The reality is that most fintech companies today in the US are private. We often learn of key milestones through press releases, but we often don’t get full transparency into what is happening in the business. This is why we’ve always taken great interest in the publicly traded online lenders. Today, OnDeck, GreenSky and Lending Club all reported their Q2 2018 earnings. Below we share the highlights of each from our perspective.

GreenSky

GreenSky went public just a few months ago on May 24, 2018. Their IPO was significant for a couple of reasons. One was the lack of US based fintech IPOs over the last few years and the second was that GreenSky is a wildly successful business. Last year they reported $139 million in net income on revenues of $326 million.

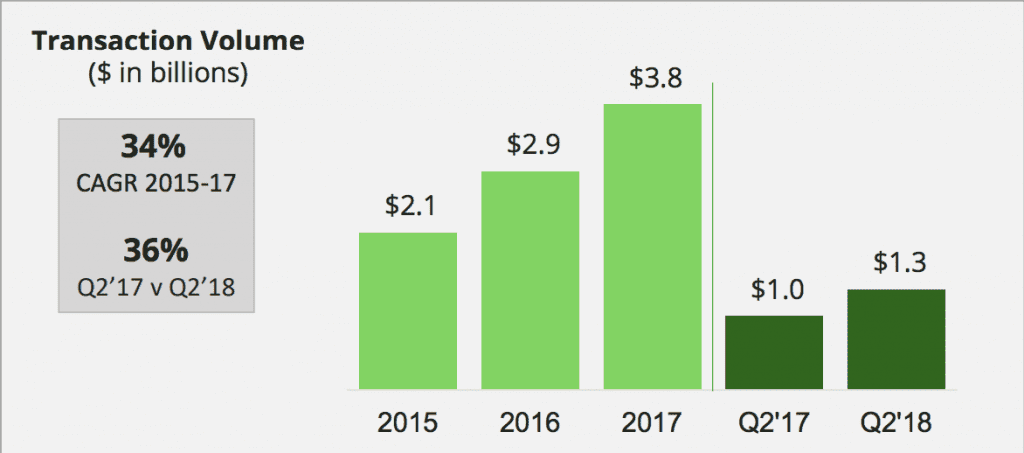

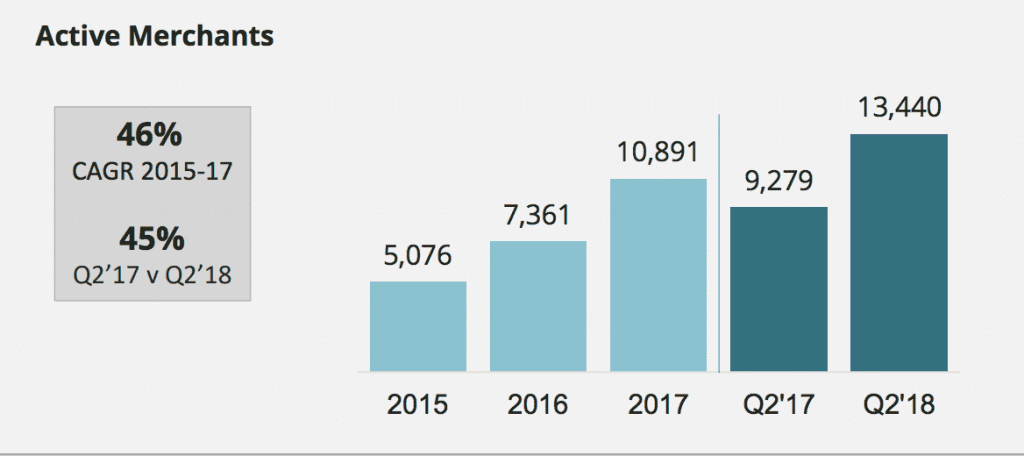

In the second quarter of 2018, the company grew revenue 28.3% to $105.7 million quarter over quarter and adjusted EBITDA was $52.1 million. In the prepared statement as part of the press release, CEO David Zalik noted that crossing $100 million in revenue and $50 million in adjusted EBITDA were milestones for the company. The company also increased transaction volume by 36% with the increase of home improvement merchants and elective health care providers utilizing the platform. Pro forma net income for the quarter was $33.5 million and the company ended the quarter with $236.6 million in cash.

Also of significance was a strategic partnership that was announced yesterday with American Express. This will further Greensky’s reach by accessing merchants who accept American Express. Under the partnership, customers will have access to point of sale loans for large purchases. What’s also interesting is the two companies are piloting a direct-to-consumer installment loan offering to some American Express Card Members. This will be first focused on the home improvement space in select markets, but if this pilot goes well it wouldn’t be surprising to see this partnership being the first example of a fintech and credit card company teaming up to tackle the broader personal loan category.

