Prosper announced their second quarter numbers today and the results are quite promising. Even though Prosper is a private company they are regulated by the SEC and have to file quarterly and annual financials just like public companies. It has been a while since we reviewed Prosper’s numbers so I thought it was time to share.

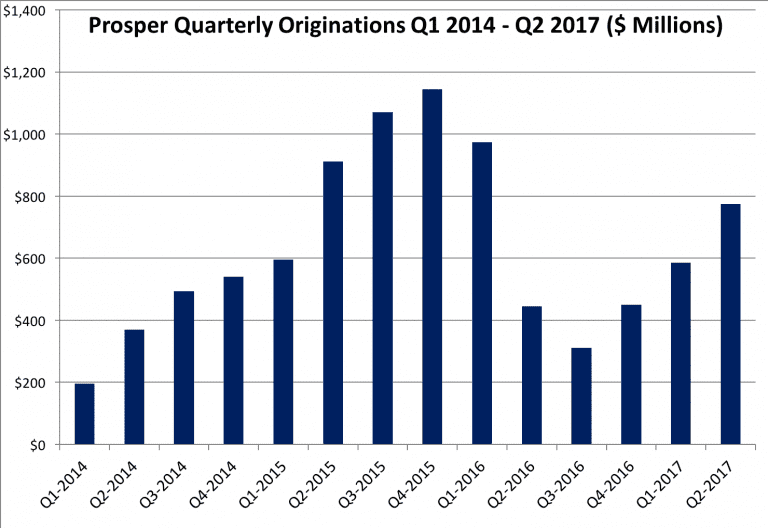

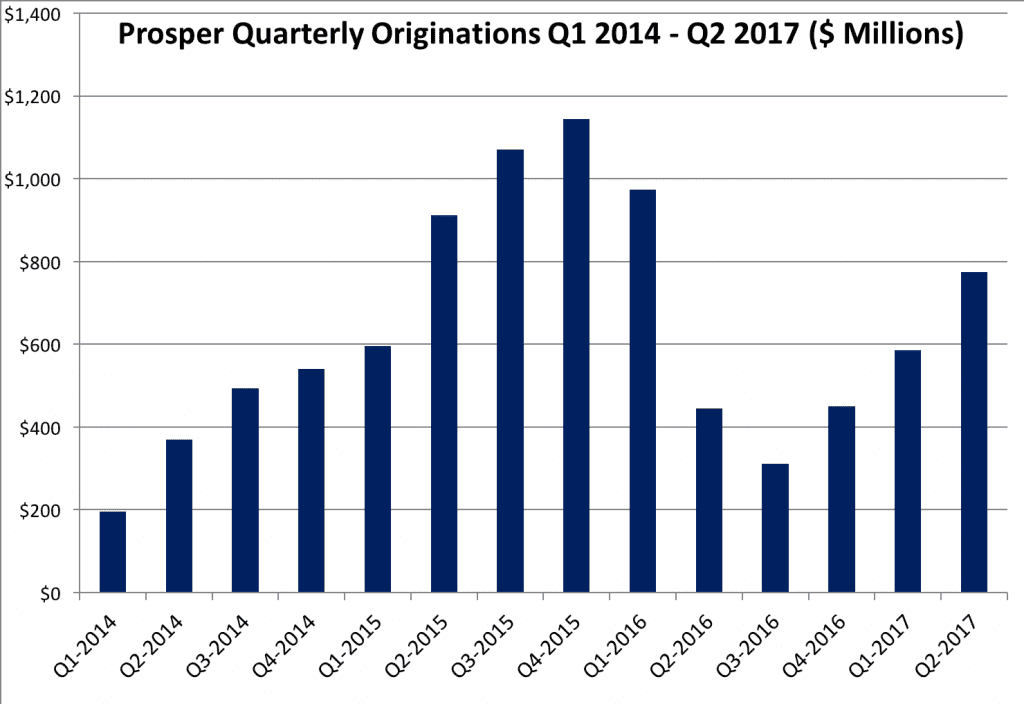

As you can see in the graphic above Prosper had a rocky 2016. They went from a quarterly origination high of over $1.1 billion in Q4 2015 to a low of $312 million in Q3 2016. Since that time they have shown some solid growth with originations in Q2 2017 coming in at $775 million up from $586 million in Q1. They still have a long way to go before they reach record levels but growth has returned to the first US marketplace lender.

