Time for my regular quarterly returns post, one of the most popular features here on Lend Academy. I have been sharing my detailed quarterly returns with readers since 2011 and I will continue to do so for the foreseeable future. I know investors are most interested in returns, in particular how they have been trending over time. You can go back and look at the breakdown of my investments every quarter for the past six years.

If you do look at my historic returns you will see they have been moving steadily in a downward trajectory since the beginning of 2014 when my trailing twelve month (TTM) return was 12.44%. I look back on those returns wistfully now, when my accounts were firing on all cylinders and in reality we were being overly rewarded for the risk we were taking. Today, the pendulum has swung too far the other way and I think the return is too low for the risk.

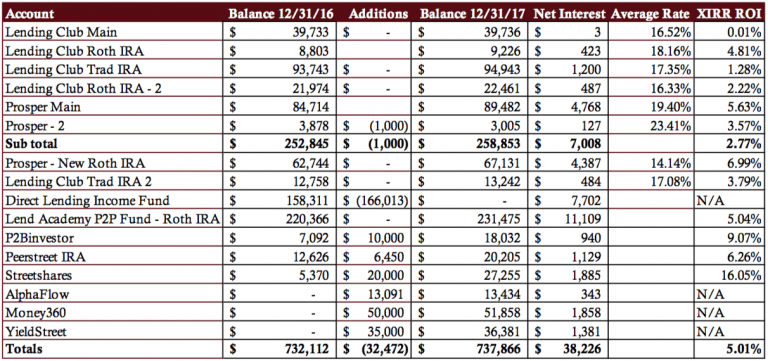

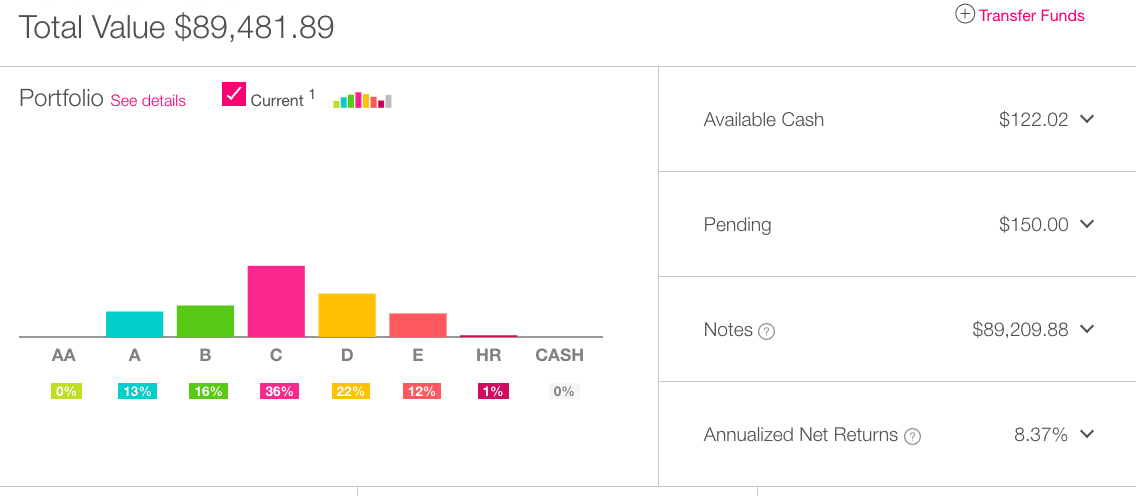

Overall Marketplace Lending Return at 5.01%

The long decline in my returns has continued with 2017 by far my worst year since I began investing with LendingClub back in 2009. My overall TTM return in Q4 2017 was 5.01% compared to 6.64% in Q3 2017 and 8.07% one year ago.

