SoFi reported fourth-quarter GAAP Revenue was $286 million, up 67%, and $984.9 million for the year, up 74% from 2020.

SoFi has become the latest fintech to apply for a full national bank charter. They filed a de novo bank...

The new expansion into Hong Kong is SoFi’s first foray into international markets; SoFi Invest will allow investors access to...

SoFi CEO Anthony Noto was interviewed by Jim Cramer on CNBC’s Mad Money yesterday where he talked about the investing...

There has been a lot of anticipation for SoFi‘s banking product. Not only does it round out SoFi’s product set...

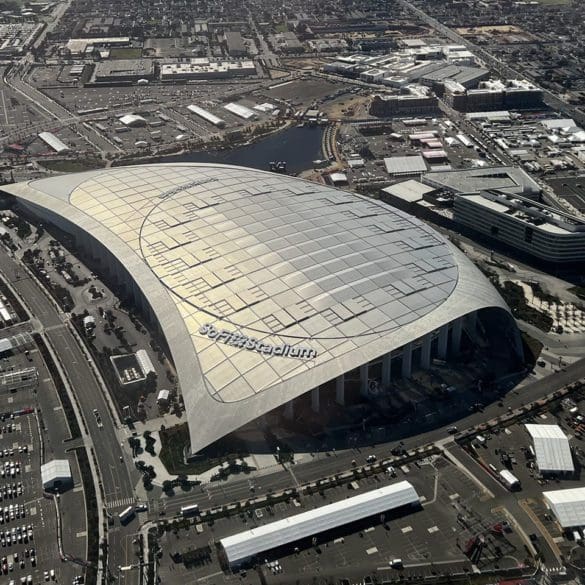

Last Sunday night the world saw SoFi Stadium in all its glory for the first time. Well, that’s not exactly...

At LendIt Fintech USA 2018, in his first public appearance as the new SoFi CEO, Anthony Noto spoke with Emily...

The rumors that have been flowing for many months have been confirmed. Leading fintech company, SoFi, has acquired naming rights...

The CEO of SoFi talks priorities, innovation, company culture, competition and what it will take to build a world class...

On CNBC’s Power Lunch, CEO Anthony Noto stated, “We want to accelerate our investment in some new products, one of...