OnDeck

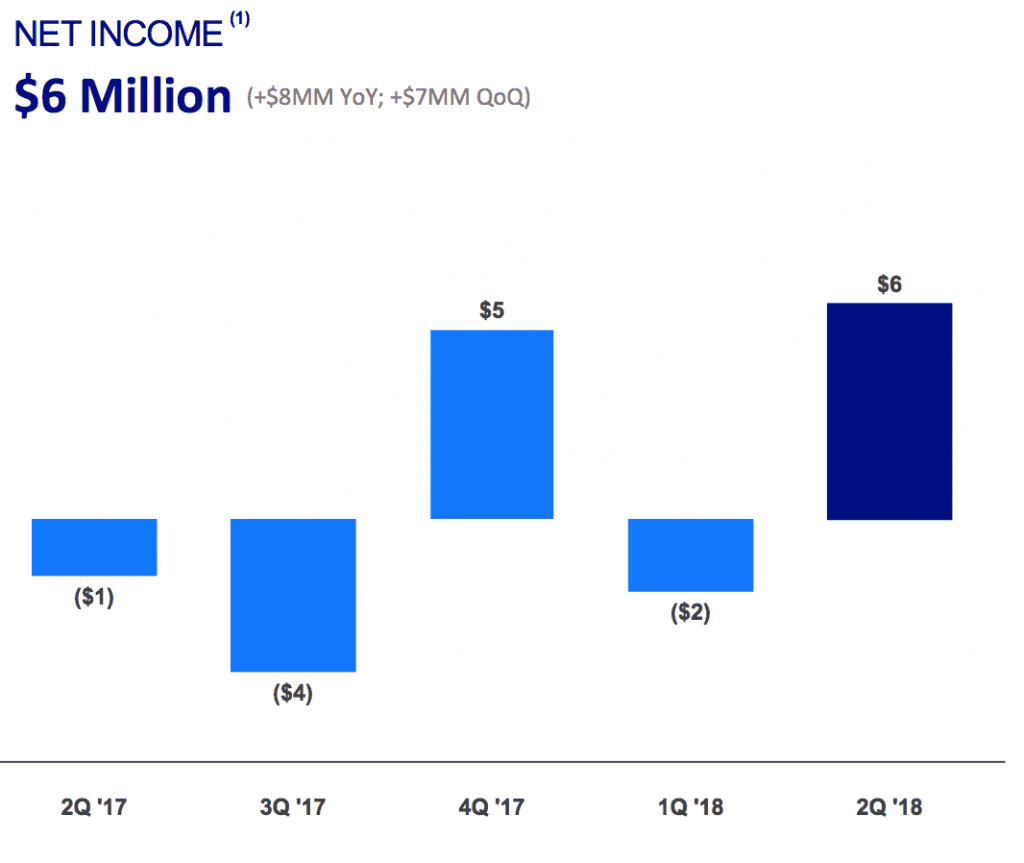

OnDeck reported net income of $5.8 million for the quarter with gross revenues of $95.6 million, up 10% year over and 6% from the previous quarter. Originations grew to $587 million, up 26% from the prior year period, but down slightly from the previous quarter. The company’s trend of increasing the number of loans funded and decreasing the average loan size continues.

