In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status...

In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status...

SoFi Money is one of the latest offerings in the digital banking space; SoFi is able to offer this checking/savings...

The company is introducing the new account by leveraging a bank partner; the account will pay 2% APY and will...

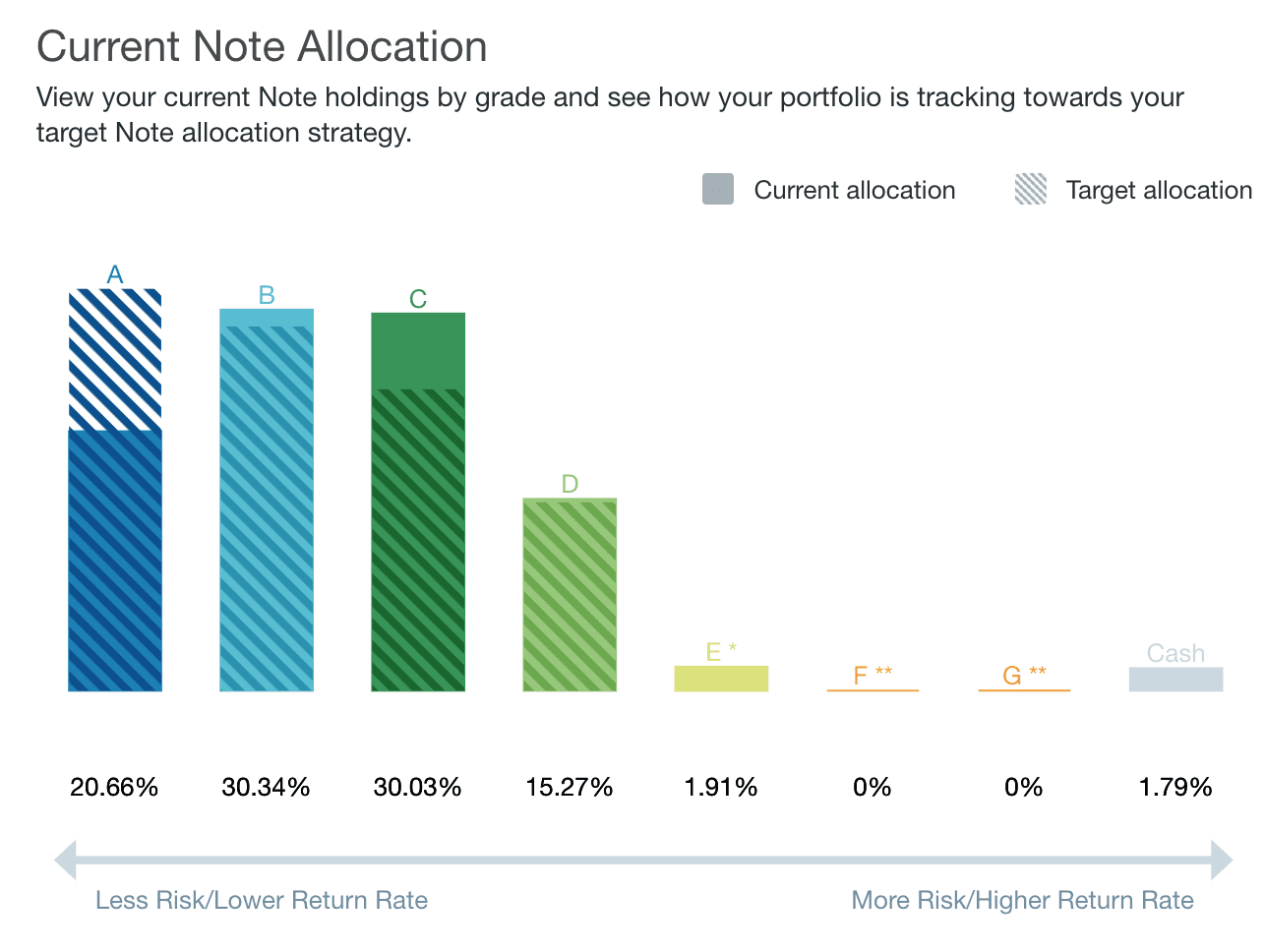

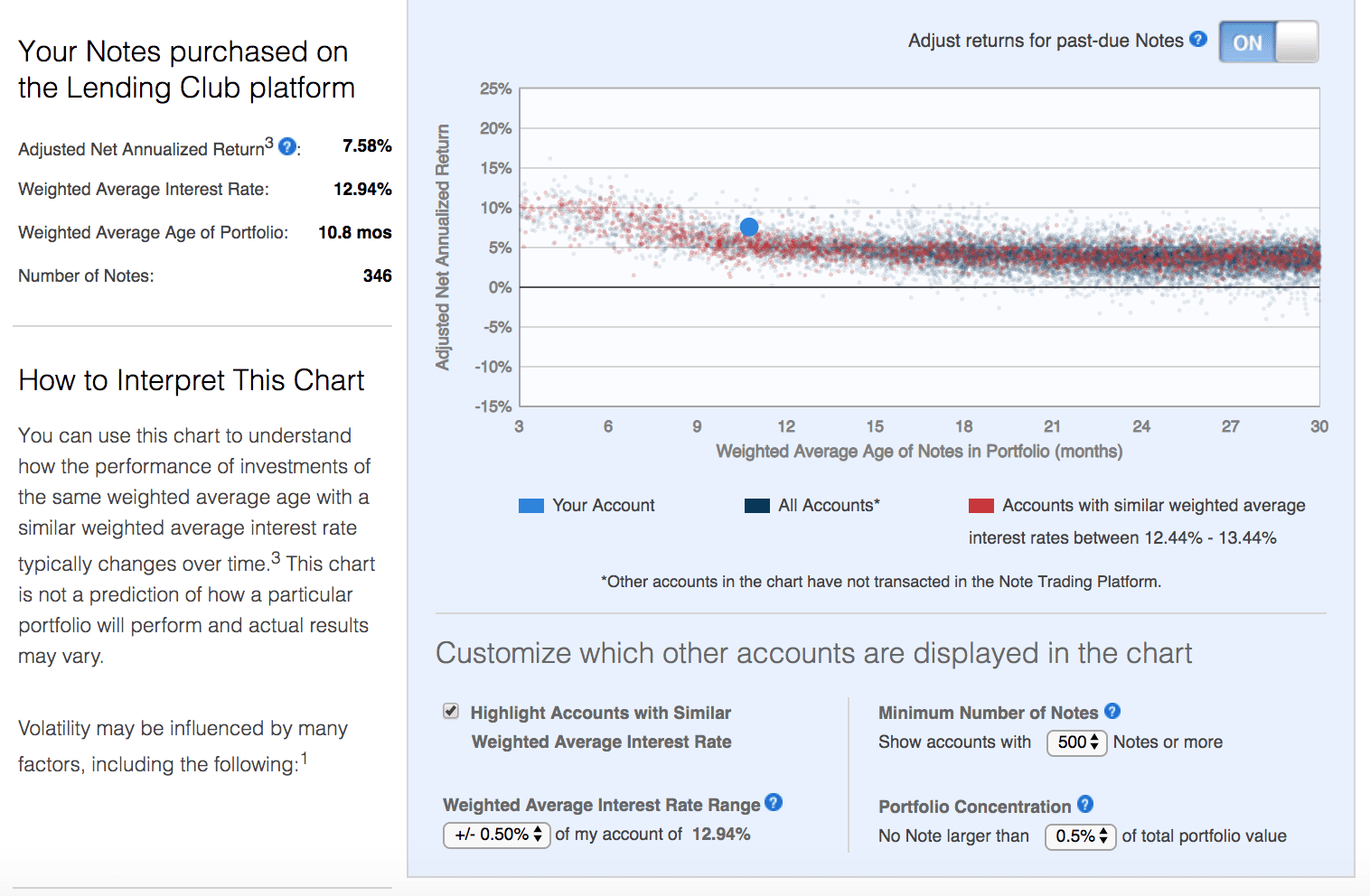

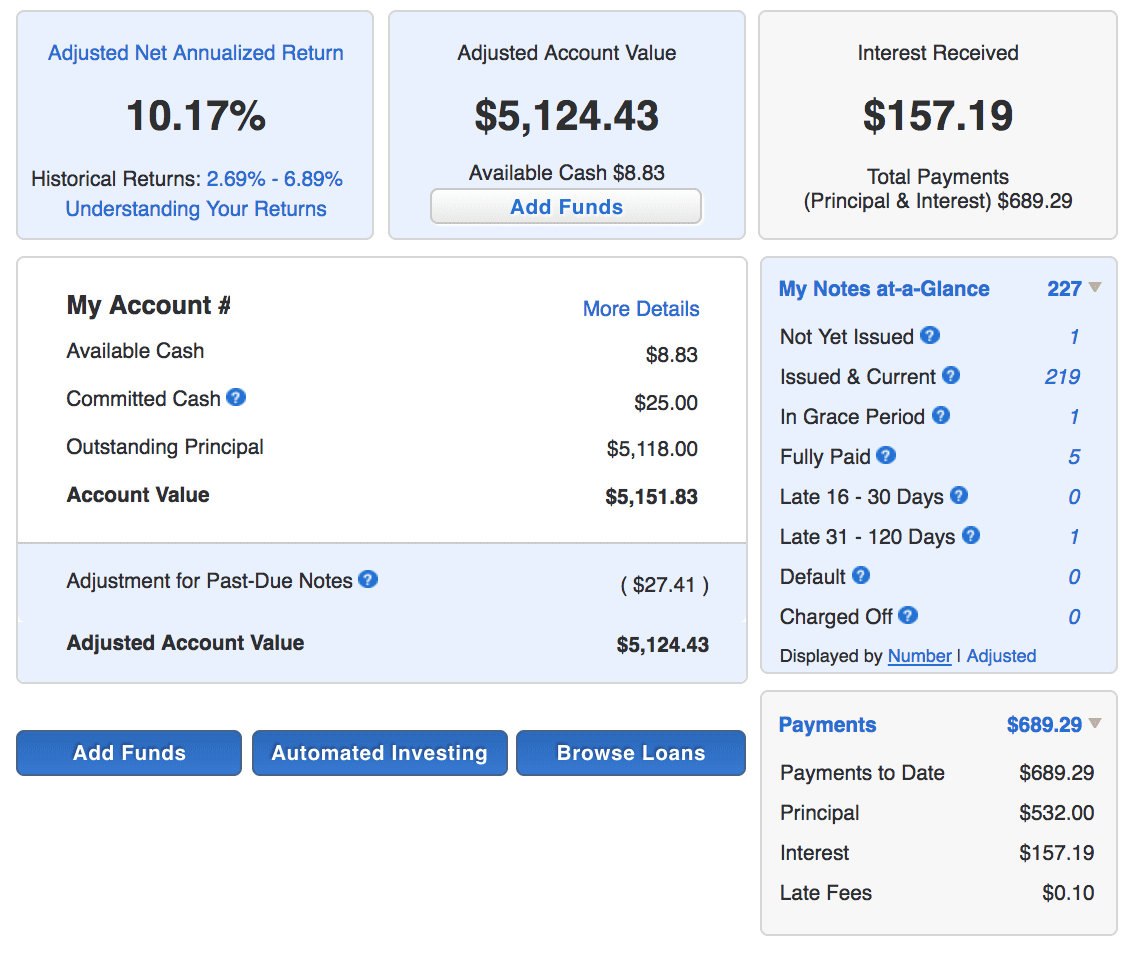

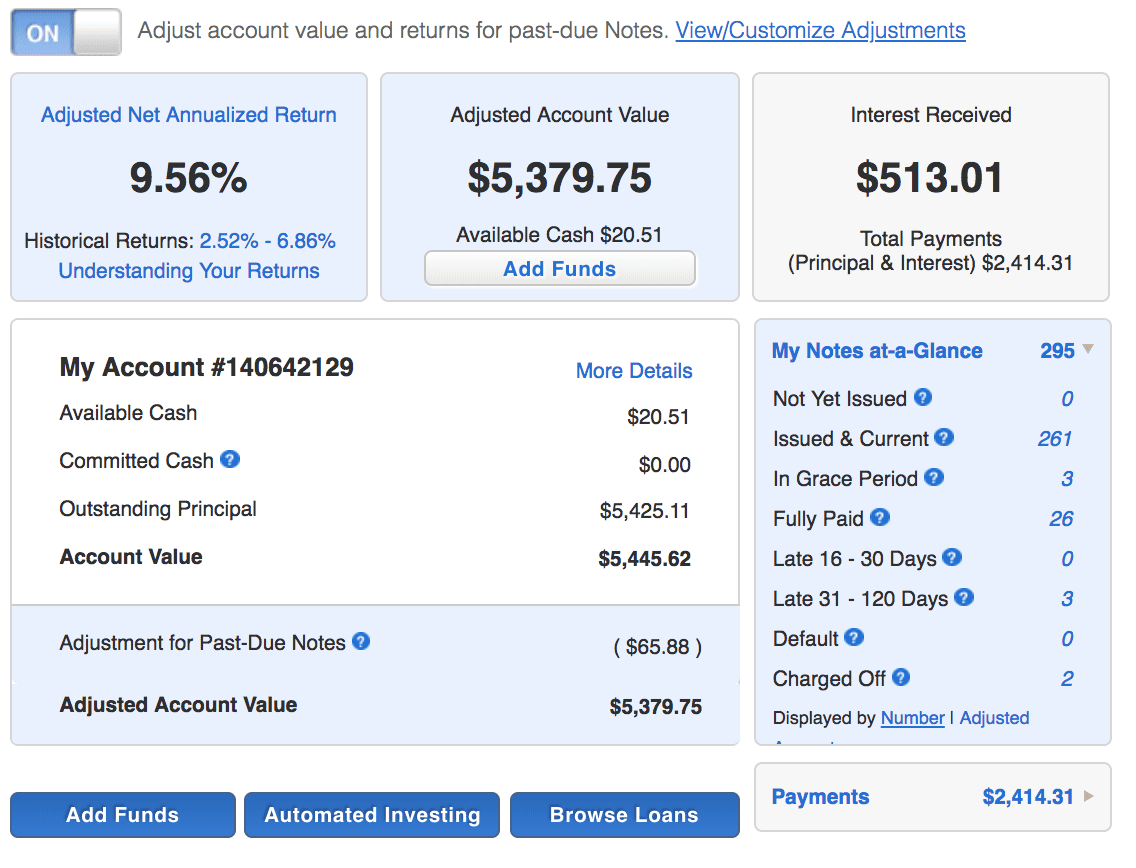

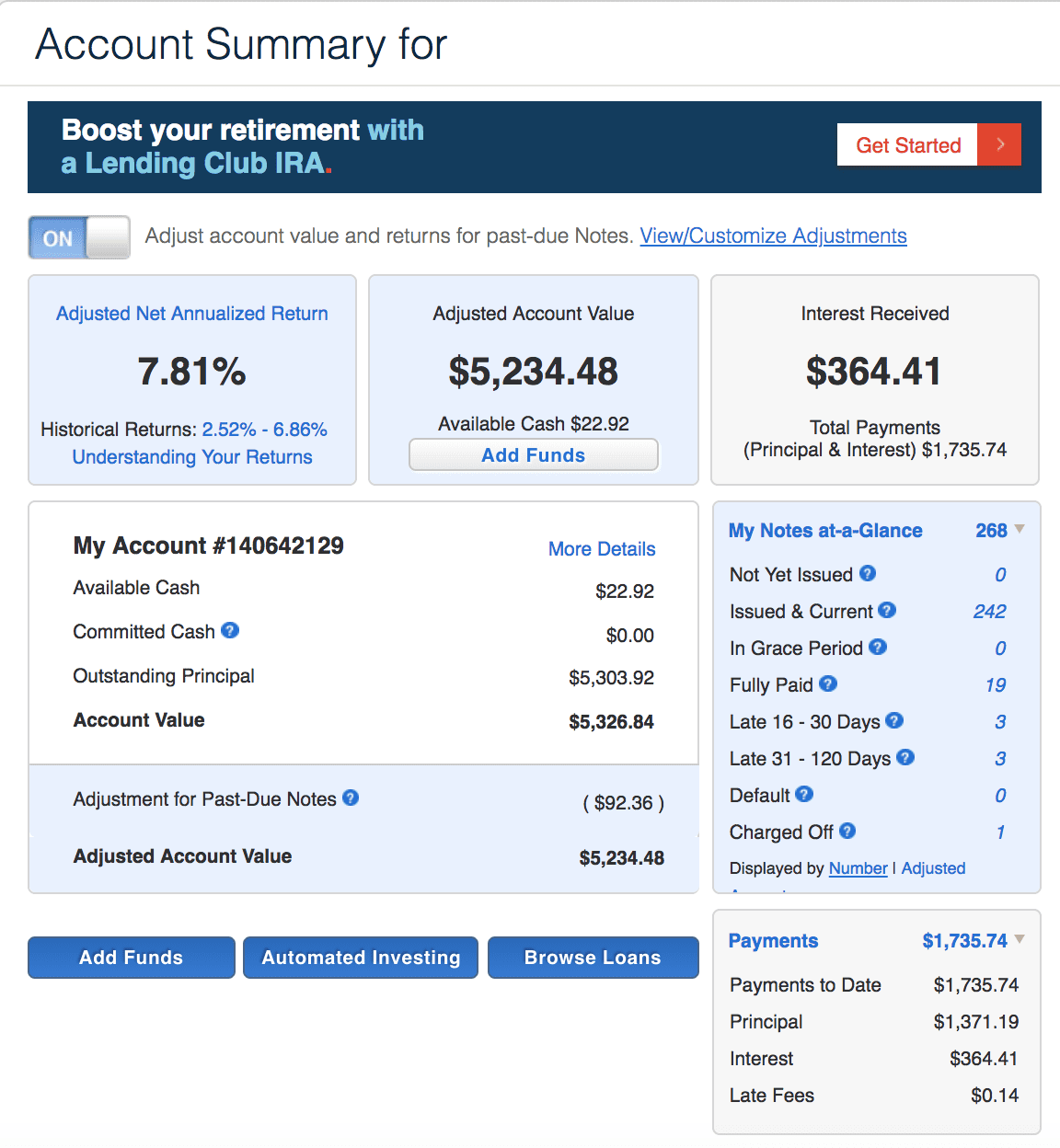

Back in April 2018 we shared that LendingClub had provided us with $5,000 to start a brand new LendingClub account....

In April 2018, LendingClub provided us with $5,000 to open a brand new account; since then we have been chronicling the...

In just one year after launch RateSetter has brought in £175 million through their first ISA product; the cash invested...

In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status...

In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling...

In this post we share the process of opening up a new LendingClub account, the first in a new series we will be sharing over the coming quarters. Source