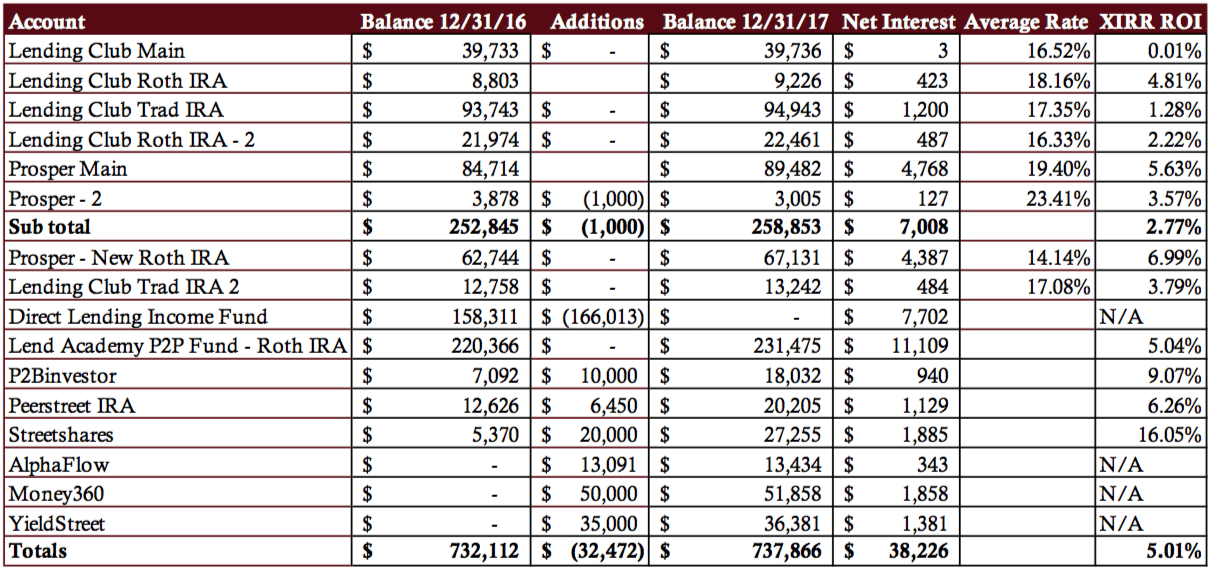

I used to proudly say I had never had a down month in my LendingClub or Prosper investments. Now, I have not just had down months but down quarters as well. And I came perilously close to having a down year in my main LendingClub with my return coming in at 0.01%.

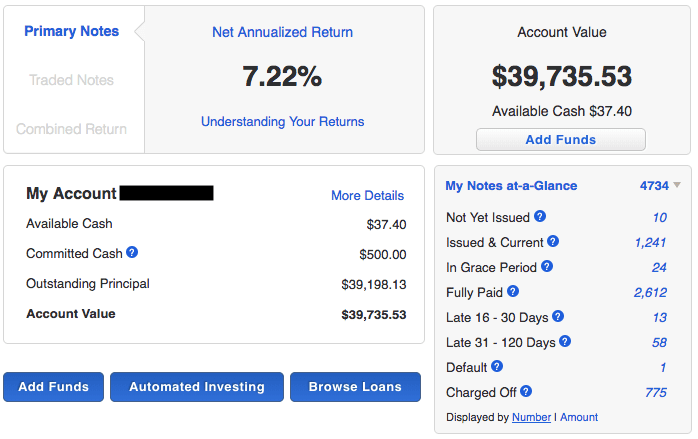

The reality is that I had been far too weighted in the highest risk loans. For many years these D, E, F and G grade loans were the best performing loans and I had no reason to believe that would not continue. So, I eschewed the low risk, lower return loans and concentrated my entire portfolio in these higher risk segments. But since the 2015 it has been the A and B grade loans that have performed best at LendingClub. While Prosper’s returns have also declined from their peak as you can see in the table below they are holding up relatively well.

Now on to the details. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way for individual investors to determine their actual return.

- The six older accounts have been separated out to provide a level of continuity with my earlier updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

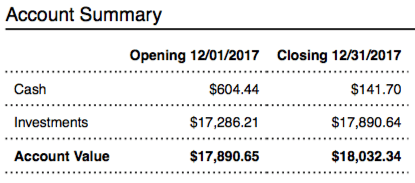

LendingClub

Above is a screenshot of my very first Lending Club account that I opened in June 2009. This is the account that made just $3 in 2017, a 0.01% return. All my LendingClub accounts are suffering from reduced returns due to the challenges with the 2015 and 2016 vintages there. I hold out hope that the much vaunted new credit model (read more about that here) that was put in place in September 2017 is an improvement on what was in place in 2015 and 2016. Regardless, though, I have learned my lesson. I am primarily investing in Grades A, B and C today with just a sprinkling of the higher grade loans. Given past experience I think that is a more prudent approach.