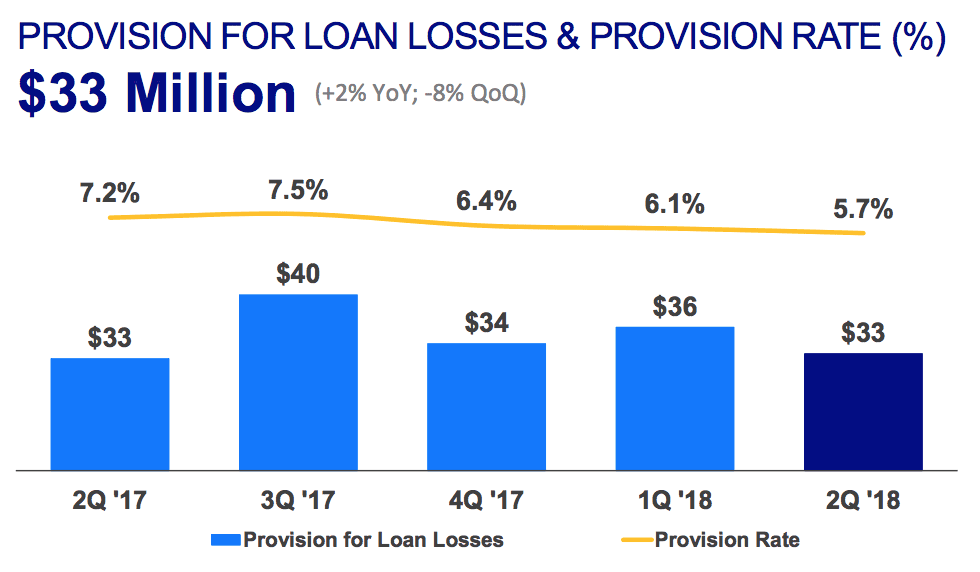

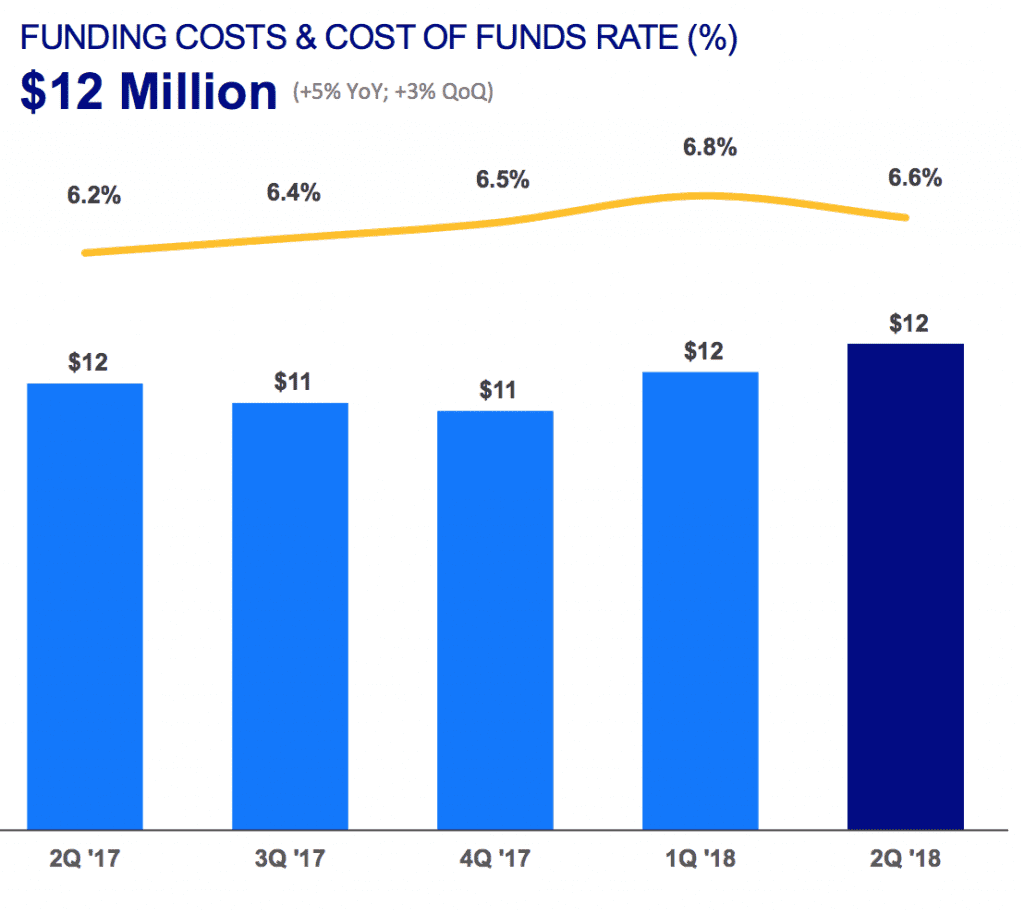

There were three contributing factors to OnDeck’s successful quarter: higher interest income, lower provision rate for credit losses and lower cost of funds rate.

Beyond posting their most profitable quarter ever, Noah Breslow hinted again at another bank partnership to be announced later in the year. OnDeck also raised guidance for 2018:

- Gross revenue between $380 million and $386 million, up from between $372 million and $382 million,

- Net income between $10 million and $16 million, up from between $0 and $10 million

- Adjusted Net income between $30 million and $36 million, up from between $18 million and $28 million.

OnDeck’s stock price ended the day up about 24%.

