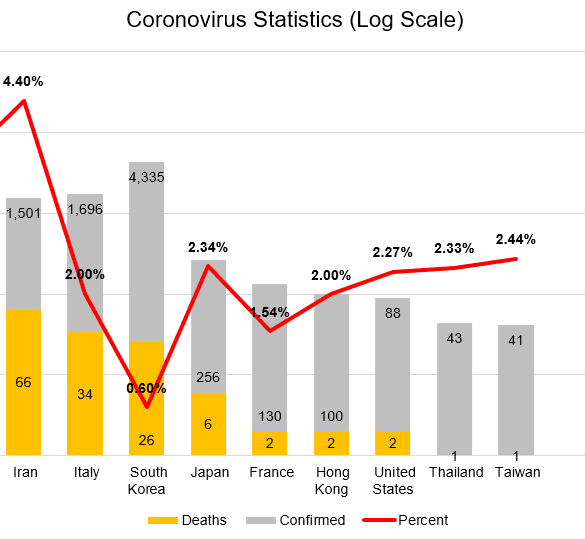

I look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low -- but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that's what the conspiracy theorists want you to think!

Last year the amount of global investment in Chinese fintech companies reduced dramatically to $4.9 billion, down from $34 billion...

When we started LendIt in 2013 I had no idea that China was a hot bed of peer to peer...

Over the weekend China’s central bank stated that they will be gradually introducing a system of rules in order to...

Early data coming out of China shows an increase of loans that are past due; According to Bloomberg, overdue credit-card...

China’s banking regulator is looking at potentially setting up regional bad-debt managers to deal with the collapse of the significant...

China’s central bank as accepted Amex’s application to start a bank card clearing business, but they still need to receive...

Amazon recently closed its marketplace in China but is still working on other businesses in the region; they are now...

Last August U.S. lawmakers passed the National Defense Authorization Act which was designed in part to stem Chinese acquisitions of...