Regular readers know that this is one the most popular features on Lend Academy. I have been sharing my detailed quarterly returns with readers since 2011 and I will continue to do so for the foreseeable future. I know investors are most interested in returns, in particular how they have been trending over time. You can go back and look at the breakdown of my investments every quarter for the past five years.

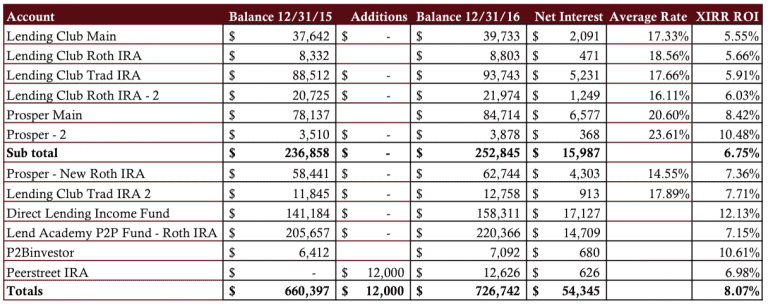

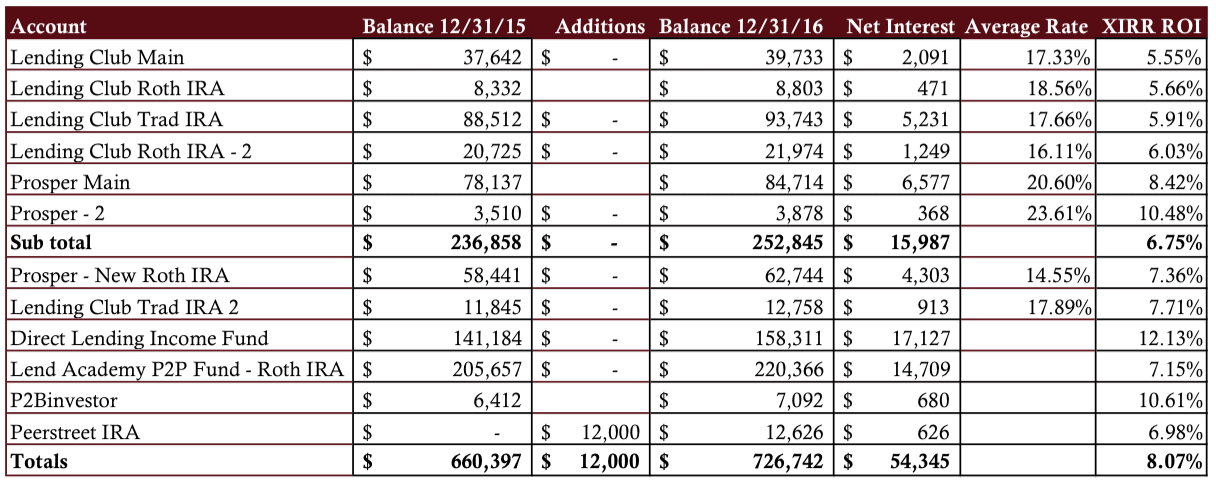

Overall P2P Lending Return at 8.07%

The good news, if there was any this past quarter, is that my declining returns have stabilized somewhat. My overall trailing twelve month (TTM) return in Q4 2016 was 8.07% compared to 8.21% in Q3 2016. I am taking this as good news because in every quarter for the previous one and a half years my returns had dropped 0.5% or more. Comparing the year ago quarter the picture is still not pretty – my TTM return in Q4 2015 was 9.85% so I am down almost 2% since then.

I have been thinking for some time that my returns have just about reached bottom but now I am not so sure. The reality is that Q4 was the worst quarter I have ever had if you look at it in isolation. Just taking a look at my six mature Lending Club and Prosper accounts the TTM return for those accounts was 6.75%, but the annualized return just for Q4 was just 5.3%. And if you look at my main Lending Club account that was opened in 2009 the numbers were even worse – the annualized Q4 return on that account was just 2.1%.

Overall my defaults in Q4 were the highest they have ever been. Several of my Lending Club accounts had negative months where the charge-offs were more than the total interest earned. December seemed to be a little better and January was also decent so I am hoping the worst is behind us. We are all paying for the mistakes made by Lending Club and Prosper in 2015 as they clearly mispriced many of their loans, particularly those in the higher risk loan grades where my portfolio is focused. They have since increased interest rates and tightened underwriting considerably so we should see better results from 2016 and 2017 vintages. But the reality is I still have many loans in my portfolio from 2015 that are late and will eventually default.

If you are interested in more analysis of the Lending Club and Prosper loans issued in 2015 you should read this excellent analysis done by Ryan recently.

Now on to the details. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The six older accounts have been separated out to provide a level of continuity with my previous updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

Lending Club

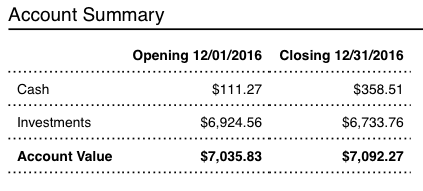

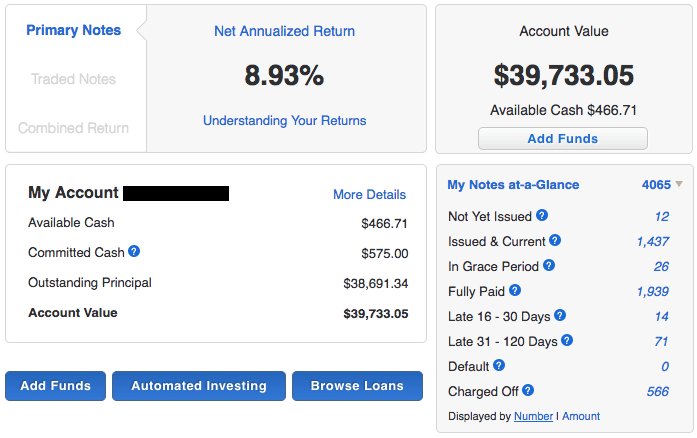

Above is a screenshot of my very first Lending Club account that I opened in June 2009. You can see my NAR is 8.93%, this is well above my TTM return of 5.55% because Lending Club takes into account all notes and does not look exclusively at the TTM. As I said above the reality is that for most investors returns have been decreasing for some time and Q4 was my worst quarter ever at Lending Club. It is interesting that across all of my mature Lending Club accounts (these accounts have all been open at least six years) my TTM return is in a tight range: 5.5% – 6%. I know other long time investors who are also seeing returns in this range. I would like to see this number improve in 2017. I feel that we should be aiming for returns in the 7-8% range particularly given the benign economic environment.

Prosper

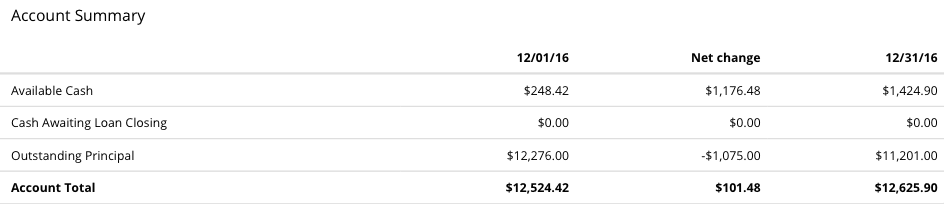

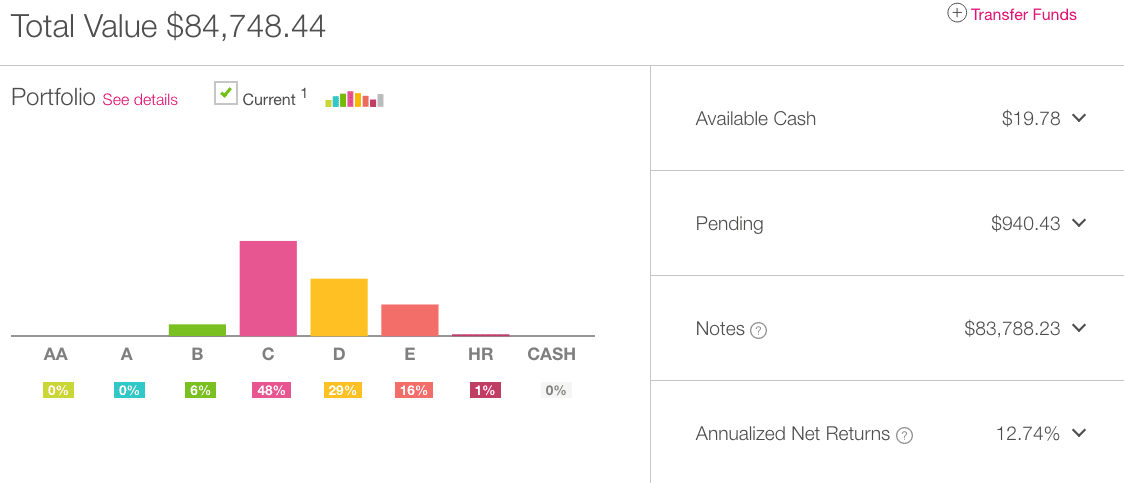

I started at Prosper a little after Lending Club, opening my first account there in September 2010. Over a two year period I invested $50,000 into this account and have added no new money for several years. Prosper has done better than Lending Club in recent months as far as performance goes in my accounts. Looking at my average interest rate of 20.6% these are actually riskier borrowers than at Lending Club but they have held up reasonably well with a return of 8.42%. It is interesting to look at my more conservative Prosper account, my Roth IRA, that I opened about three years ago. Returns there have been remarkably consistent in 2016. They have hovered between 7.2% and 7.5% all year. The increased defaults have been primarily in the higher risk loans.

