Every quarter I take some time to share how my marketplace lending investments have been doing. I open the kimono and take you inside my Lending Club and Prosper accounts, as well as many other investments, to share my returns. I do this because I believe in transparency and I want people to see how returns can change over time. I have been sharing these returns for almost five years now.

My list of accounts keeps growing. You will see in the table below that I now have 12 accounts – eight Lending Club and Prosper accounts (I know it is a little excessive) and four other investments. The new kid on the block this quarter is PeerStreet – listen to my podcast with their CEO Brew Johnson from earlier this year. PeerStreet is a real estate platform primarily focused on fix and flip properties – so short term loans. I like the marketplace lending real estate vertical and will be moving more money into this sector in the coming months.

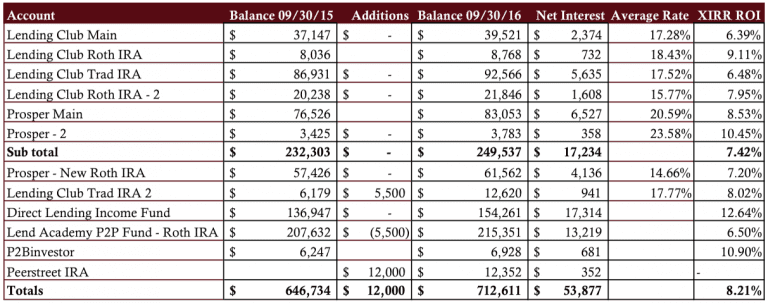

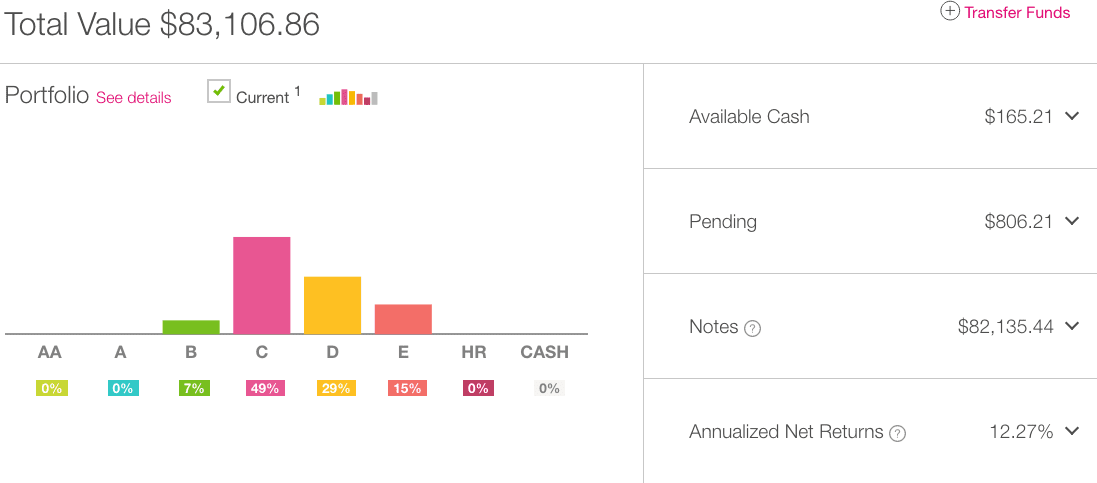

Now, let’s get right to the numbers.

Overall Marketplace Lending Return Now at 8.21%

I am beginning to wonder when the decline will stop. I thought it would have stabilized by now but in Q3 my overall returns saw another substantial decline. I think it is safe to say that Q3 was my worst quarter ever when it comes to defaults at Lending Club. I have been focused on the higher risk end of the spectrum and those loans with vintages in 2014 and particularly 2015 continue to perform worse than previous years. Both Lending Club and Prosper have increased interest rates several times this year as well as tightened their underwriting and that will help going forward. But because these are three and five year loans I am investing in I won’t be seeing the benefit in my returns here for quite some time.

This past quarter saw another decrease in my overall trailing twelve-month (TTM) return from 8.72% to 8.21%. It has now been six quarters in a row where my returns have declined by approximately 0.5%. Just two years ago my TTM return was at 11.28%. I have been hearing from many other investors who have been experiencing similar drops in returns so I know I am not alone. And in the scheme of things an 8% return is still very good but when you get used to double digit returns year after year it is somewhat of a disappointment. My six core holdings, those accounts that have been open at least five years, also continued their decline to come in at a TTM return of 7.42%, the lowest return I have ever had.

