The Quadrata team works fast: today, they launched their first major product, a low code Web3 passport for DeFi KYC, after they formed less than eight months ago in Aug. 2021.

With their simple solution, Fabrice Cheng, CEO and co-founder said they enable any highly regulated institution, from banks to asset managers, even pension funds, to access DeFi products on the Ethereum Mainnet through the safety of KYC.

“Blockchain technology is special; it has the power to replace and power the financial services of tomorrow, especially when you look at how those technologies are antiquated today,” Cheng said. “For us, it’s pretty obvious: A world powered by blockchain is a world that will need access to identity, access to some compliance, and access to reputations.”

Bringing permissionless passports

The Quadrata passport provides access natively on the public blockchain, and Cheng said: CeFi background checks for defi users.

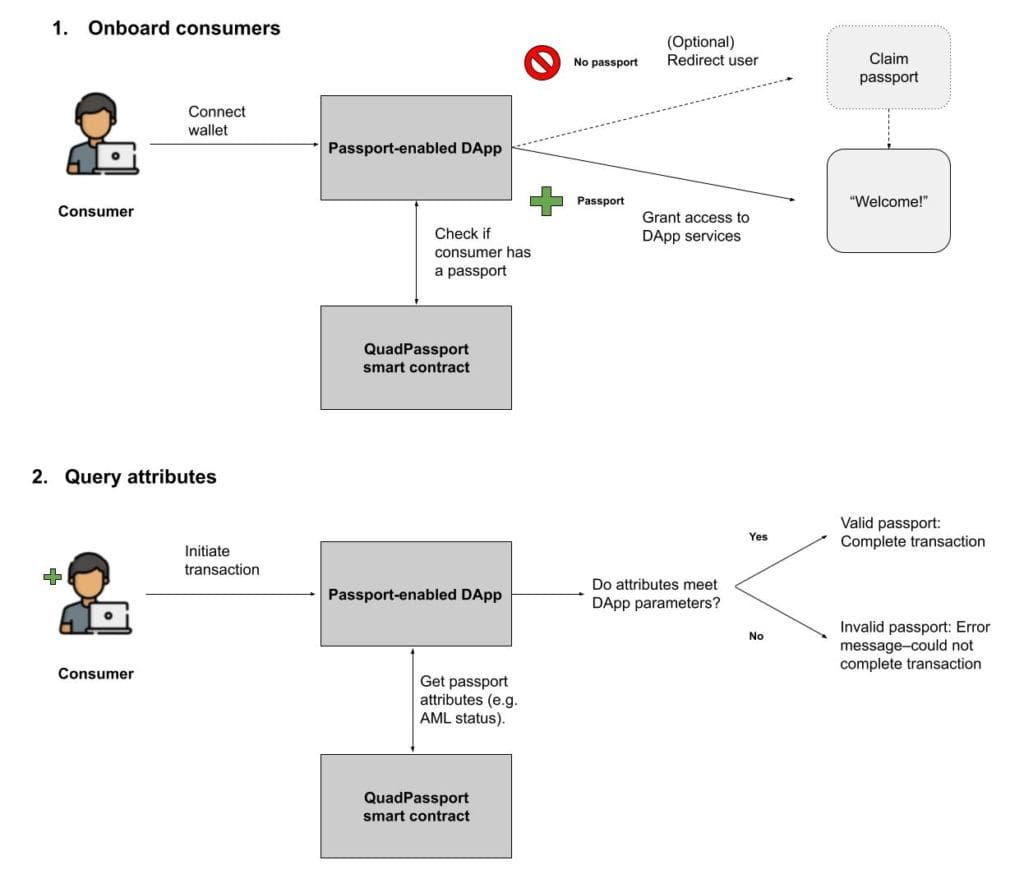

Taking TransUnion AML and KYC data, running through Spring Labs‘ Ky0x digital passport, Quadrata creates an ERC1155 NFT that records if a customer passed a background check.

To fit in with DeFi use cases, the NFT does not hold any personal data and updates regularly through off-chain background checks. Using the Ethereum Mainnet, users can save a passport directly on their web3 wallet, like MetaMask, or host them on OpenSea.io.

When a defi platform wants to onboard a customer with a passport check, they add a single line of code. When a user transacts, that code checks if their address has a passing Quadrata Passport.

Why launch Quadrata?

Lisa Fridman, President, and Co-founder of Quadrata said that while SpringLabs has applied blockchain and cryptography techniques to secure data among financial institutions in a private network, Quadrata spun out the same idea for the public blockchains. Both Fridman and Cheng were at Spring Labs as Head of Blockchain Tech and Head Blockchain Strategy.

“Our goal is to enable broad institutional adoption, or participation of opportunities in DeFi and also of use cases in DeFi,” Fridman said.

“For DeFi, or blockchain in general, to power existing types of financial services, we need to achieve two things: One, there need to be more compliance solutions, and two, there needs to be more data available on-chain.”

Fridman said people and institutions participating on-chain could not lever their reputations from the off-chain world.

However, TransUnion data, funneled through to Quadrata by their Spring Labs Partnership, can help bring the DeFi world to the next level.

“Over-collateralized lending is today’s primary use case in decentralized finance,” Fridman said.

The idea is that off-chain data like KYC will help bring the defi world “towards the types of use cases that only exist ‘in real life’ or traditional financial services, unsecured lending, under collateralized lending, mortgages, asset-backed securities, and so forth.”

At first, the biggest users in mind are traditional finance and investment firms, like asset managers or banks. Target customers are those who have been excited to get access to defi but held back by strictly regulated anti-money laundering (AML) and Know Your Customer (KYC) checks.

Quadrata brings it together

TransUnion handles all of that; off-chain, Ky0x makes it easy to passport check, and Quadrata brings it all together as a simple low code contract that looks for an NFT passport.

“By working with Quadrata to utilize the passport, our customers can now benefit from their strong off-chain credit reputation in an on-chain environment,” Liz Pagel, senior VP and consumer lending business leader, TransUnion, said.

“We look forward to being part of the journey of Quadrata and our consumers as they create an identity which can be carried into Web3 through the passport.”

Cheng said it is a one-time sign-up for regular consumers, like signing up for a CeFi background check, like Venmo, Coinbase, or TD bank.

“What it looks like in practice: a first-time user goes to an application that requires a background check, and the passport will walk you through a one-time onboarding flow,” Cheng said. “It’s very similar to when you create an account in centralized companies; you have to prove you are a real person.”

Users go to the Quadrata passport site, sign the transaction through a wallet like MetaMask, and store the check result as an NFT. But, again, no real-world identifying data can be stored in the Passport NFT.

“We understood that to match the paradigm of blockchain, there’s one thing that’s more critical than compliance: data privacy and anonymity of the user,” Cheng said. “So, it does not contain any PII and does not contain information that can derive or connect to a real person. But it says that you are a real person because you have been verified that you’re not criminal.”

Open data passports

So when a particular exchange then asks to see their passport, a single line of code interacts with the NFT and either lets them in or kicks them out at the door. And no, Cheng said these aren’t PFP NFTs; they are non-transferable, so no buying and selling passports. Instead, he called them “open data passports.”

In the future, the team plans to bring more than KYC and AML on-chain, think credit scoring and accredited investor affirmation, Fridman said.

She also said that the passport works across multiple wallets, and the team plans to add more than just the Ethereum Mainnet and make the solution truly blockchain agnostic.

“We’re really excited about bringing these and more off-chain abilities to blockchain and decentralized finance,” Fridman said. “To power a broader range of financial services and present a viable alternative with faster execution speed, lower costs, and more transparency.”