We have had quite a month of news here in the P2P lending industry. But now I want to return to a regular feature on the blog, something that I have been doing since 2011: sharing my quarterly returns.

I like sharing the details of my investment returns because I believe in transparency and I know returns are what motivates many, if not most, investors. I started out with just Lending Club and Prosper but slowly have added new investments over the years all focused on the lending space. I included a relatively new account this quarter, P2Binvestor, they are an asset-backed small business lending platform open to accredited investors – you can read my original review here.

I have a total of 11 accounts now, most are with Lending Club or Prosper and I will be adding new accounts to this list over the coming year as I am adding new money into a couple of different real estate platforms. I have a relatively large exposure to unsecured consumer credit, small business loans through Direct Lending Investments and now I want to diversify a little more into real estate. More on this later in the year. Now, let’s get right to the numbers.

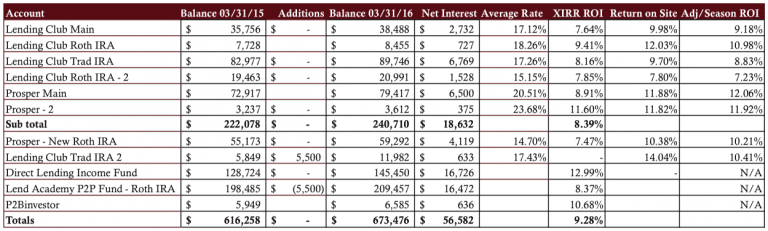

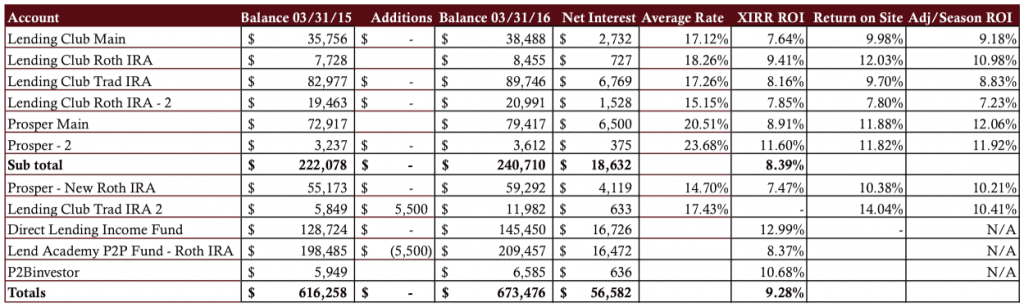

Overall P2P Lending Return Now at 9.28%

The downward decline in my returns continues. Almost all my Lending Club and Prosper accounts are now at least five years old and at this level of maturity my initial investment has long since been repaid and in some cases I am cycling through my original principal for the second or third time.

This past quarter saw another decrease in my overall trailing twelve-month (TTM) return from 9.85% to 9.28%. Just a year ago my TTM return was over 11% but as Lending Club and Prosper decreased interest rates for borrowers and defaults also increased a little my return has been hit. Now, the platforms have been increasing interest rates over the past several months but that will take a while before it is reflected in my returns here. My six core holdings, those that have been opened the longest, also continued their decline to come in at a TTM return of 8.39%.

Now on to the details. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The six older accounts have been separated out to provide a level of continuity with my previous updates.

- I do not take into account the impact of taxes.

In the past I have gone through each of my accounts in this table individually but in the interests of brevity with this post I am going to group all the Lending Club and Prosper investments together.

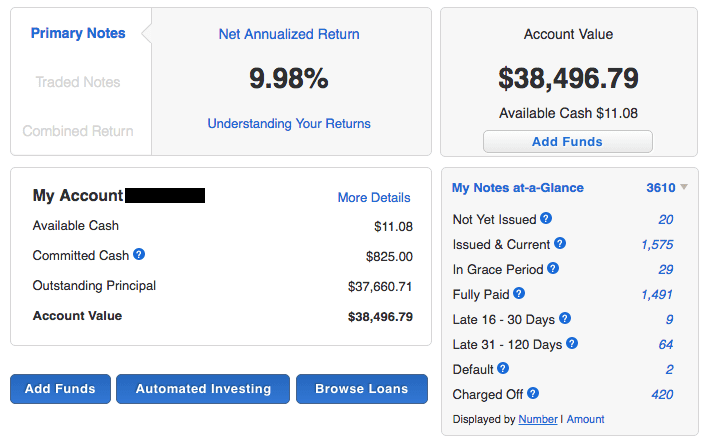

Lending Club

I have a total of five Lending Club accounts dating back to my very first account that I opened in June 2009 – the above screenshot is of that account taken at the end of last quarter. My original account was a taxable account and soon after opening this account I realized the tax benefits of holding these investments in a retirement account. So, I opened both a Traditional and Roth IRA in my wife’s name and now I have both types of IRAs in my own name. I try to invest in different notes across all five accounts using mutually exclusive filters. For those wondering how I feel about these Lending Club accounts given the recent news you should check out my post from last week.