So, here are the details. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The six older accounts have been separated out to provide a level of continuity with my historical updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

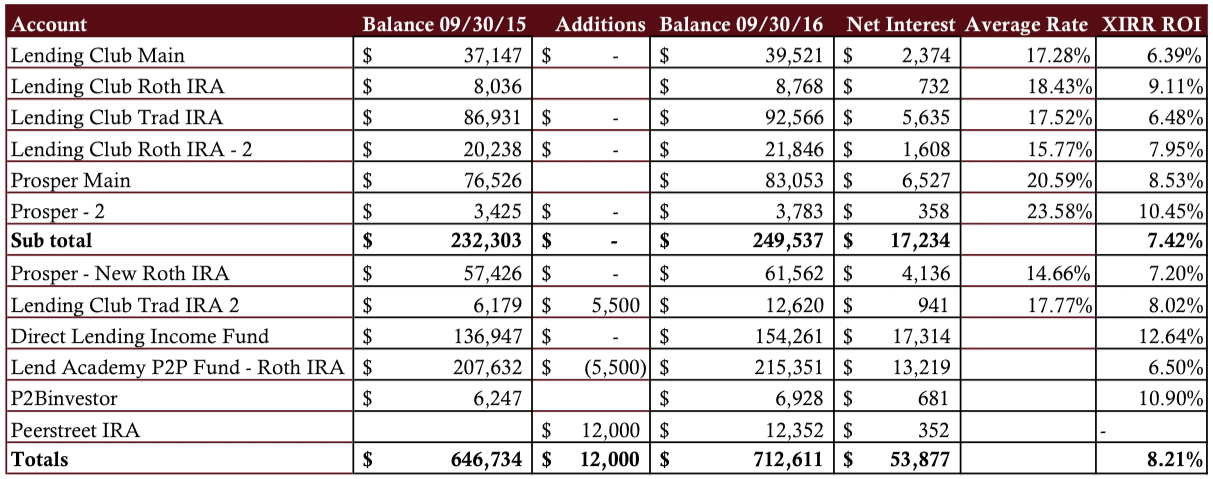

Lending Club

This was not a good quarter for all five of my Lending Club accounts. The above screenshot taken on October 1 is my main taxable account, that I opened in June 2009. What is interesting here is that the Lending Club Net Annualized Return number has dropped considerably this past quarter after being pretty steady for many quarters. In September I had the unusual situation of incurring more charge-offs than interest earned, so the total account value actually went down that month, only the second time that has happened. But the biggest disappointment for me this quarter was in my largest Lending Club account, my wife’s traditional IRA. The TTM return on this account dropped from 7.41% to 6.48% in this past quarter, down from 8.16% in Q1. This is a significant drop caused primarily by increased delinquencies in loans issued in 2015.

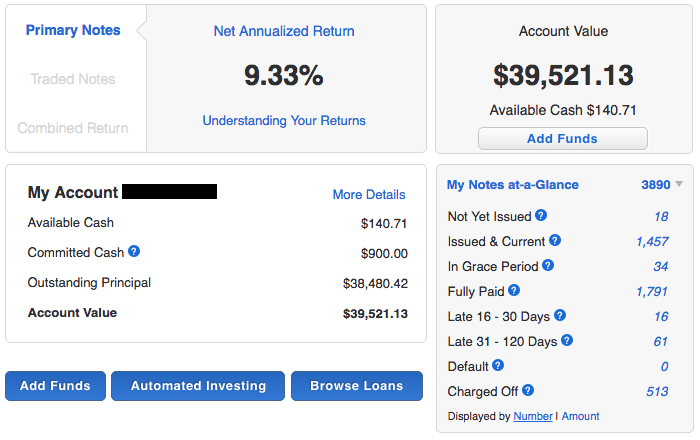

Prosper

My Prosper accounts have proven to be remarkably resilient compared to Lending Club. The reality is that my largest Prosper account, which has been open for six years, has maintained TTM returns of between 8.5% and 9% over the last three quarters. While there continues to be significant delinquencies their level has not been much higher lately than it has been in previous quarters. My newest Prosper account, my Roth IRA is focused on lower risk loans as I seek to diversify beyond the high risk segment which is where most of the increased defaults have been concentrated.

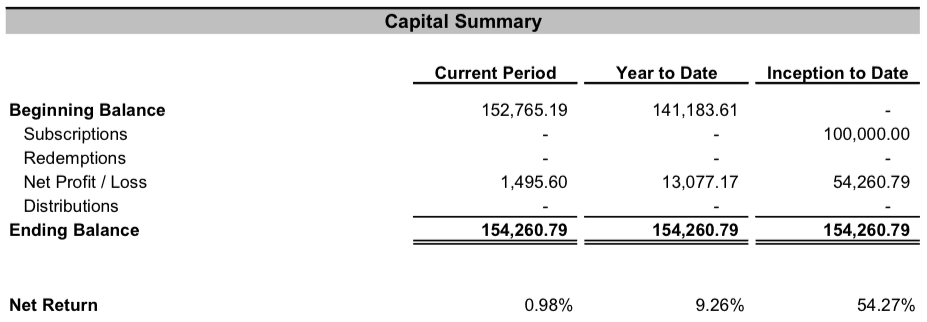

Direct Lending Income Fund

I invested in this fund, managed by Direct Lending Investments, back in April 2013 and every quarter since then it has been my best performing investment. The investment strategy has changed somewhat from investing only in short term small business loans to providing warehouse lines to a variety of platforms offering short term and high yield investments. You can learn about how the Direct Lending Income Fund works by listening to the recent podcast I recorded with Brendan a couple of months ago. The fund is now one of the largest in the marketplace lending space at almost $800 million in AUM.

