The UK has been fundamental to the growth of open banking.

Although many nations adopted policies, it was in the UK that they were taken on at full force, sparking a revolution of challenger banks and alternative payments options.

Since its conception, the UK open banking sector has gone from strength to strength. The COVID-19 pandemic accelerated an already fast-paced growth, and innovation has given rise to much development.

The sector as we know it today was born from the introduction of the Payment and Services Directive 1 (PSD1). In 2009 this regulatory initiative was introduced by the European Union to stimulate competition in the financial services industry.

Its later development into Payments Services Directive 2 (PSD2) was the catalyst in the evolution of the payments and banking sector into modern Open Banking.

Although the legislation was directed at the whole of the European Union, the UK took it one step further. Regulatory assistance, simplification, and cooperation between the government, tech, and financial markets created a fertile environment for innovation.

Over five million UK citizens and small businesses are active users of open banking-enabled products with 336 regulated providers (as of February 2022).

Coordination between the Competition and Markets Authority (CMA) and the industry-led Open Banking Implementation Entity (OBIE) has been fundamental to the evolution and standardization of Open Banking within the UK.

Under the mandate of the CMA, the OBIE has carried out various activities involving the supervision and monitoring of data, generation of standards, promotion of the ecosystem, and providing services and infrastructure that are critical to the running of open banking.

UK development into open finance

After the success in the Open Banking sector, there has long been a call for a move into Open Finance.

In November 2019, Sheldon Mills, then Director of Competition at the FCA, presented a speech on the benefits of Open Finance.

Within the address, he explained Open Finance to be part of a broader sharing initiative, with the potential to improve access within financial services and change the nature of competition. A proposed focus was put on consent management, digital ID verification, and cross-sectoral consistency to enable consistency.

Open Finance is seen to “empower” consumers, giving them more control over their data and providing a market rich with competition and innovation to meet their needs better. It builds on the Open Banking model, allowing third-party providers (TPPs) access to more financial data across savings, mortgages, insurance, consumer credit, and pensions.

Work on a pensions dashboard started in 2019, not long after modern Open Banking initiatives were launched. Still, a definitive solution is yet to be released, although recent plans have been published stating that schemes will start staged onboarding in early 2023.

The dashboard’s slow development tells of the difficulties that face a sector-by-sector approach to Open Finance.

“The question is, do you continue to look at it sector by sector, for example, an initiative around insurance. Or do you have a big bang approach where you say, `let’s open up data full stop.'” commented Innovate Finance Head of Policy, Adam Jackson.

There are arguments that the sector-by-sector approach is too slow for some issues, such as climate change solutions and financial exclusion.

“GDPR has a broad look at data, but there aren’t really the legal arrangements that enable easy sharing of data across the economy. What we don’t have is the requirement for companies to publish metadata,” continued Jackson.

“We have a cost of living crisis and issues of financial exclusion where people are struggling to get access to affordable credit. The more we can do to open our data to enable people to build up credit files, the better.”

“There are arguments that these kinds of things can’t wait another seven years, so we need to look at ways of accelerating it.”

Data transparency essential

The efficient development of Open Finance lies fundamentally in data transparency. For many, to enable quicker implementation, continued coordination with external initiatives and think tanks is critical.

In his introduction to the OBIE annual report of 2021, Imran Gulamhuseinwala OBE, the Open Banking Implementation Trustee stated in the light of the government announcement of its vision for Open Data initiatives, “The OBIE has built unique expertise and assets in these areas: it would be both sensible and beneficial for these to be utilized in these adjacent initiatives, ensuring that people and small businesses can access their data in the same safe and secure manner, regardless of product or sector.”

Alex Lempka, CEO and founder of Connect Earth, a company focused on collecting data and data transparency, said, “The whole reason we exist is to eliminate friction in obtaining data. It’s not just fintech…we collect data to make it easy to build APIs and products. At the moment, it’s really hard to get this data (and make these products).”