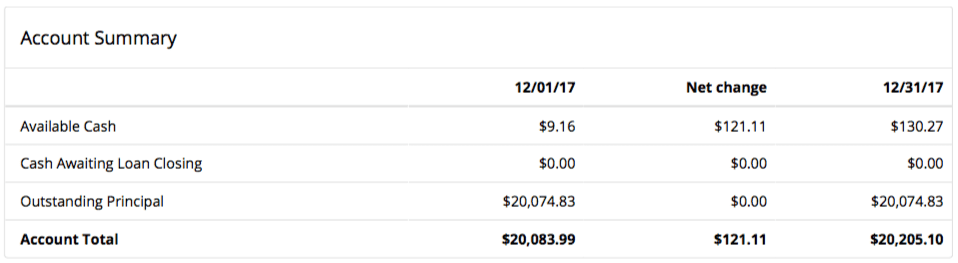

Prosper

My main Prosper taxable account has had $50,000 of investments starting in 2010 and continuing until 2013. Since then I have just been reinvesting all earnings. While my accounts at Prosper have not had the same performance issues as LendingClub I am still down considerably from where I was a year ago. It is interesting that the one account where I have taken a balanced approach since day one, my Prosper New Roth IRA account is performing the best. This account was opened about four years ago and is managed by Lend Academy sister company NSR Invest using their balanced strategy. I used to question my approach here as every quarter this was a drag on my returns but now it is far and away my best performing account at either LendingClub or Prosper and it also happens to have the lowest average rate for the underlying loans.

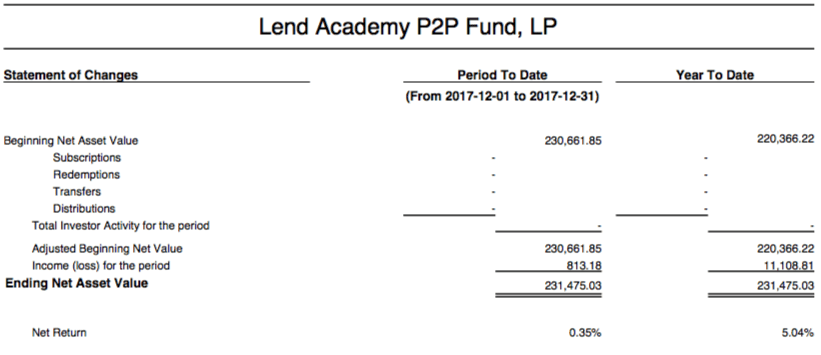

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by NSR Invest, invests in LendingClub, Prosper and Funding Circle loans and has a small position in Upstart as well. Given where my self-managed accounts are at I am not displeased with the returns here. While 5.04% is down considerably from where the fund has been it is still significantly better than the 2.77% I received at my six original marketplace lending accounts.

P2Binvestor

One of the great things about asset-backed small business lender P2Binvestor is that your money is liquid. These are short-term loans, backed by accounts receivable, with 30-60 day liquidity. This has been a consistently good performer always returning in the 8-10% range. I would put more capital to work here but with few new deals coming on the platform it takes too long to deploy capital today. Hopefully, that will change soon. I really like their new bank partnership product and I am invested in a few of these loans now (full disclosure: I am on the advisory board of this Denver-based company).

PeerStreet

My first real foray into marketplace lending for real estate is PeerStreet. They are a real estate platform focused on short term loans of 6 months – 2 years duration. These are primarily residential fix and flip properties where a developer intends to renovate and then resell the property in a short amount of time. One of best things about Peerstreet from an investor perspective is that they have a $1,000 minimum investment per loan, whereas most real estate platforms have a $5,000 minimum. All these loans are secured by property which is the main reason I have been moving more money into this asset class.