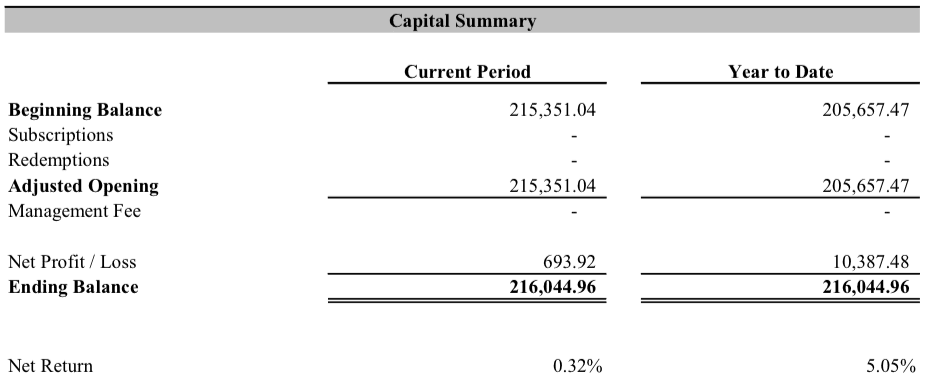

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by the team at our sister company NSR Invest, is my largest holding and it invests in Lending Club, Prosper and Funding Circle loans and has a small position in Upstart as well. One of the differences about investing in a fund like this one is that it creates a monthly NAV and this is impacted by changing interest rates as well as by defaults in the underlying loans. The CEO of NSR Invest, Bo Brustkern, explained how this works:

The Lend Academy fund’s NAV reflected the change in rates at Lending Club and Prosper when each of these origination platforms raised rates, in the month it occurred. That means an immediate price adjustment is recognized, which is very different from what happens for a fund using the typical Loan Loss Reserve methodology, which many other funds in our industry are using. Funds that use Fair Value are attempting to deliver a more accurate NAV, which naturally means a more “fair” NAV for investors entering and exiting a fund.

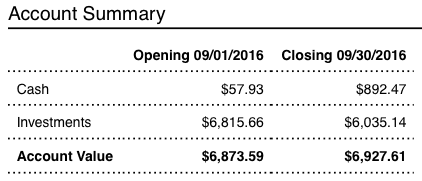

P2Binvestor

P2Binvestor is an asset-backed working capital platform for small businesses based in Denver, Colorado. Full disclosure, I am on the advisory board of this company and have known the founders since before they began operations. I am including them here now because they have built a decent track record and I believe they provide another nice diversification for accredited investors. These are revolving lines of credit, backed by accounts receivable, with 30-60 day liquidity.

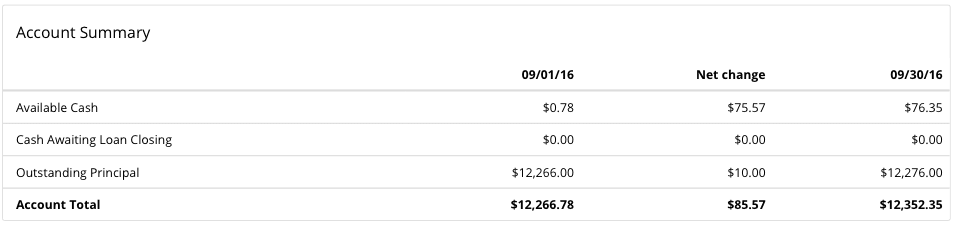

PeerStreet

My new entrant this issue is PeerStreet, a real estate platform focused on short term loans of 6 months – 2 years. These are all secured loans with an LTV below 75% so if the borrower cannot pay back the loan the property can be foreclosed and the proceeds returned to the investor after it is sold. The loans on Peerstreet pay typically between 7% and 9% to investors. So, the purpose of this investment is not so much to juice my returns but to bring some downside protection and provide some diversification into property.

Final Thoughts

While I am disappointed with my returns this quarter I am not making big changes. I still very much believe in Lending Club and Prosper and will continue to make reinvestments there. Although I will be changing strategy somewhat and will continue to slowly move to a more conservative loan mix. More on that in a future blog post.

I am also looking to diversify beyond unsecured consumer credit. Including the Lend Academy P2P Fund, which is primarily unsecured consumer, I have well over $500k invested in this asset class. As I said above I will be looking to slowly build up other asset classes. Going forward I will be investing new money mostly in real estate as well as small business loans with the long term goal of having a roughly equal amount in all three asset classes.

At the end of every quarterly update I like to highlight my Net Interest earned number. This quarter it is $53,877 for the previous 12 months. This number really brings home to me the impact of defaults. One year ago that number stood at $56,074 on a closing balance of $640,487. Today my balance is much higher but the income generated by my portfolio is more than $2,000 lower.

If you have any questions or comments I am happy to discuss in the comments section below.