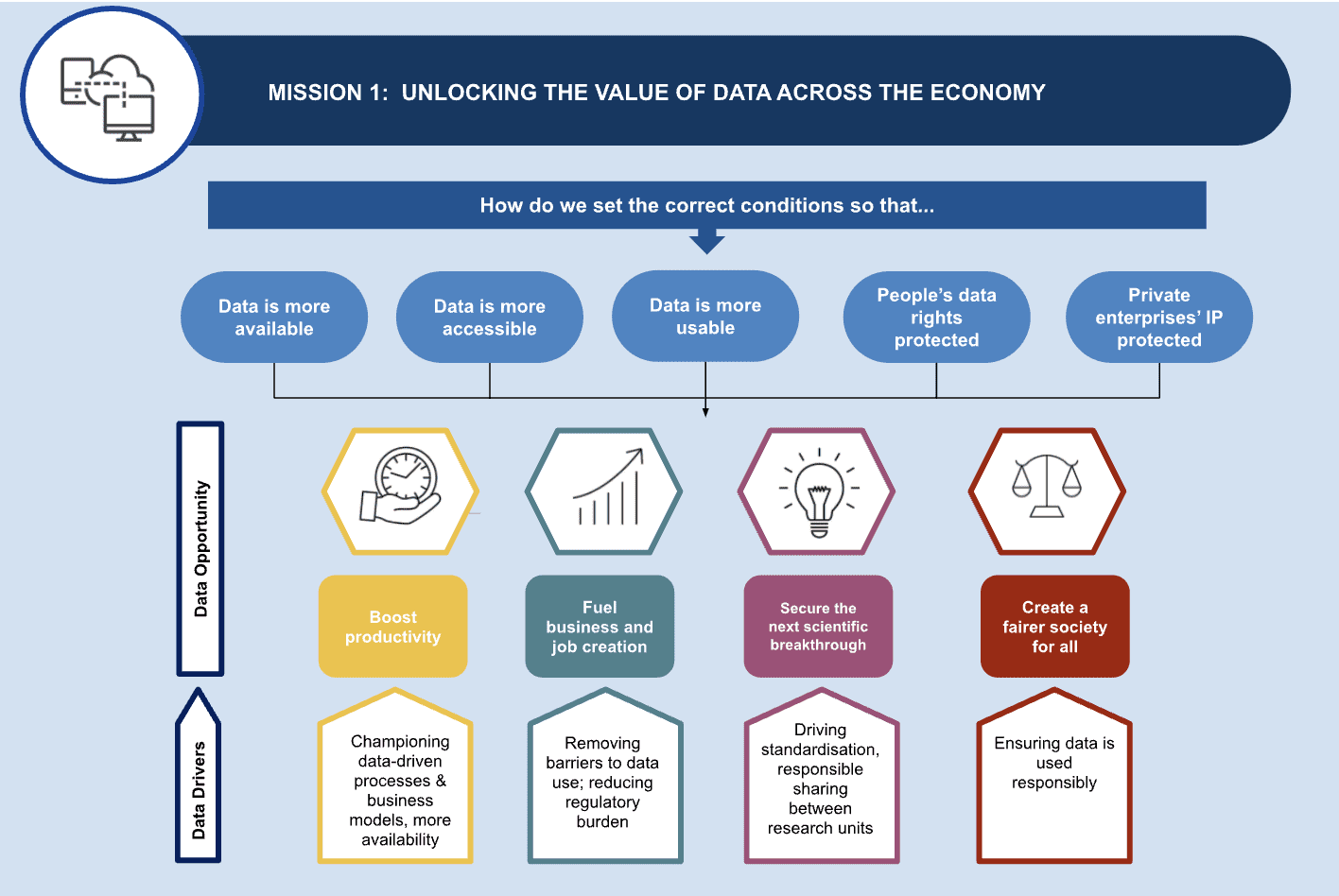

On Nov. 24, 2021, The Department for Digital, Culture, Media, and Sport (DCMS) published a policy paper titled National Data Strategy Mission 1 Policy Framework: Unlocking the value of data across the economy.

The paper was an extension of the National Data Strategy, published December 2020, and proposed a framework to guide intervention unlocking data across the economy and identify priority areas for action.

It marked the first step to data access, a crucial development element in Open Finance.

The report identified various barriers to access at different levels, the most prevalent being concerns about legal risks and data protection, with 39% of businesses stating that this was the most significant factor stopping the sharing of their data.

Other cited factors were lack of knowledge, high costs, and lack of incentives.