LendingClub

CEO Scott Sanborn noted that LendingClub’s core business is firing on all cylinders with record revenue and originations. The company has seen a 50% increase in applications year over year. Originations were $2.8 billion, up 31% year over year and up from $2.3 billion in the previous quarter. For context, the company originated their last high water mark of $2.75 billion in the first quarter of 2016. Revenues came in at $177 million, up 27% year over year.

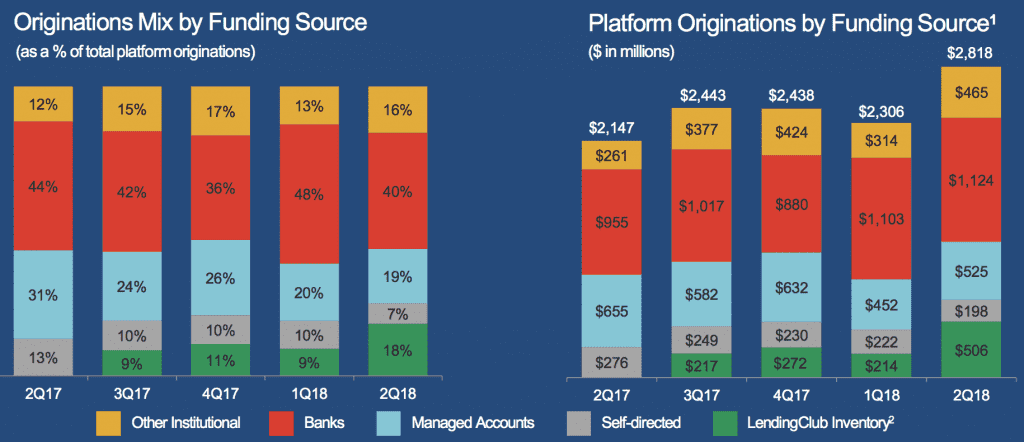

It’s always interesting to look at funding sources over time. The biggest change for the quarter was the significant increase of LendingClub inventory. LendingClub leverages their cash and credit facilities in order to accumulate loans which will be purchased in future transactions. At the end of the second quarter LendingClub held $515.3 million in loans for sale. LendingClub’s CLUB Certificates program announced in late 2017 has brought in around $500 million of funding from asset managers.

While revenues and originations increased, the company reported a GAAP net loss of $(60.8) million, an increase of $35.4 million from the prior year period and $29.6 million from the prior quarter. The company noted that this was primarily due to a $35.6 million of goodwill impairment related to the company’s patient and education finance unit. This business was purchased when growth expectations and valuations were much different. It will be interesting to see what ends up happening to this piece of LendingClub’s business as they evaluate the path forward.

Sanborn also spoke about other successes of the business in their direct pay product, the decreased time for customers to get a loan by 40% over the last year and that a quarter of customers are coming back for another loan. He also alluded to exploring like minded partners to offer additional services. This will allow the company to bring in additional revenue with low to no acquisition costs.

Sanborn reiterated that individual investors remain important for the company and it sounds like there will be a new offering in 2019 with their Exchange Traded Partnership (ETP) program that was first shared at their investor day. The structure that Scott Sanborn alluded to would allow for more liquidity as well as simplicity for the individual investor.

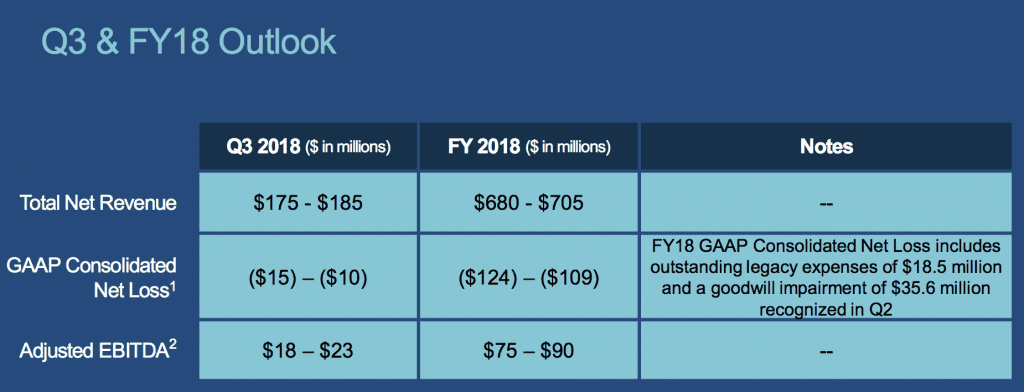

Finally, LendingClub provided the below Q3 full year results: