Pinwheel’s new partnership with American Express is the latest development for a fintech that has been quite busy over the past two years. The income and employment API is now American Express' direct deposit switching partner for their new checking account.

American Express and Square announced on Nov. 16 a plan to launch a new credit card explicitly built for Square sellers on the AmEx network.

A couple of weeks after rebranding, Bread Financial launched a feeless, unlimited 2% Cashback Amex Express credit card.

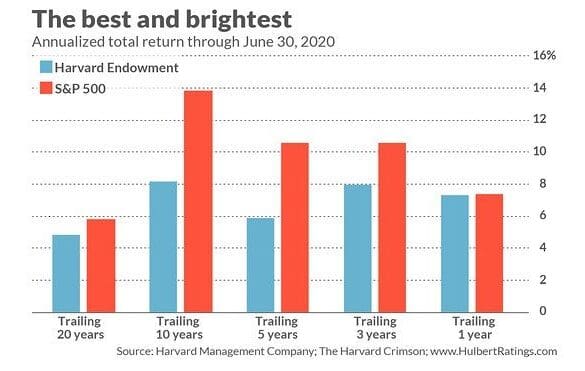

As the sun sets on 2020 and we look back at this past year nearly everything is viewed through the...

The great fintech consolidation of 2020 continues. While we knew this deal might be coming, as it was leaked last...

Making news this week was Stripe, American Express, the CFPB, SoFi, Celsius and more

On Tuesday, Extend, launched an API that enables SMBs to issue digital cards from any company, including American Express.

Most countries in the world today have some kind of centralized repository for credit data. But this data exists in...

In this conversation, Will and I break down a few important pieces of recent news. MetaMask, the crypto wallet, hit 1 million month active users in yet another sign of the acceleration of retail adoption.

Square’s market cap is now equal to that of American Express, and the former also announced it has purchased $50 million of Bitcoin with its balance sheet. What do these pieces of news mean?

Greenwood Financial launched, a neobank led by Andrew J. Young, a civil rights legend, Killer Mike, a rapper and activist, and Ryan Glover, founder of Bounce TV network. How much scope is there for financial services for affinity groups instead of traditional geographical or product coverage areas?

Here are the most read news stories from our daily newsletter today: American Express reportedly in talks to buy Kabbage...