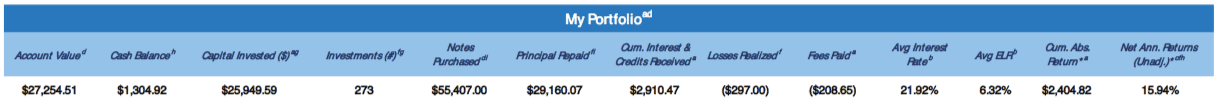

Streetshares

Since I was redeemed from the DLI Fund in June last year small business lender StreetShares has been my best performing investment. It is now the only investment I have still solidly showing a double digit return. I invest across the risk spectrum at StreetShares with $100-$150 per loan and I have created a portfolio now of almost 300 small business loans. Their new contract financing product, which is a factoring type product aimed at government contractors, is the best risk reward investment available in the market today in my opinion. You are investing in invoices backed by the US government and being paid 1% per month in interest.

AlphaFlow

Real estate platform AlphaFlow was part of a group of new investments I made when I liquidated my investment in the DLI Fund. What I like about AlphaFlow is that you can quickly build a diversified portfolio of 75-100 properties. They do everything for you deploying your capital in deals across multiple platforms. This way you are using their expertise to screen the very best properties and even with a small investment you are still well diversified.

Money360

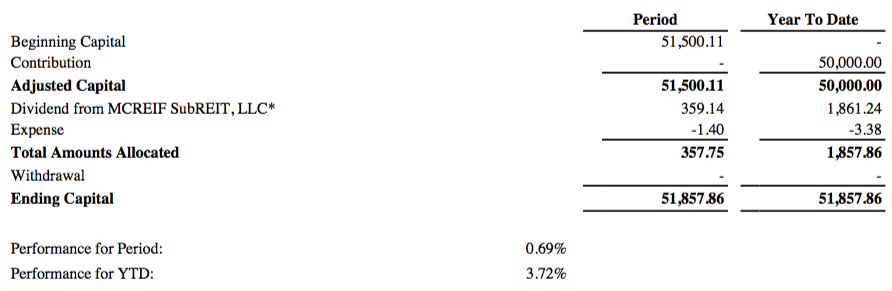

When it comes to commercial property I had virtually no exposure until I invested in the Money360 fund, M360 CRE Income Fund LP, six months ago. The fund invests primarily in bridge loans in the $1 million to $20 million range for commercial properties. The fund is managed by M360 Advisors, LLC, the wholly owned investment management company which is part of Money360. I expect this fund to be a consistent performer in the mid to high single digits.

YieldStreet

My other recent addition is YieldStreet. They are an interesting platform that provides investments in a range of asset-backed investment products. They offer real estate loans, secured business loans and litigation finance. I have exposure to the first two assets classes elsewhere but I had never invested in litigation finance until making this investment with Yieldstreet. I have invested in their “Diversified Pre-Settlement Portfolio XXIII” which is a portfolio of plaintiff advances related to 365 different personal injury cases. These advances are intended to help individuals pay for essential life expenses while they await the resolution of their personal injury lawsuits. This is a unique investment in my portfolio in that whenever payments of principal and interest are made on these loans they are deposited directly to my bank account, there is no way to reinvest these proceeds as of today.

Final Thoughts

I continue to be disappointed in my LendingClub and, to a lesser extent, Prosper returns. The fact that today I can buy a 10-year Treasury Note for close to 3% and some 5-year CDs are approaching that number means I need to be earning way more than 3% in my marketplace lending investments. The 2.77% return I received in 2017 is not acceptable to me. While I certainly made mistakes with a lack of diversification, which I have corrected, I need these returns to start rebounding. By the end of 2018 the fifth generation credit model at LendingClub will have had a chance to make a difference in my own portfolio and I expect significantly better returns as a result of this.

As interest rates continue to rise we need to demand higher returns for our unsecured loan investments. By this time next year we could easily be looking at 4% 10-year Treasury Notes which means we will all need to adjust our return expectation higher.

Finally, I will highlight my Net Interest number. This is the money that my portfolio actually earned in the past year. Due to my lower returns this number is the lowest it has been in several years: $38,226.

As always feel free to share your thoughts in the comments below.