Up until now the marketplace lending securitization space has been on a tear. We share PeerIQ’s detailed securitization reports every quarter and for over a year we have discussed record or near record issuance from the top lenders in the marketplace lending space. Deals have been getting larger and a few new companies have joined in the mix over the last several quarters. In Q4 2018, we saw a pretty stark reversal of this trend as PeerIQ released their most recent report.

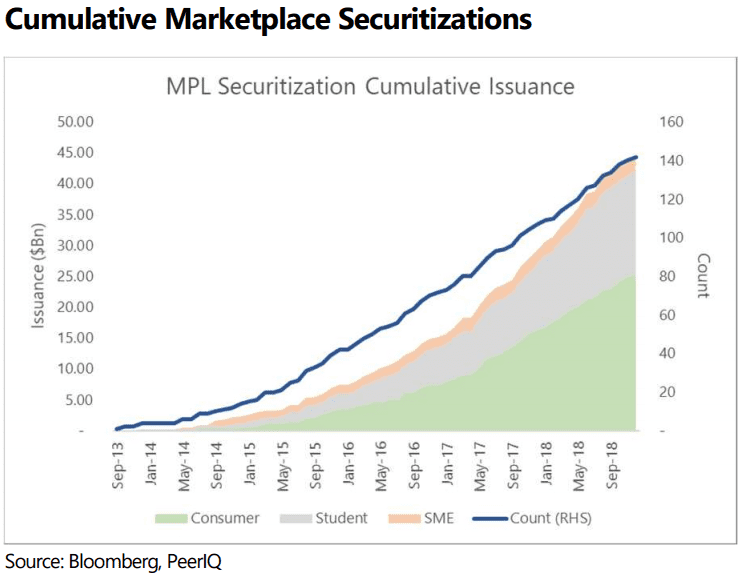

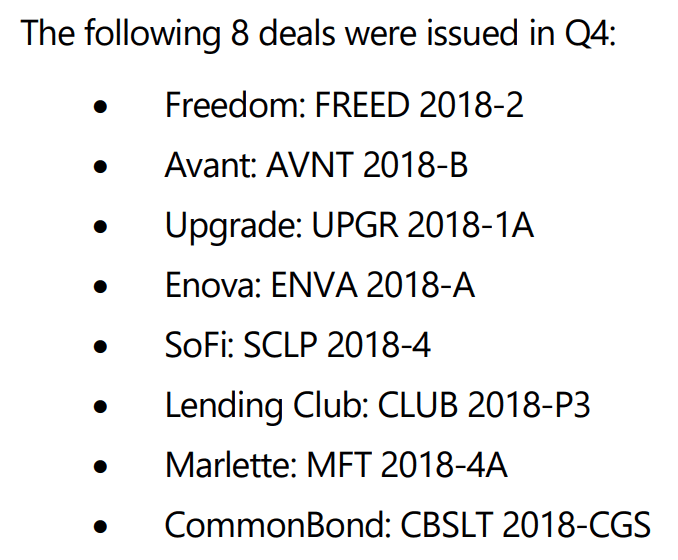

Issuance totaled $2.6 billion, which is the slowest pace of issuance in 5 quarters and was related to market volatility according to PeerIQ. Volume decreased 44% from the prior year period and dropped 25% quarter over quarter. Total issuance in 2018 was $15.3 billion and included newer issuers Upgrade and Enova. PeerIQ expects that Upgrade and Enova will continue to participate in the securitization market going forward. While Q4 represented a drop in deals, cumulative issuance still stands at $44.5 billion across 142 deals which is a significant amount.

Another reversal from the previous quarter were that spreads widened and yields increased on new issuances. Below PeerIQ shares the deals issued in the quarter.

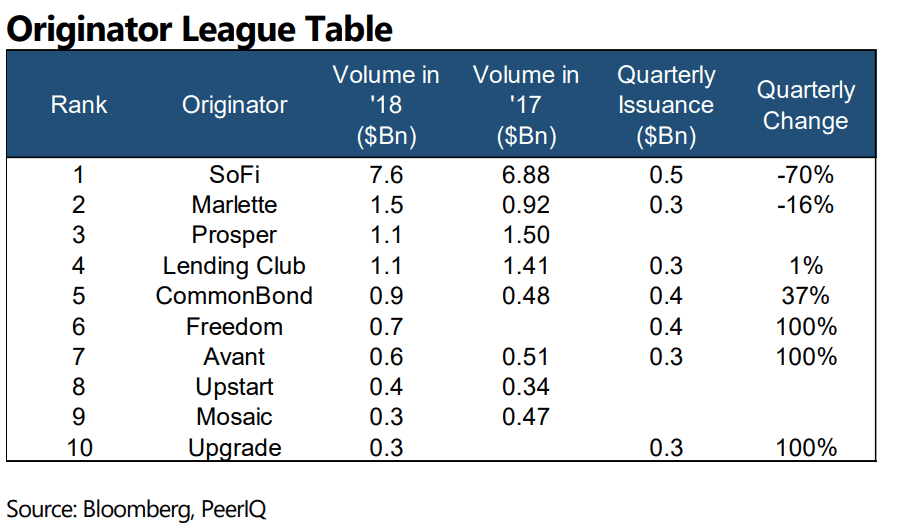

SoFi continues to lead in total origination volume over the past 2 years. Many familiar names in the marketplace lending space round out the top 10 list. We should also point out that LendingClub sold more than $1 billion in CLUB certficates in 2018 which likely reduced their securitization volume in 2018.

Beyond tracking the actual deals getting issued, the ratings agencies involved and the lead-managers, PeerIQ also provides their macro view of the economy. There are many moving pieces with the economy growing, inflation rising and the fed increasing rates. However, while the economic indicators are positive PeerIQ noted that the capital markets shared a different story in 2018 as we saw the stock market decline in late 2018. The US yield curve also inverted which in the past has predicted recessions despite the actual timing not being precise. If you want to learn more about PeerIQ’s unique perspective on the securitization space as well as their economic outlook you can download their recent report on their website for free.