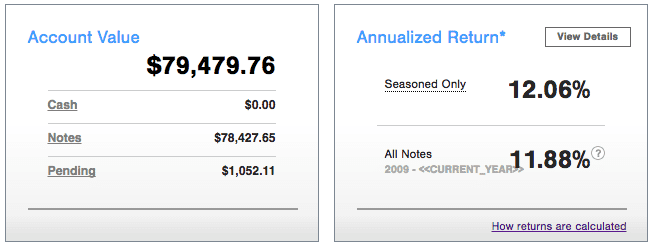

Prosper

When I first opened my Prosper account back in 2010 they didn’t have an IRA option. So, the first couple of years I focused all my Prosper investing in taxable accounts. Historically, Prosper charged higher interest rates than Lending Club and had a higher risk mix of loans so my average interest rate has been higher there. Today, the platforms are more in line and the average rates are within one percentage point of each other. My newest Prosper account, my Roth IRA is focused on lower risk loans as I seek to diversify beyond the high risk segment.

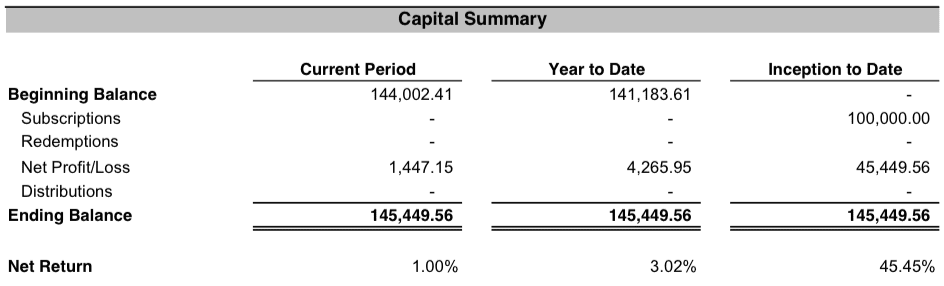

Direct Lending Income Fund

This fund managed by Direct Lending Investments is now three years old and continues to be my best performing investment. It invests in high yield, short-term small business loans across multiple lending platforms and has consistently returned in the 12% – 14% range for me. I am very pleased with the work Brendan Ross and his team is doing as they continue to provide high yield even as the fund has grown tremendously in size – to around $575 million in AUM today.

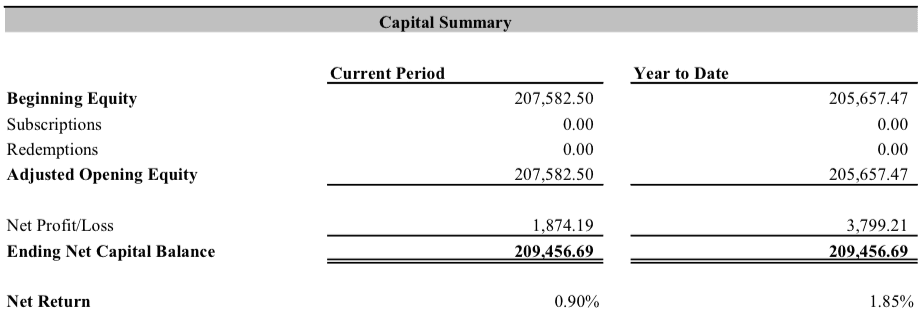

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by the team at our sister company NSR Invest, invests in Lending Club, Prosper and Funding Circle loans and has a small position in Upstart as well. While I have been very happy with the way the fund has performed, when Lending Club and Prosper raise interest rates, as they have done several times recently, it impacts the NAV of the fund. Bo Brustkern explained it best in my last quarterly update:

The Lend Academy fund’s NAV reflected the change in rates at Lending Club and Prosper when each of these origination platforms raised rates, in the month it occurred. That means an immediate price adjustment is recognized, which is very different from what happens for a fund using the typical Loan Loss Reserve methodology, which nearly all other funds in our industry are using. Funds that use Fair Value are attempting to deliver a more accurate NAV, which naturally means a more “fair” NAV for investors entering and exiting a fund.

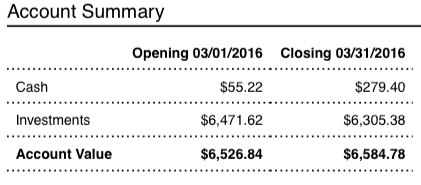

P2Binvestor

My new entrant this issue is P2Binvestor, an asset-backed working capital platform for small businesses based in Denver, Colorado. Full disclosure, I am on the advisory board of this company and have known the founders since before they began operations. I am including them here now because they have built a decent track record and I believe they provide another nice diversification for accredited investors. These are short-term loans, backed by accounts receivable, with 30-60 day liquidity.

Final Thoughts

As I said in my last update I think the new normal for returns is in the 8-10% range. While I would like my returns to be higher I am not reducing my holdings by any means. I still feel that investors are rewarded well for the risks we are taking.

Speaking of risk, I have always tended to focus my investments in the higher risk segments of the platforms. These have historically been the best performing loans at both Lending Club and Prosper. But that could be changing. If and when the next recession hits the best returns may well come from the lower to medium risk loans. So, I have been slowly moving my investments into slightly more conservative loan grades.

I always like to highlight my Net Interest earned number. This quarter it is $56,582 for the previous 12 months. This is actually down slightly from my Q4 2015 update as I suffered slightly more defaults this quarter and did not add to any positions. I expect this will rebound nicely in Q2.

If you have any questions or comments I am happy to discuss in the comments section below.