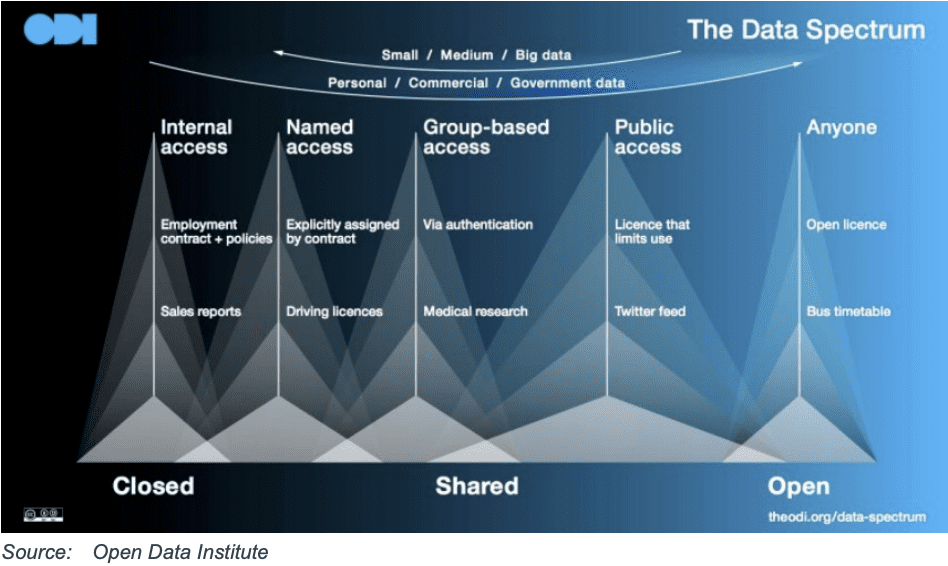

The DCMS, with the commissioned help of Frontier Economics, is currently exploring different levels of data availability along the open data spectrum, along with levels of access.

Future activities focused on supporting sector-specific trials, drawing insights from their implementation, and research, monitoring, and engagement with domestic stakeholders.

Issues with data consent

Although open finance is presented as enabling more competition, concerns have arisen regarding customer discrimination on granting access to their data and the concerns mentioned above on data protection.

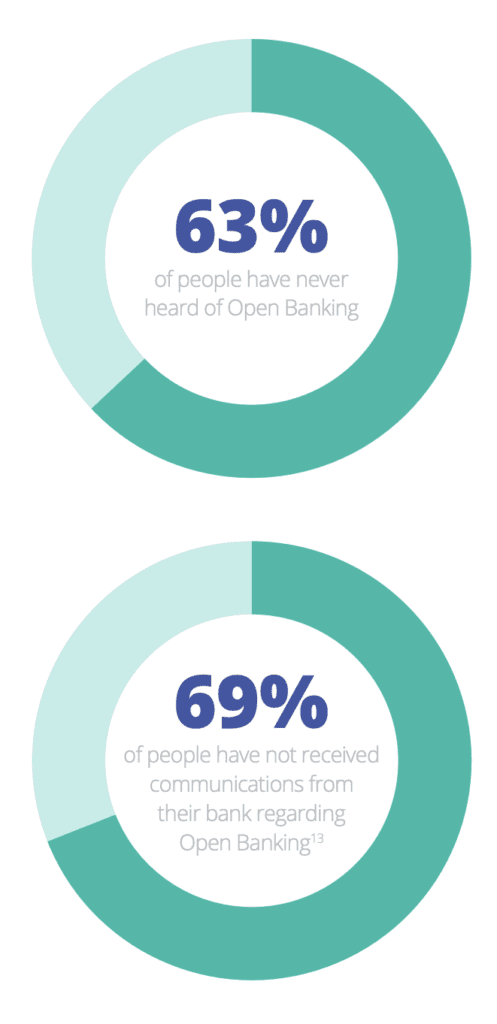

In May 2021, Zopa carried out a study to analyze the reasoning behind consumer choices not to use Open Banking. The study showed that of the 37% that had heard of Open Banking, 30% stated they were concerned about data privacy and vulnerability to fraud. 26% were unwilling to open financial records out to companies.

The Finance Innovation Lab (FIL), a charity centered on developing the global finance sector, stated that “People will only benefit from the power of their financial data if they are supported to turn it into insights that they can act on in their best interests.”

“This is a fundamental challenge given that the finance sector (including banks, fintechs, and other firms) is primarily motivated to pursue commercial gains.”

On consenting to the use of data, in many cases, users are unaware of which specific data multiple entities will be able to access.

With the use of computing and AI, without proper regulation, companies could have access to enough data to “Fine-tune prices to the highest customers will accept, cherry-pick the best customers (often the wealthiest), and target adverts for inappropriate products (such as high-cost credit) to people at their most vulnerable,” as warned by the FIL.

Issues with digital literacy also pose problems to citizens, given that a lack of understanding of the internet and computers restricts access to tools such as the Pensions Dashboard.

The Centre for Data Ethics and Innovation (CDEI), a subsector of the DCMS, has focused efforts to research issues regarding data use and trust.

Their work includes investigating the role of AI and Privacy Enhancing Technologies and the opportunity for the use of data intermediaries in enabling data sharing.

The investigation has made steps towards establishing guidelines for the ethical handling of data. Edwina Dunn, Interim chair of the CDEI, said, “The CDEI is working in partnership with a range of organizations to help them overcome barriers, mitigate risk and put high-level ethical principles – such as accountability and transparency — into practice.”

“It’s practical work like this will enable us to build greater public trust in how data and AI are used.”