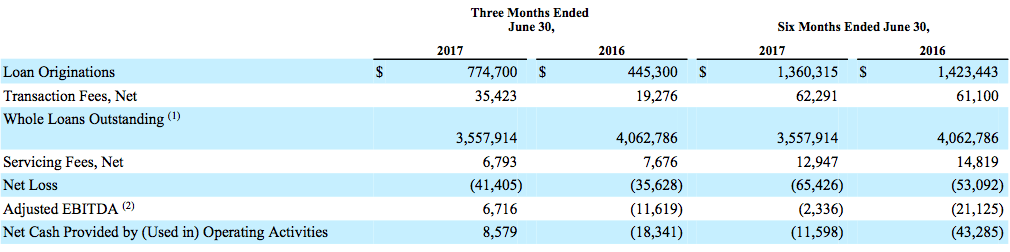

More important than growth, though, is profitability. I copied some detail from the 10-Q filed today and you can see that Adjusted EBITDA was $6.7 million last quarter. While officially their net loss was over $41 million that included $39 million of a one-time charge related to warrants. The solid quarter was also demonstrated in their positive cash flow, they generated $8.6 million of cash from their operating activities in Q2.

Here are some other interesting anecdotes from the report:

- Total originations from inception through June 30, 2017 was $9.7 billion.

- Transaction fee revenue rose to $35.4 million, up 32% quarter-over-quarter and 84% year-over-year.

- Whole loans represented 94% of total loan volume in Q2.

- Adjusted EBITDA was $6.7 million up from a loss of $11.6 million in Q2 2016.

Now, this is not the first time Prosper has made a profit in their more than 11-year history. We reported back in Q3 of 2014 when Prosper had their first profitable quarter. Then the company went into major growth mode in 2015 and they slipped back into the red. I sense that will not happen again as Prosper is far more disciplined today having gone through the major challenges of last year.

While Prosper did not break down how much the consortium contributed to the origination growth one can assume that they were responsible for the lion’s share of the growth. Having committed (up to) $5 billion over just two years I would expect they will be heading towards the quarterly run rate of $625 million some time soon. I very much doubt they are there yet but I expect by the end of the year they will be.

Second $500 Million Prosper Securitization Closes

Speaking of the consortium Prosper also announced today that they have closed their second securitization from the Prosper Marketplace Issuance Trust, Series 2017-2, “PMIT 2017-2.” We covered the first one here and according to Prosper this has performed better than the first.

As with PMIT 2017-1 the loans in this second securitization are likely from the consortium as part of their $5 billion commitment. PMIT 2017-2 was rated by both Kroll Bond Rating Agency, Inc. and Fitch Ratings, Inc. with the Class A pool both receiving an “A” rating.

My Take on Prosper’s Quarter

On the heals of positive earnings reports from both Lending Club and OnDeck last week the Prosper quarter is another positive data point for the marketplace lending industry. In my talks with industry leaders over the past week I have felt more positivity than at any time since 2015. Unlike 2015, though, when there was irrational exuberance, today there is cautious optimism. There is a feeling that we have turned the corner.

Now, many of us heard rumors a few days ago of Prosper’s new fundraising round that is reportedly going to be a $50 million round at a $550 million valuation. If the rumors are true and this round closes it will be a dramatic fall from the $1.9 billion valuation they received in April, 2015. It will also not be a surprise given where valuations have trended over the past couple of years.

Valuation aside, it is important for Prosper to create a sustainable, profitable business. This earnings report says to me that they are well on their way to fulfilling this promise.

You can review Prosper’s press release here.