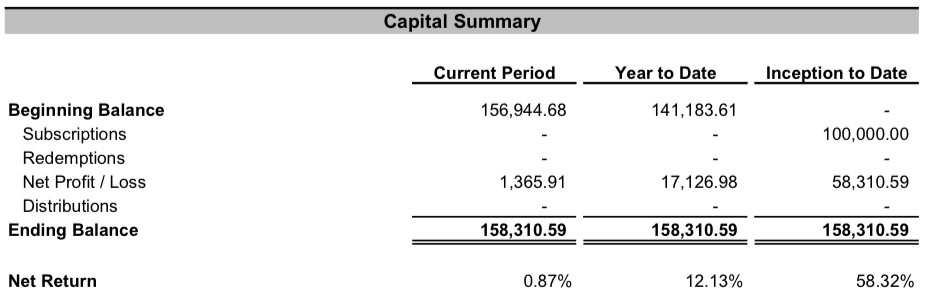

Direct Lending Income Fund

The Direct Lending Investments fund is, as always, my best performing investment. Brendan Ross and his team there have done a remarkable job in growing this fund into a behemoth that will likely cross $1 billion in assets some time this year. The focus of the fund has changed over time – it used to invest in high yield, short-term small business loans across multiple lending platforms but now it provides funding lines for a variety of consumer, small business and real estate lenders. While returns have gone down a little over the years they are still very solidly in double digits.

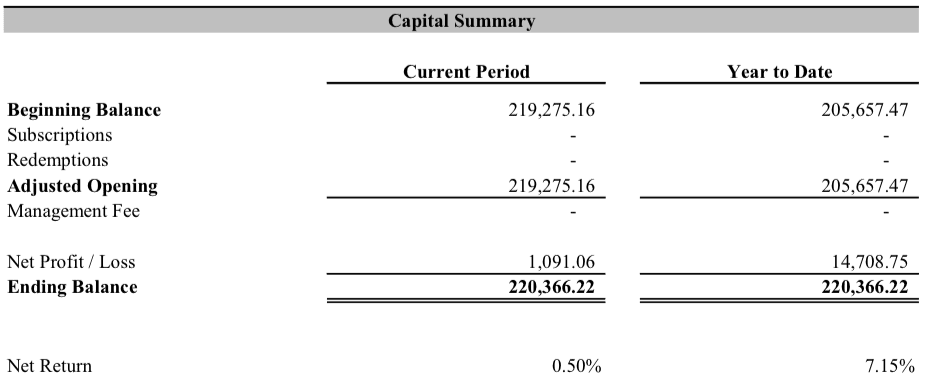

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by the team at our sister company NSR Invest, invests in Lending Club, Prosper and Funding Circle loans and has a small position in Upstart as well. Given the state of the industry in 2016 I am quite pleased with the returns here. While not hitting it out of the park it has performed far better than many other similar funds and a 7.15% return is better than I managed on my own Lending Club and Prosper accounts.

P2Binvestor

One of the great things about asset-backed small business lender P2Binvestor is that your money is liquid. These are short-term loans, backed by accounts receivable, with 30-60 day liquidity. I have never lost any principal to defaults, although one account is delinquent today, and with returns over 10% I am very happy (full disclosure: I am on the advisory board of this Denver based company). My only complaint is that they need to add more deals – it has become more difficult to deploy capital in recent weeks.

PeerStreet

As time goes on I am liking real estate more and more. While it is not easy to get double digit returns here I like the fact that my investments are backed by an asset thereby helping to prevent principal loss. PeerStreet is a real estate platform focused on short term loans of 6 months – 2 years. I have only been investing since April and already I have had about half a dozen loans pay back in full. One of the many things I like about PeerStreet is that it has a $1,000 minimum investment per loan, whereas most real estate platforms have a $5,000 minimum. While investing in 12 properties is not fully diversified I feel like with real estate, given the principal protection it is not as risky as if this was an unsecured small business or consumer loan. My goal here is produce a 7-8% return and I am on target with that goal so far.

Final Thoughts

Aside from Lending Club and Prosper my other investments are only open to accredited investors. There is still a dearth of opportunity for non-accredited investors and I think that is a real shame. While some of the real estate platforms like Realty Mogul, Fundrise and Groundfloor have offerings as well as small business lender StreetShares, it is still difficult for non-accredited investors to access online lending investments.

Anyway, as for my returns this past quarter I am still not that happy overall. While 8% in the general scheme of things isn’t bad I would very much like to stop the downward decline in returns. I wouldn’t be surprised if I drop below 8% in Q1 but I expect that returns will start increasing again later this year. I don’t know if I will ever get back to an overall return of 10% again but I would be reasonably happy to stabilize my returns in the 8-9% range.

One of the lessons of 2016 is that the higher risk loans do not always return the most even in a benign credit environment. While I have some accounts investing in a more conservative way I think I need to expand my diversification here. We don’t know what is ahead economically and I think it is prudent, at least for me, to be diversified into a broader range of risk levels. So, I will be making some changes on this front in 2017.

Finally, I always highlight my Net Interest earned number. This is the number that reflects our actual gain in real dollars. As you can see in the above table this quarter it is $54,345 for the previous 12 months. This is up from the previous quarter but still down from a year ago when I was earning close to 10% on my money. I will be very interested to see if I can grow this number to a new record this year.

As always feel free to share your thoughts in the comments below.