exchanges / cap mktsgaming & sportsgovernanceidentity and privacyMetaverse / xRNFTs and digital objectsregulation & complianceSocial / Community

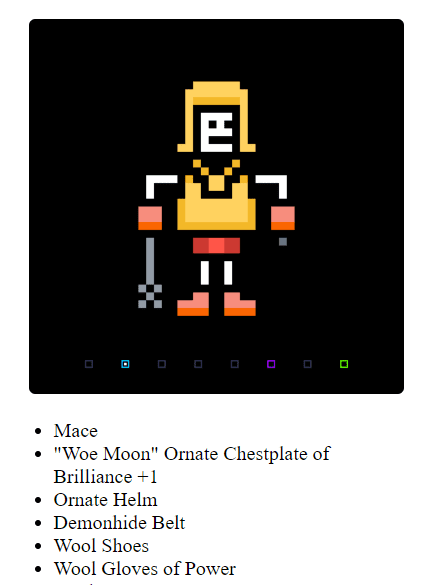

·We discuss the top-down and bottoms-up approaches to innovation and project building. For the former, we reference Australia’s draconian surveillance laws, and the integration of US driver’s licenses into Apple’s wallet. For the latter, we dive into the Ethereum-based Loot project and its incredible derivatives, $500MM token, and $200MM of volume. Last, we conclude by highlighting the role of creators on the coming wave of Fintech.